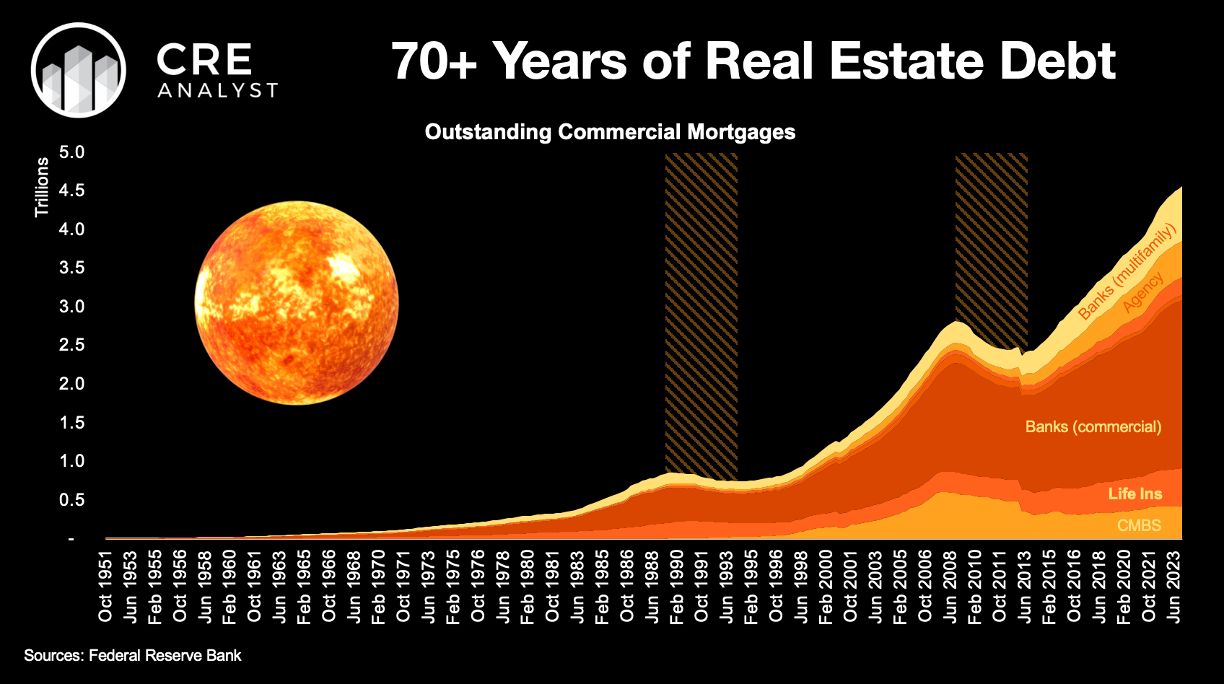

Debt is the sun of the real estate solar system, and every few decades we live in darkness for a few years. Is this one of those times?

There have been 10 (ish) real estate recessions over the last 70+ years.

Every one of these recessions felt like a crisis at the time. Too much supply, falling incomes, high interest rates, higher default rates, more losses, etc. Serious stuff, no doubt.

But two of these downturns were much more punitive than the others: the early 1990s and the GFC.

In both instances, values fell by 40%+. Lenders experienced 30%+ default rates. Widespread bank failures.

What differentiated these really bad downturns?

Deleveraging.

i.e., the amount of debt in the real estate system contracted.

Lenders slowed their new loan production in every cycle, but they didn't actually pull debt out of the system (on a net basis) outside of those two really bad downturns.

Both of those big contractions lasted about three years.

---- 1920s: the original real estate crisis ----

We don't have great data on outstanding mortgage debt before 1950, but we know there was a third deleveraging in the 1920s. Anecdotal evidence suggests it was at least as painful as the early 1990s and GFC experiences.

So let's assume there have been three really bad real estate downturns over the last 100 years.

---- YoY Debt Growth ----

Jul 2022 9.0%

Oct 2022 8.0%

Jan 2023 7.4%

Apr 2023 5.8%

Jul 2023 4.7%

Oct 2023 3.9%

Jan 2024 3.3%

3.3% YoY growth in real estate debt is the lowest on record, outside of the 'really bad' real estate contractions mentioned above.

Will we flip into a deleveraging cycle, or will this be a historically insignificant downturn?

Your thesis on this should probably inform your real estate risk appetite. If you think we're in for a deleveraging, you should run and hide. If not, you should probably be 'risk on.'

[This isn't investing advice.]

COMMENTS