Why are real estate debt funds raising so much money!? This...

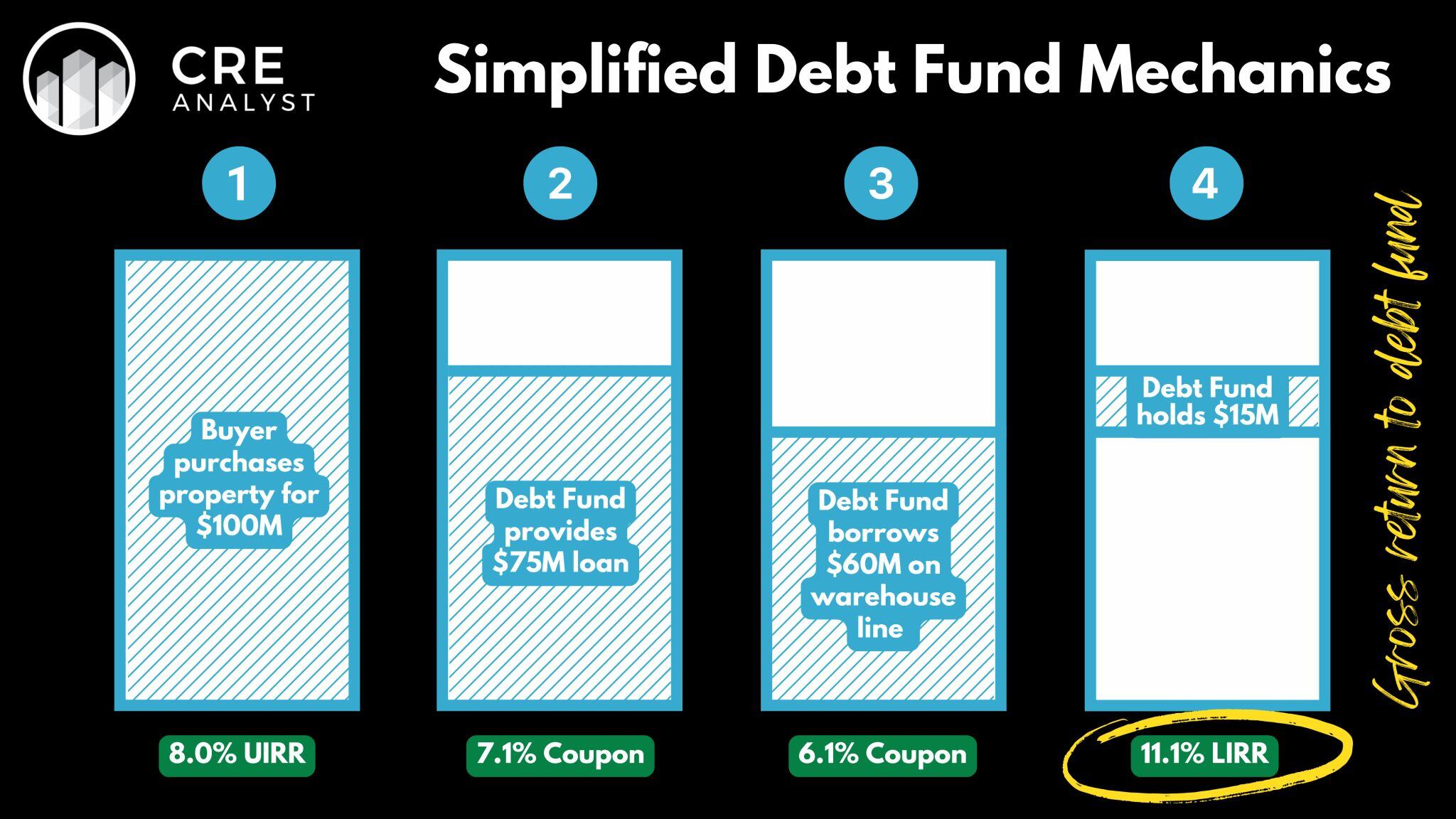

1. Borrower needs a 75% LTC loan.

2. Debt Fund originates a $75M loan at S+275 with a 3% SOFR floor.

3. Debt Fund borrows $60M at S+175 with no floor.

4. Implied return is 11% with origination fees.

Things get better if...

SOFR falls lowering the Debt Fund's borrowing costs without necessarily falling for the property owner (thanks to the floor).

Things get worse if...

There's a default. Any loss would be magnified since the Debt Fund's holding is in the junior portion of the stack.

COMMENTS