How "the Warren Buffett of banking" keeps beating Wall Street...

Jon Gray, Stephen Ross, Sam Zell, and Jamie Dimon are household names, but Andy Beal? He’s the billionaire banker you’ve never heard of, quietly outplaying Wall Street at its own game.

Beal's formula is simple:

1. When credit is plentiful, hide.

2. When credit contracts, buy debt at big discounts.

3. Lever up with cheap government debt.

4. Avoid uncapped downside.

5. Rinse and repeat.

It’s not flashy, but it works—turning Beal Bank into one of the most profitable financial institutions in the country.

About Beal Bank

Unlike traditional banks that focus on loan origination and retail banking, Beal Bank primarily operates as a buyer of distressed loan portfolios and structured financial products.

Contrarian credit player

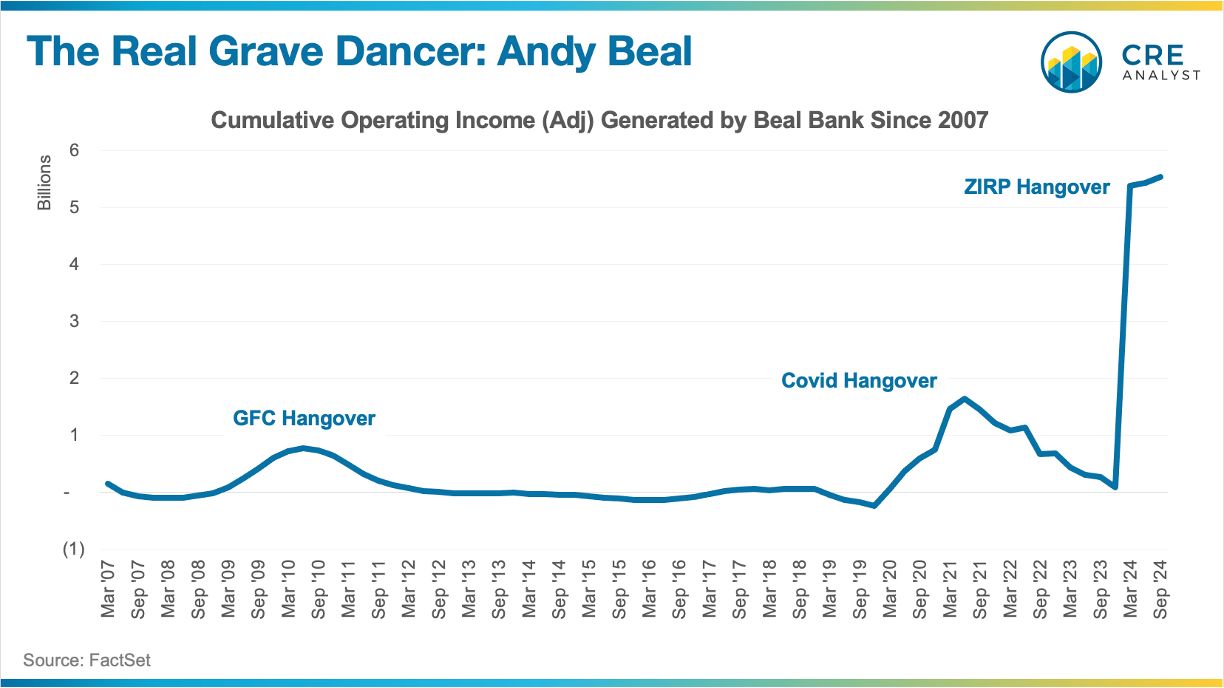

Beal has a history of stepping back when credit markets become overheated. From 2004 to 2007, as other banks aggressively expanded lending, Andy Beal sharply reduced activity, shrinking his bank rather than participating in risky loans.

Never waste a crisis

Beal thrives in downturns. He bought energy bonds during the 2001 California power crisis and aircraft-backed bonds after 9/11. When the financial crisis hit in 2008, he aggressively purchased distressed loans, failed banks, and assets from the FDIC. He repeated this strategy in 2022 by scaling back lending and betting on Treasuries when rates rose, generating massive profits.

Record profitability in 2022

In 2022, Beal Bank’s net income more than doubled to $1.2B, delivering a 40%+ return on equity—far exceeding the profitability of even the largest U.S. banks. This was largely due to its arbitrage strategy, borrowing cheaply from the Fed while investing in higher-yielding Treasuries.

Unique lender

Beal Bank tapped the Fed’s discount window for up to $4.7B in late 2022, a move that allowed it to profit from the gap between borrowing costs (2.5%-3.25%) and Treasury yields (4%+). It also borrowed $4.4B from the FHLB.

Dodging bullets

While banks like Silicon Valley Bank and First Republic collapsed due to deposit flight, Beal Bank avoided major risks by reducing its loan exposure and focusing on government-backed securities. Its funding model and conservative positioning shielded it from the turmoil that shook the industry in 2023.

Avoiding the spotlight

Despite his massive success, Andy Beal avoids publicity, rarely granting interviews. He prefers working behind the scenes, evaluating deals with a tight inner circle. His secretive approach extends to internal operations—he famously conceals his computer screen with cardboard to keep his pricing strategies confidential.

"Why do people not do the great deals and do all the stupid ones? It's crazy." Andrew Beal

COMMENTS