Jobs day cheat sheet

---- Oxford Economics ----

We expect growth in nonfarm employment in August to bounce back following a disappointing July and for the unemployment rate to tick down a notch...

We expect the unemployment rate to edge down 0.1ppt to 4.17%, triggering the Sahm rule, but the recessionary signal is weaker than usual...

---- Sahm Rule 101 (JPM) ----

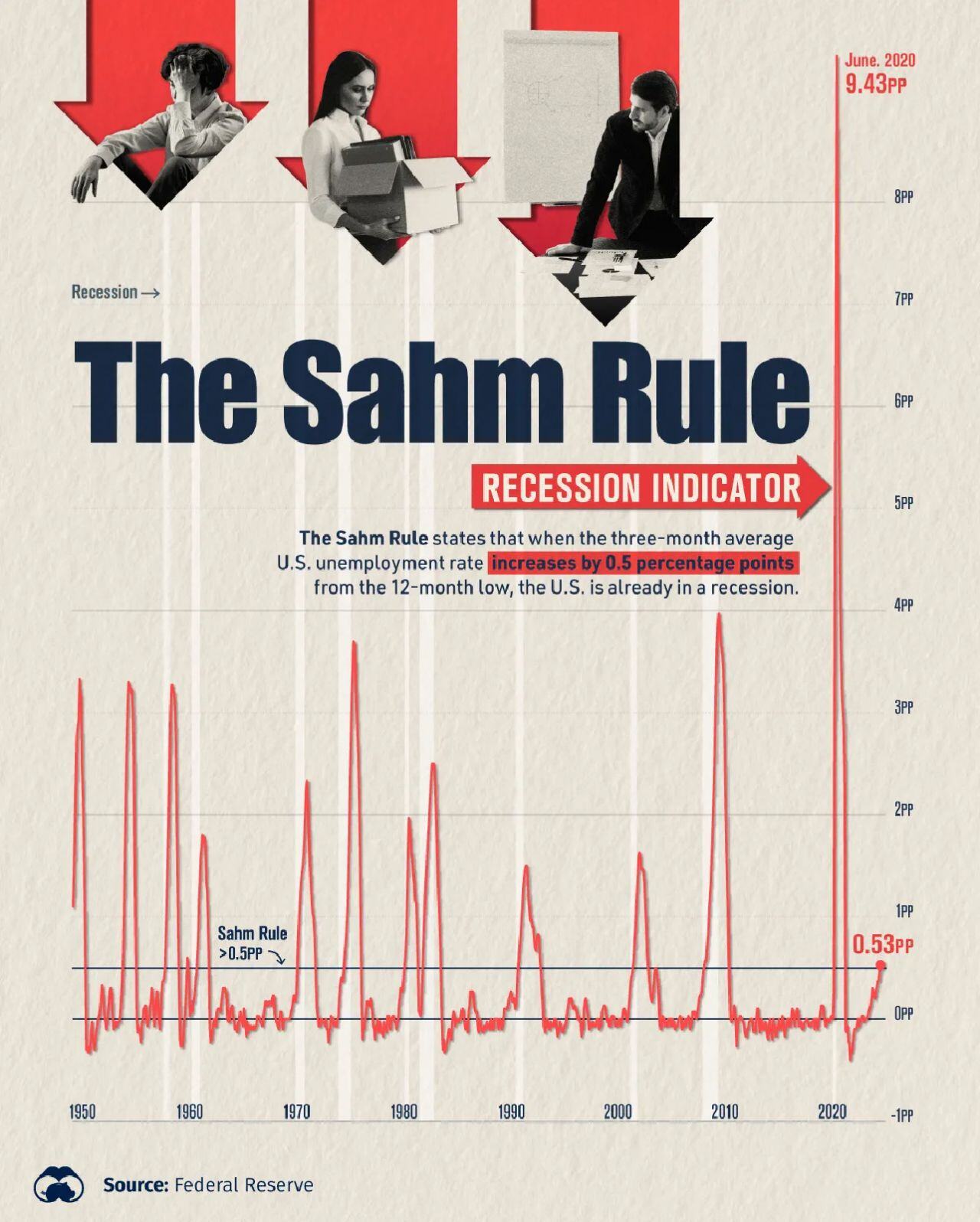

Economic rule of thumb created in early 2019 by economist Claudia Sahm. It is meant to serve as a helpful guide for policymakers and intended to act as an “early diagnosis” of possible recession.

What it says...

When the rolling 3 month unemployment rate increases by 50+ bps vs. the trailing 12 month low, the economy is in recession.

Why it’s getting so much attention...

Since 1970, the Sahm Rule has coincided with every recession without failure.

---- Claudia Sahm's current take ----

"In the current environment, it’s important not to assume that any rise in the unemployment rate is evidence of cooling demand."

"A rise in the unemployment rate due to weakening demand for workers gains momentum in recessions, which is why the Sahm rule has worked well historically. But a rise in the unemployment rate due to an increase in the supply of workers is different. The rate will decrease once the jobs “catch up” with the new job seekers and more workers allow the economy to grow more. The Sahm rule does not distinguish between these two dynamics, and can look more ominous when the labor force is expanding rapidly."

"There are signs that stronger labor supply, not just weaker labor demand, helped push the Sahm rule past its 0.50 percentage point threshold. Unemployed entrants to the labor force (new or returning) accounted for about half of the increase. That’s a notably higher share than in recent recessions, when most of the contribution came from unemployed workers who had been laid off temporarily or permanently. The current Sahm rule reading is likely overstating the weakening in demand and not at recessionary levels. Even so, there are risks. Recessions have occurred while the labor force is expanding, as in the 1970s, so the current episode would not be a historical outlier for the early stages of recessions".

---- Takeaways ----

-- Employment market continues to moderate (at best)

-- Expect more concern if the Sahm Rule continues to be triggered

-- But the indicator may be wrong this time (for the first time in 50 years)

PS - Claudia Sahm's substack newsletter provides macro insights in plain English, which is rare for an economist. It's worth subscribing.

COMMENTS