Lessons learned from the 'retail apocalypse'

---- Flashback to 2017 ----

From "America's 'Retail Apocalypse' is Really Just Beginning" (Bloomberg, 2017):

"The so-called retail apocalypse has become so ingrained in the U.S. that it now has the distinction of its own Wikipedia entry."

"...more chains are filing for bankruptcy and rated distressed than during the financial crisis."

"...if today is considered a retail apocalypse, then what’s coming next could truly be scary."

"...making matters more difficult is the explosive amount of risky debt owed by retail coming due over the next five years."

"...Retailers have pushed off a reckoning because interest rates have been historically low..."

"...now that boom is finally going bust."

"'...a pall has been cast on retail,' said Charlie O’Shea, a retail analyst for Moody’s. 'A day of reckoning is coming.'"

---- Mall update ----

There are about 900 malls in the U.S.

...about 100 fewer over the last 5 years.

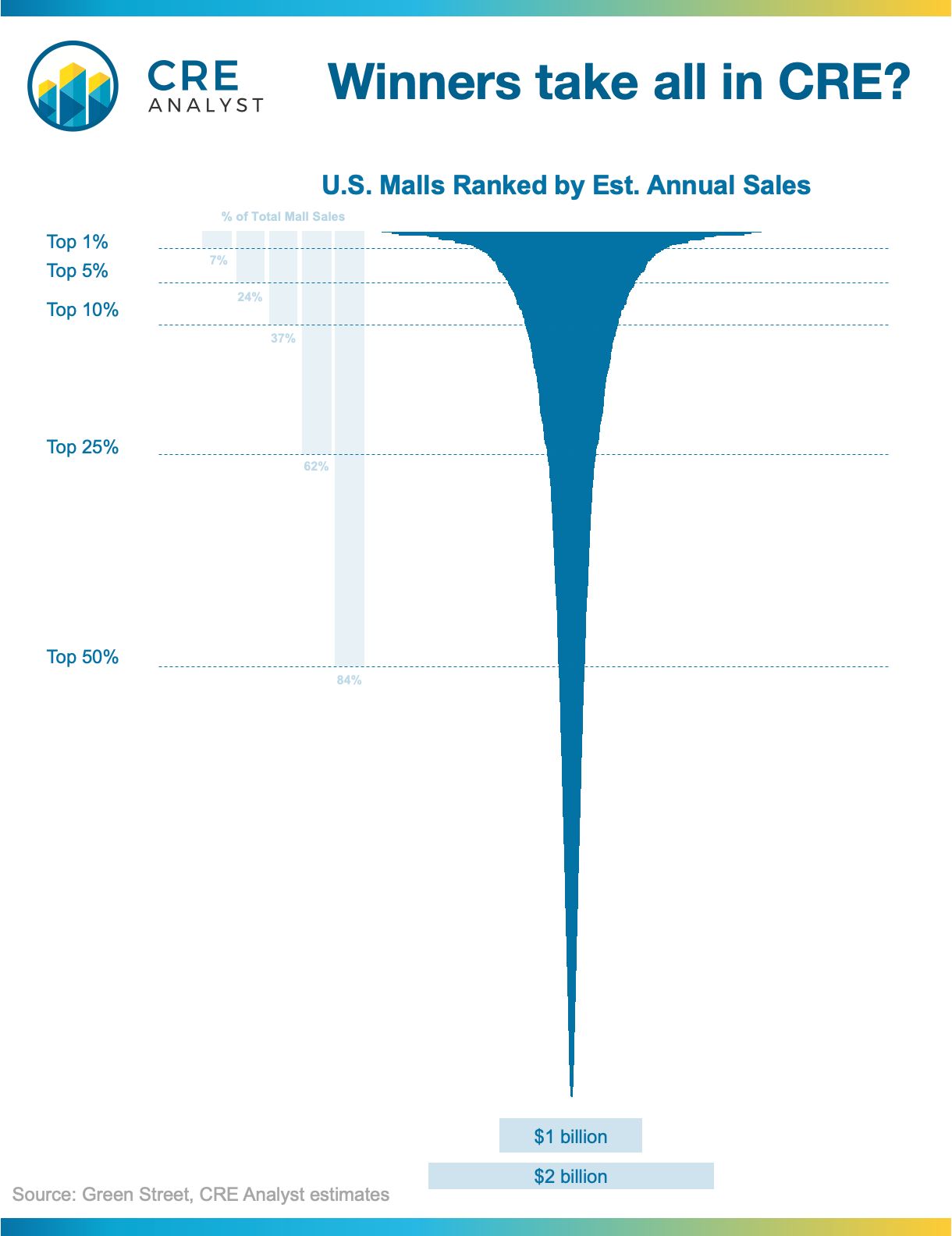

We estimate that the top 50% of these malls account for 84% of all mall sales, the top 10% accounts for 37%, the top 1% accounts for 7%, etc.

What does this say about the underperforming malls? Many of them are dying a slow death.

Bottom line: it's hard to overstate the difference between "winners" and "losers" in the mall space.

---- Our takeaways ----

1. Was there a retail apocalypse?

Ehh. Many retailers went away and all of them had to evolve their strategies. But apocalypse? No way. Retail survived and many informed players say retail is thriving.

2. What changed?

Divergence. Before Amazon torpedoed traditional retail's fortress position, value creation was all about asset allocation.

If you doubled down on multifamily and industrial and maintained reasonable diversification, you crushed it. ...regardless of your specific investments or sponsors.

3. Why does this matter now?

Then...

New trend: digital sales surge

Media reaction: retail is dead

Reality: big winners, big losers, slow burn

Now...

New trend: working from home surges

Media reaction: office is dead

Reality: big winners, big losers, slow burn

---- A parallel thesis ----

The office sector isn't going anywhere. In fact, several green shoots are emerging. But if office follows the path that malls defined over the last decade, a fraction of buildings could benefit from concentration while the others grapple with the balance sheet grenades of fewer workers, lower rents, higher TIs, and pending loan maturities.

What share of office will be "winners"?

COMMENTS