Sellers are from Mars.

Buyers are from Venus.

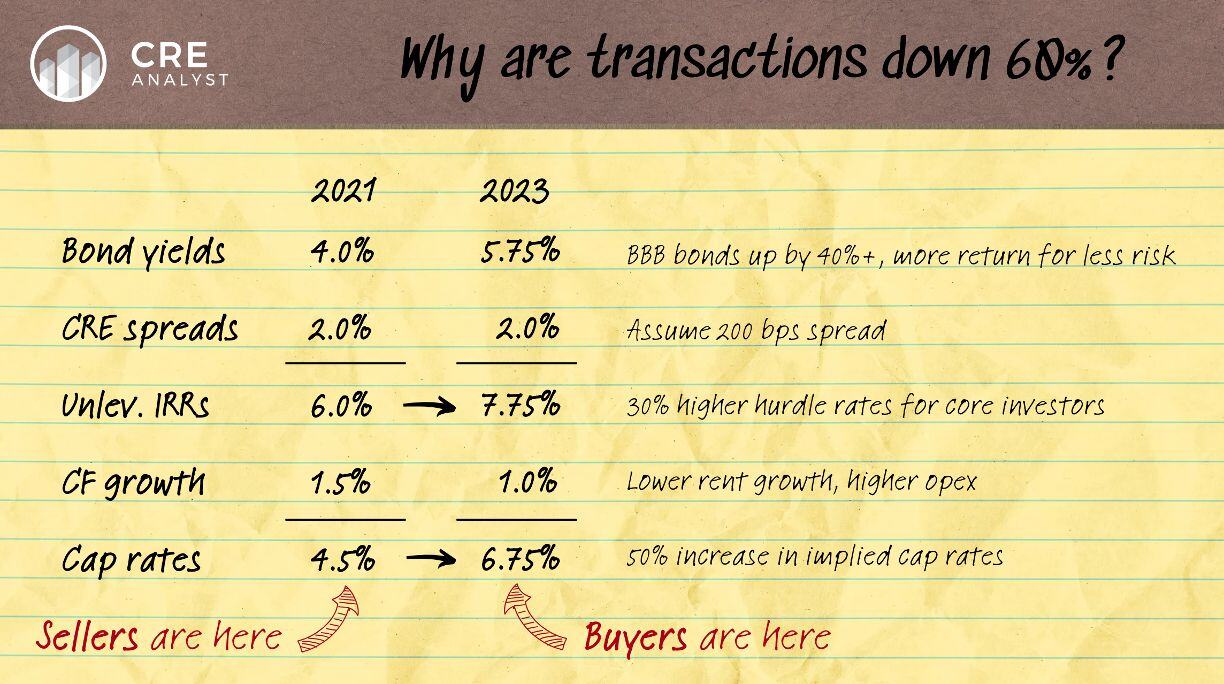

Here's how their disconnect has halted markets.

----- BBB bonds -----

If you're a pension fund sitting on a ton of cash and you need reasonably predictable long-term returns to cover your obligations, BBB-rated corporate bonds and real estate are decent alternatives.

BBB bonds currently yield 5.75%, which is a big spike from 4% (eighteen months ago) and 2% during Covid.

----- Real estate spreads -----

Since real estate is riskier than bonds, CRE investors demand a spread over BBB bonds. ...how much spread is up for debate, but investors and research firms often circle 200 bps as a benchmark spread.

----- Implied hurdle / discount rates -----

If income-oriented investors can get 5.75% yields in the bond market and they need 200 bps of additional spread to justify investing in core real estate, the unleveraged IRR required to justify investing in real estate is 7.75%.

And here's the problem for owners of core properties: This hurdle rate was 6.0% eighteen months ago. Even if you assume cash flows are the same, that's a 30% increase in the discount rate. i.e., investors are discounting cash flows by 30% more than they were 18 months ago, which puts meaningful downward pressure on property values.

----- Cap rates -----

You can keep waterfalling this simple math to cap rates. As we cover in our valuation module, there are only two drivers of real estate returns: income and appreciation. A cap rate, by definition, is a measure of income. And, assuming no cap rate changes, income growth is the only way to generate appreciation.

In other words, if cap rates were 4.5% eighteen months ago, and UIRRs/discount rates were 6.0%, investors were underwriting 1.5% cash flow growth per year. Growth has slowed, so let's assume buyers underwrite 1.0% growth in today's market.

Today's discount rate of 7.75% less 1.0% of underwritten cash flow growth results in a current cap rate of 6.75%. ...up from 4.5% eighteen months ago.

----- Disclaimer -----

It's impossible to summarize the entire market with a single statistic. ...especially in this market, where there's so much volatility and differentiation between assets.

Our goal in sharing this simple perspective isn't to say it reflects the entire market. Instead, our goal is to point out the following...

1. Capital markets tend to lead real estate markets.

2. Real estate is affected by the bond markets.

3. A shock wave is working its way through all real estate markets.

4. There's an epic tug-of-war between buyers and sellers right now.

PS - We think buyers will continue to win the tug of war until (i) bond yields moderate/cheap debt re-enters and/or (ii) core fund exit queues abate.

PPS - The arithmetic above covers core properties; the math for value-add and opportunistic properties is worse.

COMMENTS