Everyone talks about core, value-add, and opportunistic like they’re clean buckets. They’re not, especially with opportunistic strategies.

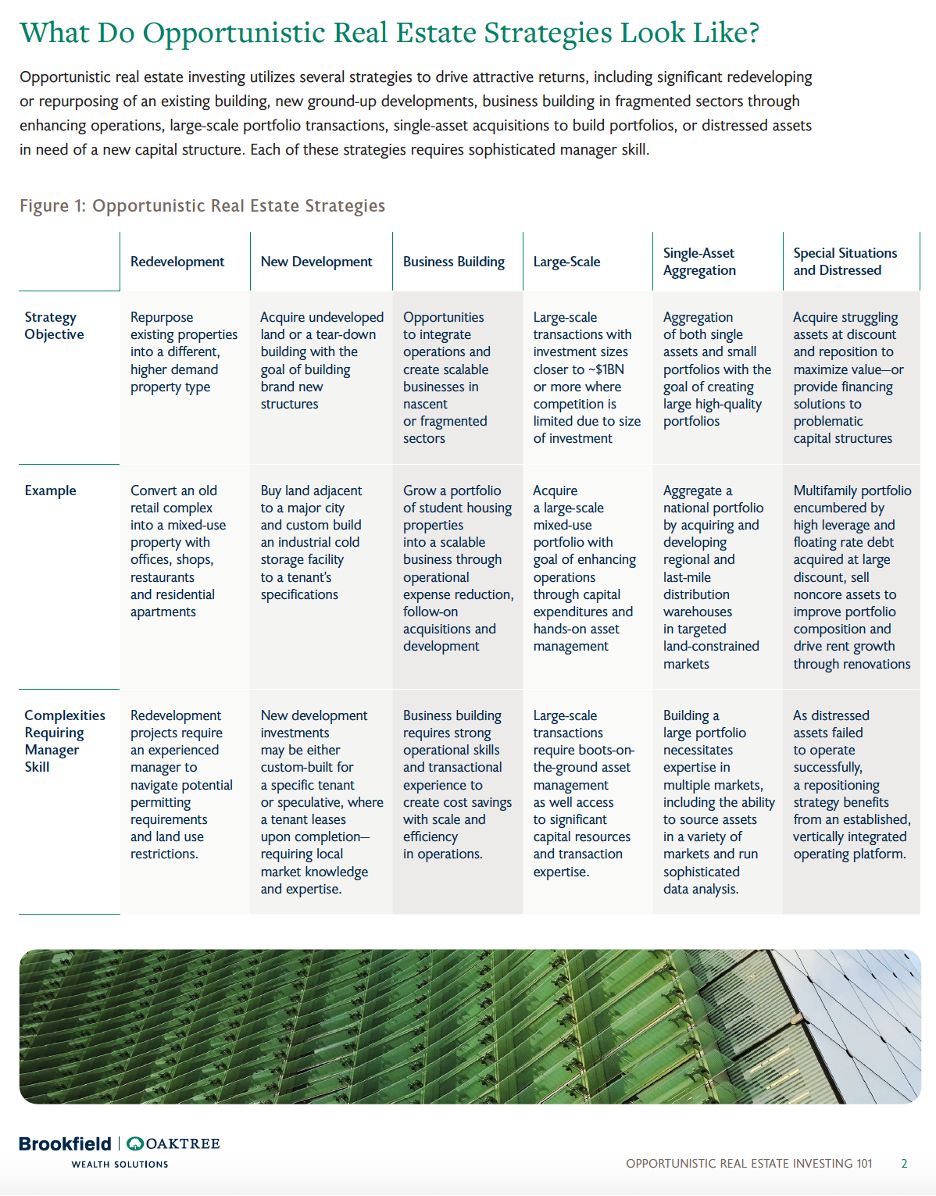

Here’s a distilled breakdown of the six major opportunistic strategies, based on Brookfield and Oaktree’s framework:

1. Redevelopment

Buy obsolete, build demand. Think dead malls into vibrant mixed-use districts or office into multifamily.

2. New development

Start with dirt, end with yield. Ground-up projects reward market insight and timing but starting from scratch is risky.

3. Business building

Platform-focused. Roll up fragmented sectors like student housing or storage, then scale operations and efficiency.

4. Large-scale transactions

Few can play, fewer can win. $1B+ portfolios where capital and execution speed matter more than price.

5. Single-asset aggregation

Build the portfolio the market forgot. One by one, turn overlooked assets into institutional platforms.

6. Special situations and distressed

Solve someone else’s headache. Rescue broken capital stacks or neglected assets, then reposition for upside.

If you're not Blackstone or Brookfield, where do you focus?

COMMENTS