CRE distress: delayed or fundraising hype?

Ares Management Corporation just announced it closed a $3.3 billion opportunistic fund, targeting 15-17% net IRRs.

"All told, the LA-based manager now has $5.5 bn to target distress real estate opportunities..." (PERE)

[Quick side note: if you haven't been following Ares's growth, you should. One of the more compelling stories in real estate. Not investment advice.]

==== Our takes ====

Is there distress? Yes.

Attractive distress? Ehh.

More distress to come? Yes.

Enough to build a strategy around? Questionable.

Do LP investors like the sound of "distress"? Absolutely.

==== Distress context ====

Human nature:

Everyone wants to be a grave dancer.

Historically insignificant:

Problem loan rates are up from 0%, but they're hovering between 0.5% and 1.5% vs. 4-5% in the GFC and 7-10% in the early 1990s. If "doom loops" exist, they haven't led to widespread loan challenges.

Where's the distress?

Chicago's CMBS office delinquency rate is nearly 18%, but investors don't want it. How many funds are being raised targeting obsolete Chicago office buildings?

Distress lags:

Borrowers don't like losing money, and lenders don't like forcing issues. Kicking the can is almost always the favorite path, especially when there's property income, which means distress normally hits during the recovery, not near the bottom.

Distress winners ***:

We think the ultimate winners in this cycle (re: distressed investing) will be those who expand the definition of 'distress' and use it as a magnet for investors to leverage their existing platforms. Ares didn't just create their opportunistic strategy. It's the fourth fund in this series with a 20% IRR track record.

*** As we will explain later this week, Ares raised $3.3 billion not by simply targeting distress. The fund is largely targeting (i) repositionings like the Ritz Kapalua, which Ares and its partners redeveloped and sold to Blackstone, and (ii) develop-to-core plays, in addition to "special situations."

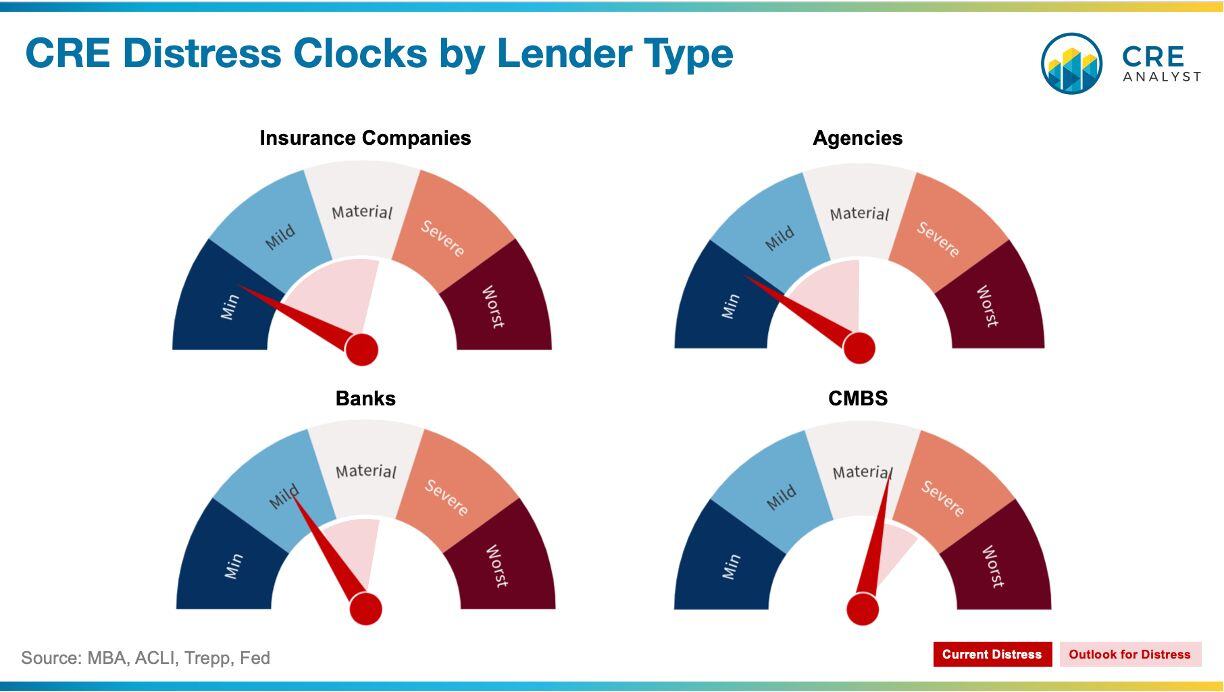

==== Distress clocks: A framework ====

Since measures of distress are all over the map, we came up with a simple way to frame and track distress in commercial real estate.

These distress clock charts show...

1. Current delinquencies and delinquency trends relative to history (needle).

2. "Min" (left side of each clock) represents the best times, no distress.

3. "Worst" (ride side) represents the highest delinquency periods since 1990.

4. Our outlook for delinquencies, which reflects the trajectory of recent delinquency rate changes and expected loan maturities over the next 3 years.

Why focus on loan delinquencies? All distress starts with lenders.

==== Your take on CRE distress? ====

A) Overrated: few grave dancing opportunities this cycle.

B) A lot more to come: we just haven't hit the wave yet.

C) Could go either way: depends on the Fed/recession.

D) Pockets of distress: big winners and big losers.

COMMENTS