Tides Equities has been in the news a lot over the last six months (see headlines below), and several realities are becoming abundantly clear...

1. Fast moving: Tides went from acquisitions to capital calls in about a year.

2. Needle mover: $7B+ in assets at the peak.

3. Tough trifecta: Falling values, higher floating rates, near-term maturities.

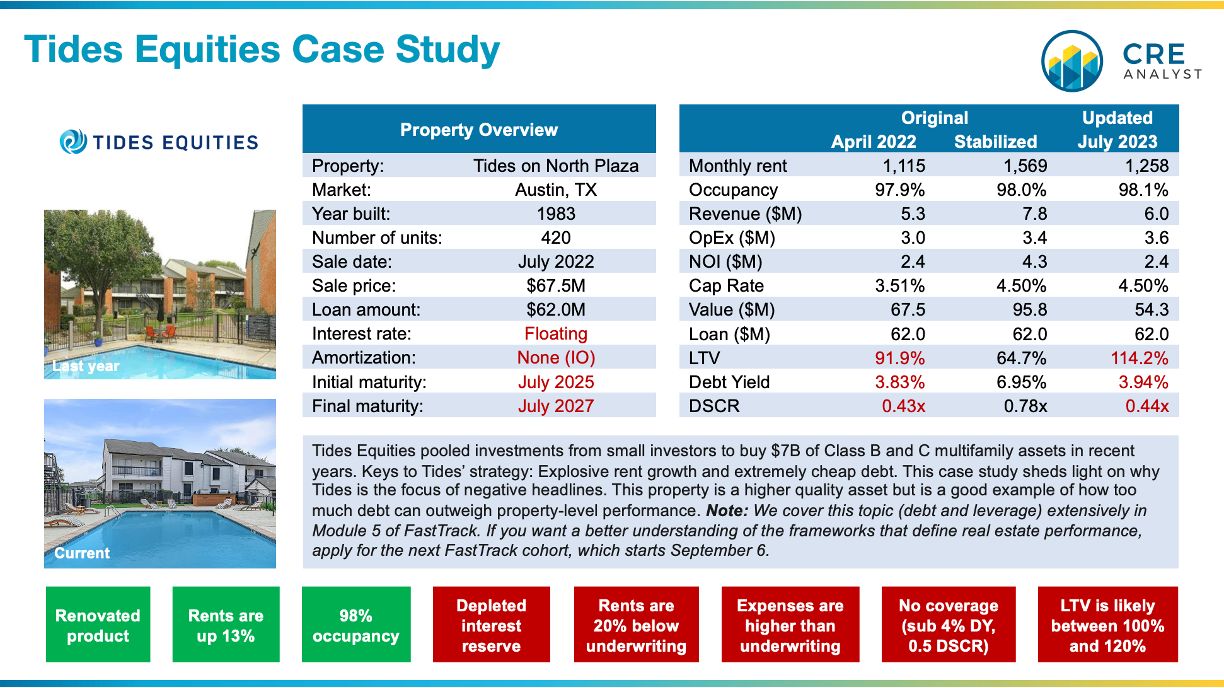

Tides on North Plaza is a good example of how property and loan-specific details matter. Market rates and vacancy are up but this property is bucking the trend. Regardless, Tides made a bet that it could grow income far beyond the market levels, but that growth has stalled. The property's DSCR is below 1.0x, debt yield is below 4%, and LTV is above 100%.

----- Bread and butter -----

"The firm’s bread and butter is Class B multifamily, taking traditional product and making it a little nicer than typical commodity workforce housing."

From "Tides Equities is staying active even as multifamily market slows"

(Dallas Business Journal, 11/28/22)

----- Expansion -----

"Just three years ago, Tides owned $2 billion in the apartment properties. Today, that number has grown to $7.5 billion, according to Kia. In that time frame, Kia said Tides has grossed hundreds of millions of dollars for itself and its investors by fixing up decades-old buildings and reselling them. Tides deployed $7 billion in 2021 and 2022 alone, making it one of the country's most prolific buyers even as the overall market for multifamily properties was cooling, due to rising interest rates. With Kia at the helm, Tides counts more than 600 individuals as his investors in addition to family-office and private-equity capital, including major firms such as KKR. The company now has 31,000 units across its portfolio. This was a vision that Kia had at just 25."

From "This 31-Year-Old Investor Nearly Quadrupled His Multifamily Housing Empire From California to Texas in Just 3 Years" (Entrepreneur, 11/30/22)

----- A new reality -----

"Last summer, Kia and Andrade, founders of Tides Equities, pitched their latest Class B play: a 270-unit apartment complex in Fort Worth, Texas. The property, which they dubbed Tides on Oakland Hills, was ripe for a value-add play, the young duo told potential investors, promising a 20 percent return in just two years. The plan: Using a floating-rate loan, Tides would buy the apartment complex for $35 million and perform an assembly-line-style renovation of its units. The booming Dallas-Fort Worth rental market would allow Tides to hike rents by 24 percent, setting up a lucrative resale.

Tides ended up raising about $10 million. But the firm is now grappling with a new reality."

From "Multifamily player Tides Equities faces $6.5B dilemma in the Sun Belt"

COMMENTS