Want to get paid? Dry powder ain't free. You may have to wait till 2033.

Closed-end funds are unique beasts...

Managers spend a year or more raising capital, a few years deploying it, and then finally work to recover investments and distribute profits. If all goes well, they start the next fund in the series.

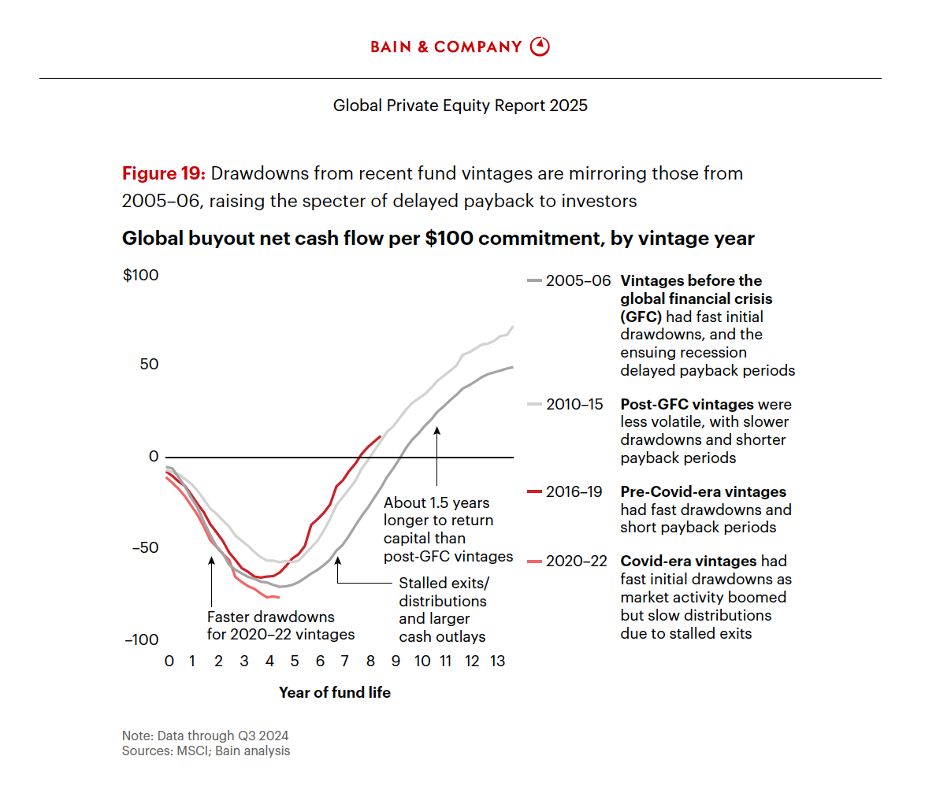

But this model has challenges, the "J curve" being the biggest.

-- No returns during the investment period.

-- LPs pay fees but receive no distributions.

-- NAV declines, showing negative returns.

J curves are a normal part of value-oriented investing, but it's worse during downturns. Drawdowns are steeper, recovery takes longer, and LPs face greater losses and delays in getting capital back.

...and its harder for LPs to hold their breathe for longer in the face of negative headlines.

---- Why this matters ----

Non-core capital represents only ~25% of the real estate market, but it drives a large share of transaction volume since it turns over more frequently (3-5 year holds vs. 10+ years for core).

A prolonged slowdown in closed-end fund activity could constrain deal flow for an extended period.

---- Hopefully we're wrong ----

This chart is from Bain’s private equity outlook, which is focused on buyout funds, not real estate. But real estate funds likely face similar headwinds...

Example: Blackstone’s most recent seasoned fund (BREP IX).

-- Targeted 30%+ IRRs during COVID

-- Now closer to 10%

-- Key question for BX: Kick the can vs. move on

If this chart fairly summarizes the real estate world and BREP IX is a reasonable indicator for real estate professionals, there could be several follow-on effects could point to a new reality: Delayed compensation.

Muted transaction activity confirms that real estate J curves are extended, but are you actually seeing this trend on the job? Is it "extend and pretend" or just a normal part of value-add/opportunistic investing?

COMMENTS