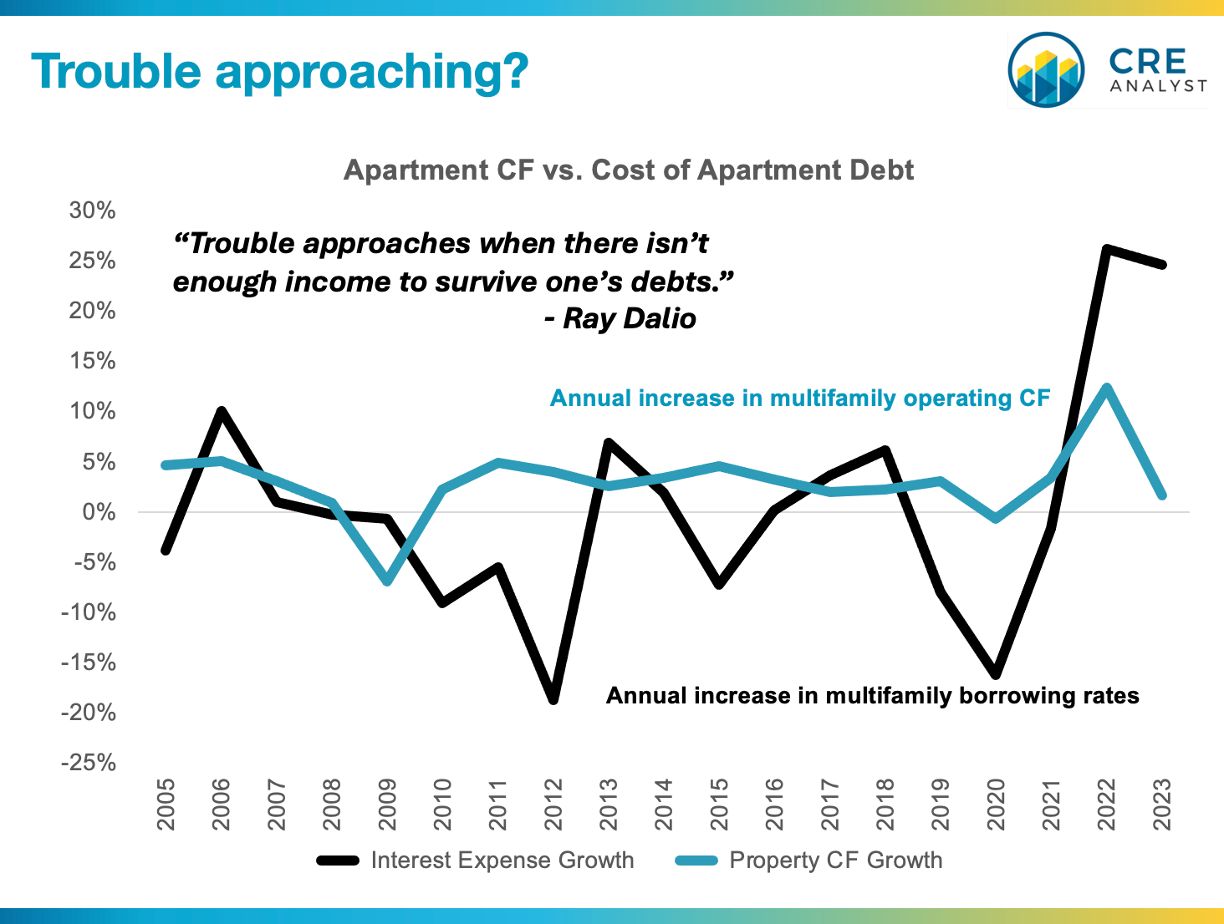

Ray Dalio--founder of the world's largest hedge fund--has some interesting takes on credit cycles. Do they apply to real estate?

Think of debt as negative earnings and a negative asset that eats up earnings and other assets. It gets paid before any other type of asset, so when incomes and asset values fall, there is a need to cut expenditures and sell off assets to raise the needed cash. When that’s not enough, there needs to be a) debt restructurings in which debts and debt burdens are reduced, which is problematic for both the debtor and the creditor because one person’s debts are another’s assets and/or the b) central bank printing money and the central government handing out money and credit to fill in the holes in incomes and balance sheets.

When credit cycles reach their limit it is both the logical and the classic response for central governments and their central banks to create a lot of debt and print money that will be spent on goods, services, and investment assets to keep the economy moving. Throughout history, when the outstanding claims on hard money (debt and money certificates) are far greater than there is hard money and goods and services, a lot of defaults or a lot of printing of money and devaluing have always happened.

How do governments react when they have debt problems? Without exception, they print money and devalue it if the debt is in their own currency. When central banks print money and buy up debt that puts money into the financial system and bids up the prices of financial assets (which also widens the wealth gap because it helps those with the financial assets that are bid up relative to those who don’t have financial assets). Typically at this stage in the debt cycle there is also economic stress caused by large wealth and values gaps, which lead to higher taxes and fighting between the rich and the poor, which also makes those with wealth want to move to hard assets and other currencies and other countries.

In the long-term debt cycle, holding debt as an asset that provides interest is typically rewarding early in the cycle when there isn’t a lot of debt outstanding, but holding debt late in the cycle when there is a lot of it outstanding and it is closer to being defaulted on or devalued is risky relative to the interest rate being given. So, holding debt (e.g., bonds) is a bit like holding a ticking time bomb that rewards you while it’s still ticking and blows you up when it goes off. And as we’ve seen, that big blowup (i.e., big default or big devaluation) happens something like once every 50 to 75 years.

COMMENTS