These 7 trends pulled $1.8 billion out of brokers' pockets over the last year...

1. Interest rate spikes since early 2022:

- Fed Funds (interbank lending rate): 0.08% -> 5.07%.

- SOFR (common benchmark for floating rate loans): 0.05% -> 5.07%

- 10 year treasury (common benchmark for fixed rate loans): 1.7% -> 3.8%

2. Economic uncertainty: The share of economists calling for a recession has decreased 44% -> 32% over the last six months.

3. Too much office space: Occupancy rates, subleasing trends, and tenant intention surveys suggest that the U.S. office market is 10-20% oversupplied with significant uncertainty around expectations due to WFH dynamics.

4. Falling values: Equity returns were at historical lows 12-18 months ago (6-7% discount rates). But now there's far more uncertainty around future property CFs and investors can get 5% by investing in bonds. Equity investors have paused, causing transaction markets to stall.

5. Bid ask gap: Sellers are trying to hold onto yesterday's values, and it's clearly going to take meaningful pricing adjustments and more certainty to lure buyers back into the market. Brokers tell us there's a 15-30% difference between seller and buyer expectations, which has further slowed the sales and debt markets.

6. Pressure on banks: Banks added $4.5 trillion to their deposit bases during COVID, which they parked it in low-yielding bonds and mortgages. With rates up and 25% of those deposits being pulled out of banks post-COVID, 3 of the 4 largest bank failures in history occurred over the last 6 months. Even if the banking crisis is over, there's a huge gulf between the winners and losers in banking.

7. Fewer new buildings: With most banks primarily focused on liquidity and survival, they have virtually no interest in providing construction financing. ...especially when the term "CRE" makes bank regulators sweat. In the long run, this will almost certainly lead to significant rent increases, but in the short run, less construction financing means fewer new buildings, less space to lease at relatively high rents, and fewer newly-stabilized assets to sell.

CONNECTING THE DOTS

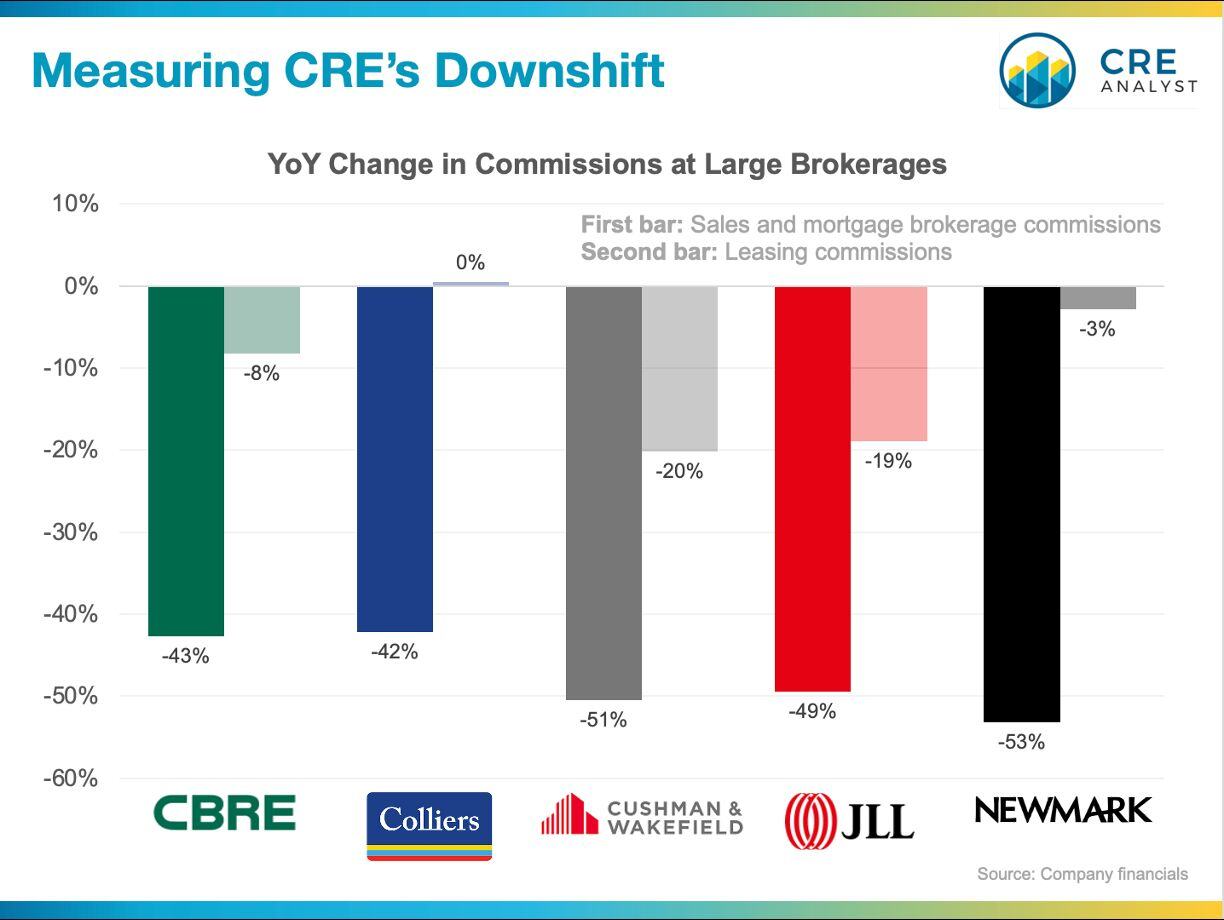

- Capital markets revenues from investment sales and mortgage brokerage at the large brokerage houses fell by $1.4 billion per quarter over the last six months vs. prior year (down 47% YoY).

- Leasing brokerage revenues at these firms fell by about $350 million per quarter over the last six months vs. prior year (down 12% YoY).

- In total, commission revenues are down $3.6 billion over the last 3 quarters, compared to prior year. Assuming 50% splits, that's $1.8 billion in foregone commissions to individual brokers.

Silver lining (perhaps): Q123 declines weren't as severe as Q422's.

Brokerages report Q223 earnings in about a month. Stay tuned...

COMMENTS