An updated look at CRE values...

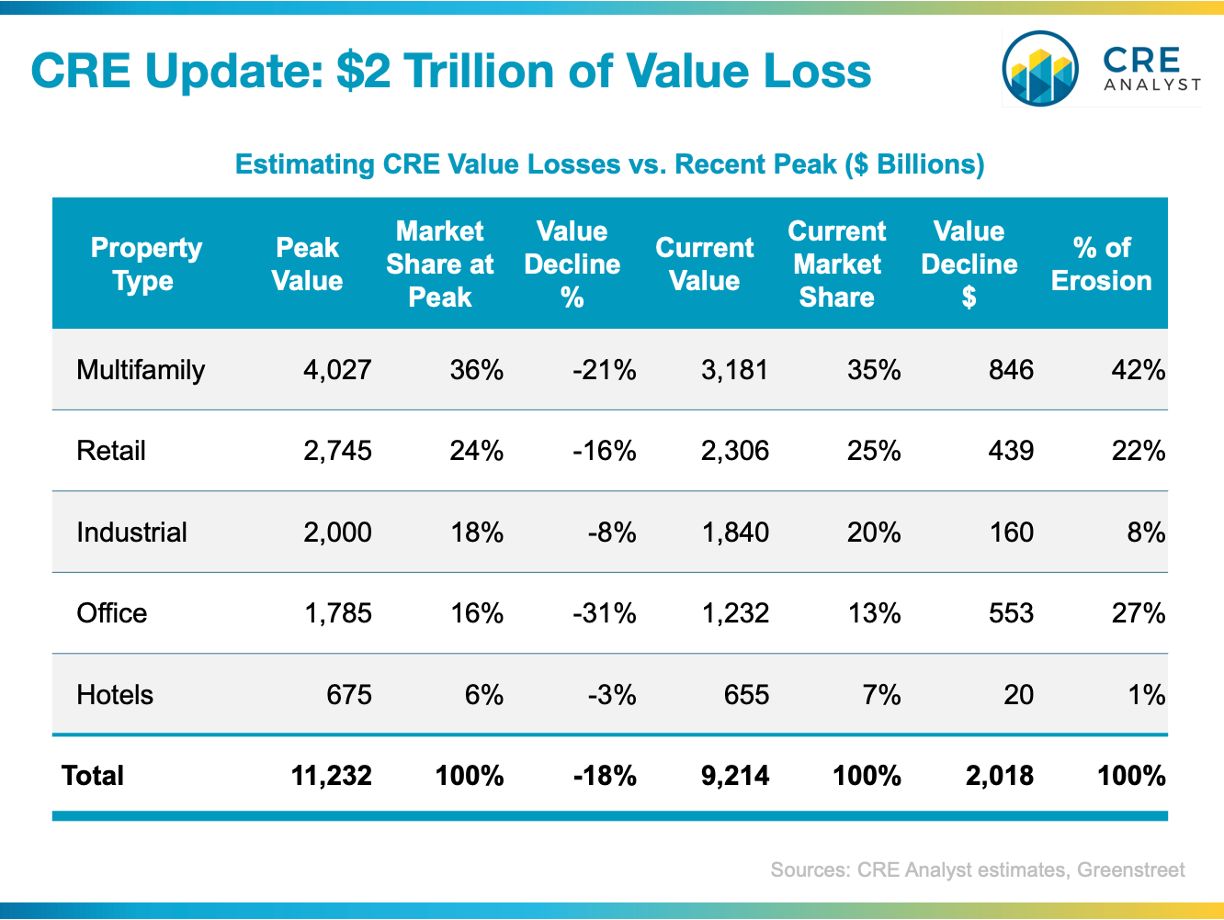

We estimated that the U.S. CRE market was worth over $11 trillion at the recent peak.

A lot has changed over the last 18 months...

Bad news 1: Values down by 18%

Greenstreet estimates that the market is down 18% from the peak, which corresponds to more than $2 trillion in value erosion over the last 12-18 months.

Bad news 2: Equity down by 50%

If you assume the average property was carrying 65% LTV debt at the peak, our estimates of value declines would imply that nearly 50% of U.S. commercial real estate equity has been wiped out.

Good news 1: Moderating declines

Since recent value declines were largely driven by capital markets shocks, values fell quickly but have since moderated. i.e., our updated estimates are generally in-line with estimates from a few months ago, except for office, which seems to be diverging from the crowd and continues to fall.

Good news 2: Most sectors had less than 65% leverage

65% LTV loans were popular in some segments (multifamily syndicators), but we think the average LTV for the overall sector was more likely around 50-55%, which would mean 30-40% equity declines instead of 50% equity declines.

Good news 3: Does a tree falling in the woods make a sound?

Paper losses don't have to turn into realized losses. ...unless you have a loan maturity.

COMMENTS