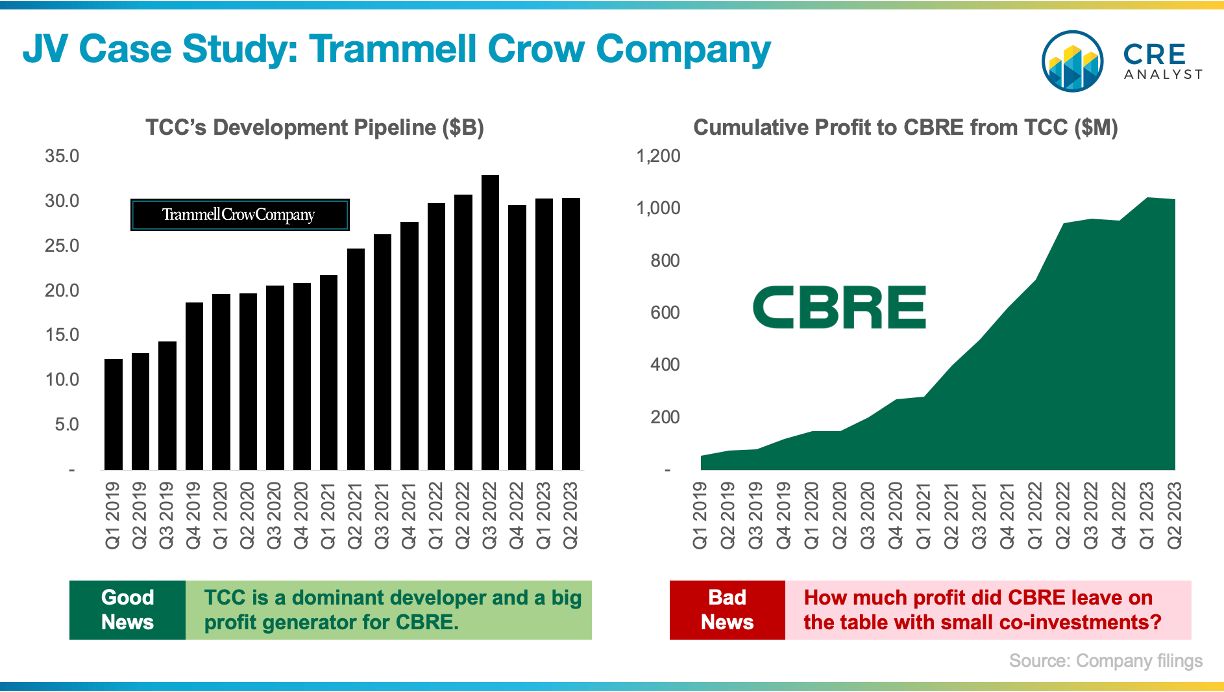

Did CBRE hit a home run with Trammell Crow Company and stop at second base?

TCC just completed one of the best runs in CRE history, generating $1B of profit for CBRE since 2019, on what we think required about $600M of equity. Estimated returns: 50% IRR, 2-3x. Kudos to TCC and CBRE for setting an extremely high bar.

But could the run have been a lot better for CBRE?

In our FastTrack class, we focus on the 5 critical components of a real estate joint venture:

1. Contributions

2. Distributions

3. Management and fees

4. Major decisions

5. Exit mechanisms

----- Thinking vs. Processing -----

Many young professionals focus on distributions/waterfalls because they think calculating is interpreting. We think financial modeling is important (but overrated) and that interpreting is critical (and underrated).

Thoughtful inputs matter. JVs are negotiated one by one, so there's room to push and pull for what's important to you, which is why we give our students a model, break them into LP and GP groups, and have them negotiate to arrive at a JV structure.

We start our JV discussions by diving into co-invests, which leaves us with a question for CBRE...

----- Why such a low co-invest? -----

- TCC is the largest U.S. developer with a $30B pipeline.

- TCC was acquired by CBRE from the Crow family in 2006.

- TCC has been a cash cow for the last 10 years.

- Many of CBRE's top executives are ex-TCC.

- CBRE's co-investments in TCC developments have averaged 5-8%.

If TCC generated $1B of profit by investing only 5% of the equity in its projects, how much additional profit could have been generated by investing more equity into TCC's deals?

Sponsor co-investments are hotly negotiated, with LPs typically wanting higher co-investments and being willing to trade more of the upside for bigger sponsor equity checks. TCC maximized IRR, but how much actual profit did CBRE leave on the table by minimizing equity outlays?

CBRE has purchased $2.5B of stock buybacks since 2019, so it had the cash. Why not double down on TCC to magnify profits?

Our guess: Developers are wealth creators; they focus on maximizing IRR not allocations or cash management. But cash isn't king if you don't use it, and CBRE had a monopoly on the largest developer during one of the best real estate cycles of all time and left a lot of profit on the table.

----- Clarification: Our goal -----

The 8 fundamentals of our business are complicated and are best learned in realistic situations, which is our goal in highlighting this situation. Do we think CBRE made a mistake over the last several years? Not necessarily. Hindsight is 20/20. We highlight it only to frame an important component within one of the critical frameworks that we cover in FastTrack (joint ventures).

What do you think?

A. Low co-invest, max IRR

B. Higher co-invest, more profit

COMMENTS