The real problem with office isn't occupancy.

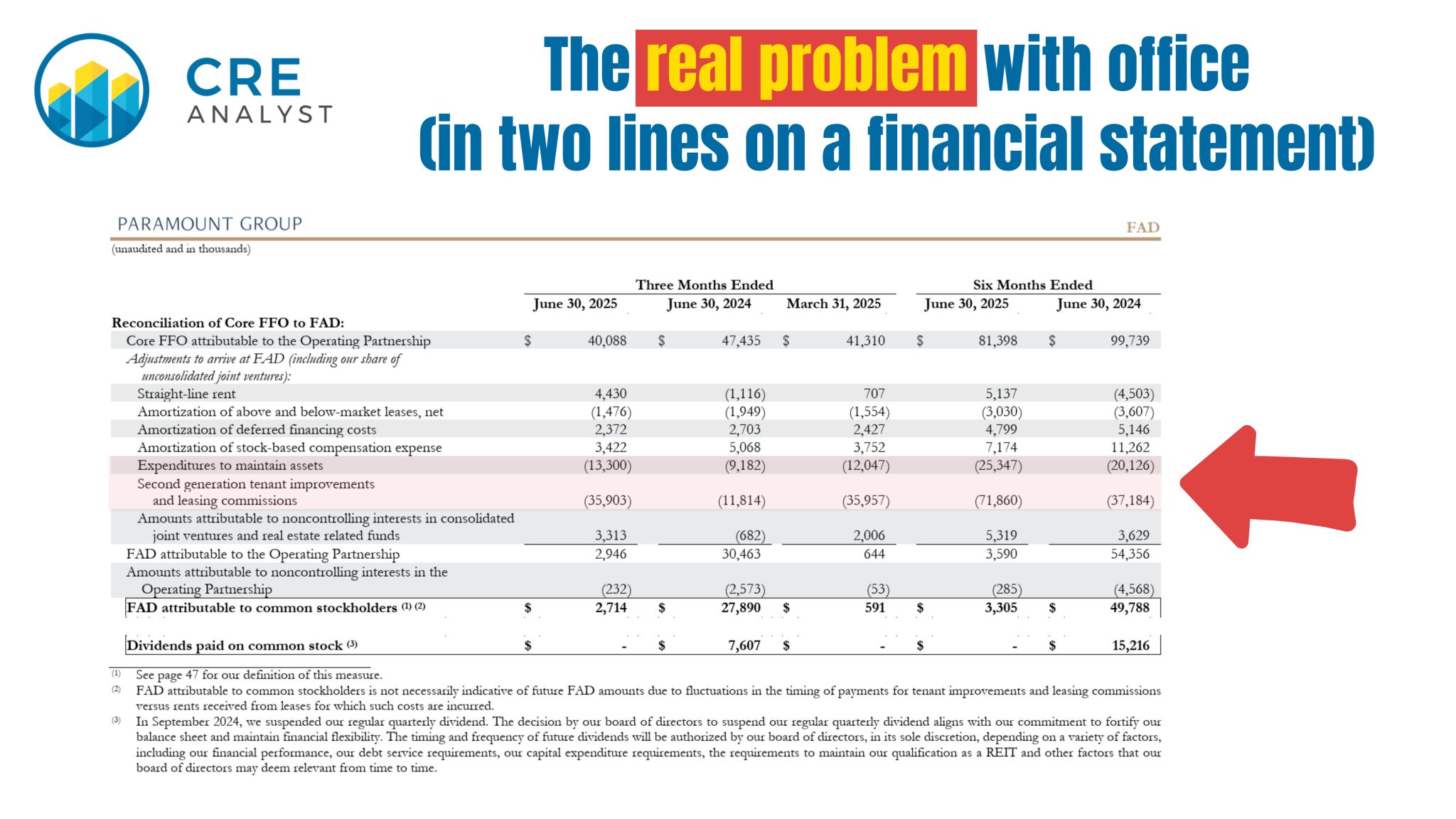

It's capital. A simple example:

Paramount Group has about $330M of NOI.

...and $100-200M of capital expenditures.

Think about that for a minute.

Paramount also has a lot of debt and $80M+ of annual G&A.

...all to manage 17 assets in 2 cities that are 85%.

---- Takeaway ----

The real problem with office is capex.

...which was largely ignored until Covid triggered an occupancy crisis.

...which led to an interest rate reversion.

...which led investors to realize that 80% of office's historical returns came from cap rate compression.

...which led to the biggest balance sheet reset in the history of office real estate.

COMMENTS