Goldman Sachs thinks CRE is on "firmer footing," but there's a catch...

On a relative basis, CRE is due...

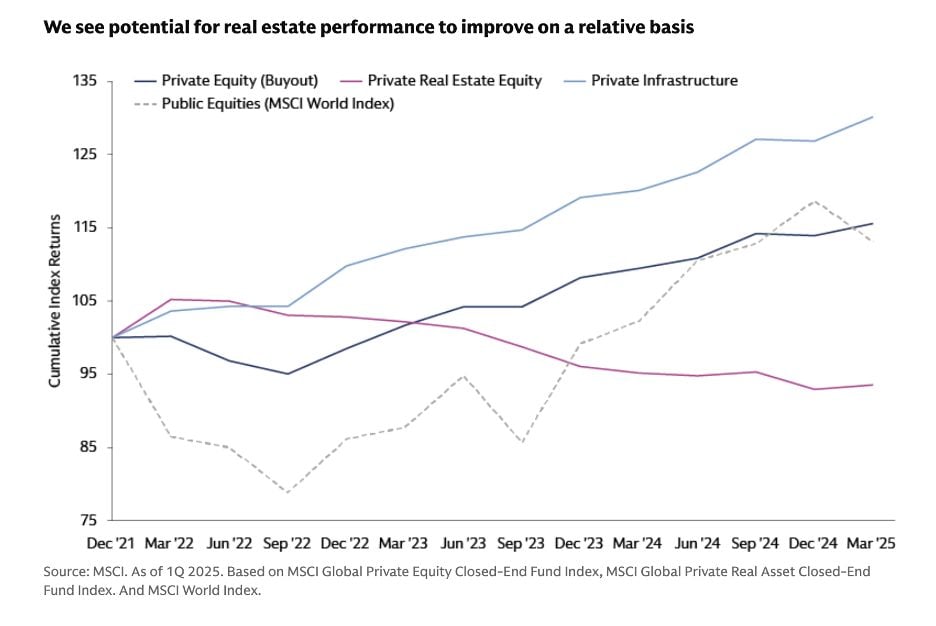

"Improving sentiment, valuations, liquidity and positive supply/demand fundamentals point to attractive entry points and relative value opportunities in real estate, including private real estate which has underperformed other asset classes like private equity, infrastructure, and credit markets over the last three years."

But this time might be different...

"We anticipate that the nature of the real estate recovery will diverge from the post-global financial crisis (GFC) experience. We are now operating in an environment defined by structurally higher interest rates and inflation. Therefore, we expect a larger share of total return in the future to come from income growth rather than cap-rate compression. Investors must also navigate divergence across regions."

How do you interpret this chart:

A) The red line (CRE) reflects the new normal.

B) Nothing can underperform forever, and CRE will bounce back.

C) Something else? [comment below]

COMMENTS