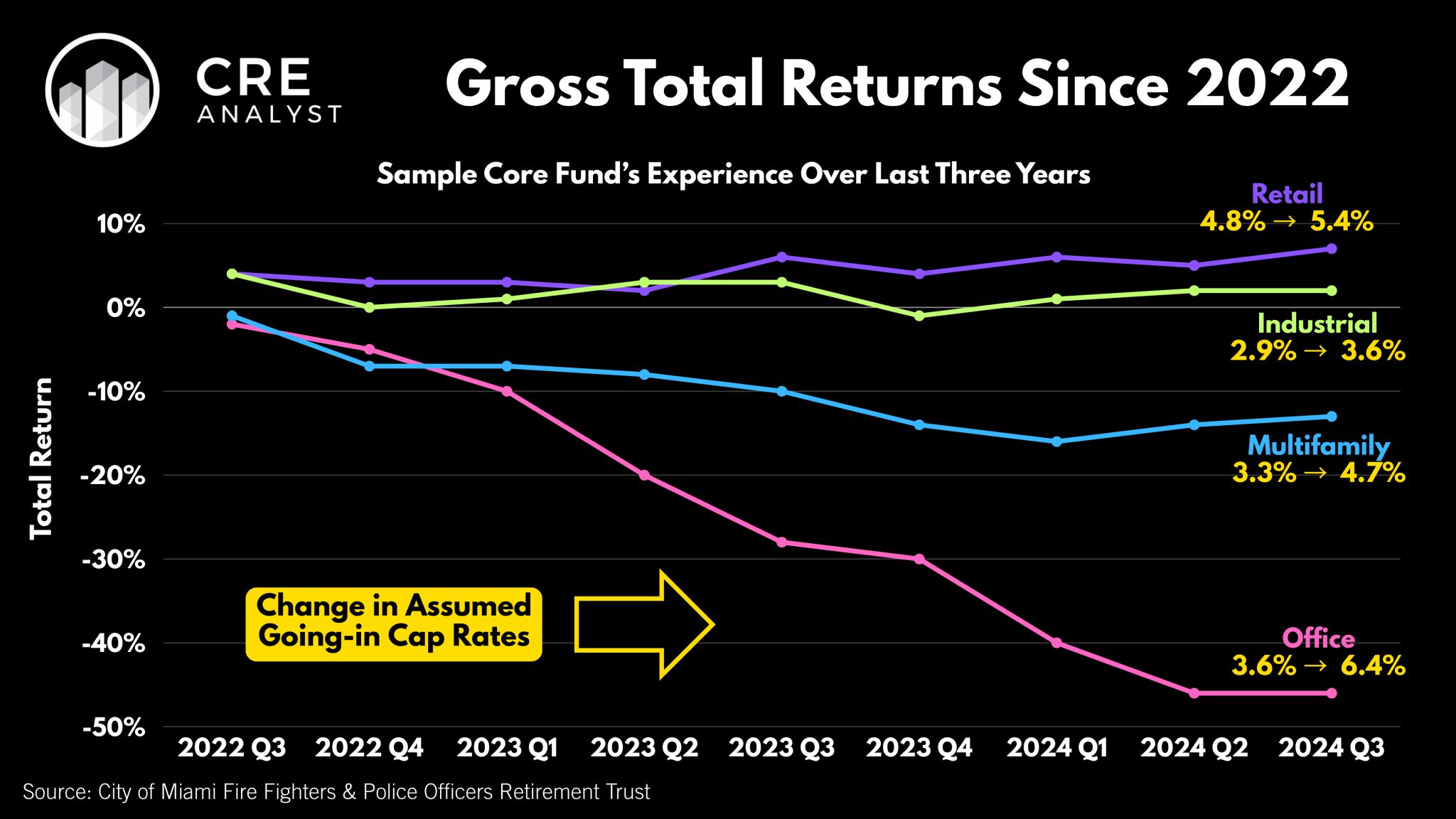

A rare look inside the valuation guts of a top-ranked core fund:

Retail

• Golden child

• +60 bps cap rate expansion

• High single-digit total returns

Industrial

• Largest allocation

• +70 bps expansion

• Just treading water

Multifamily

• +140 bps cap rate expansion

• -10% to -20% total returns

• Income growth helping… barely

Office

• Nearly -50% total returns

• +180 bps cap rate expansion

• Still a dirty word with institutions

---- Takeaway ----

Headlines don’t define markets. You need to be able to follow the dollars to navigate this market. DM us to join the next FastTrack cohort.

---- Want the details? ----

Click here to see original deck, which includes allocations, benchmarks, discount rates, cap rates, rent growth assumptions, etc.

COMMENTS