The rich get richer. A consolidating industry.

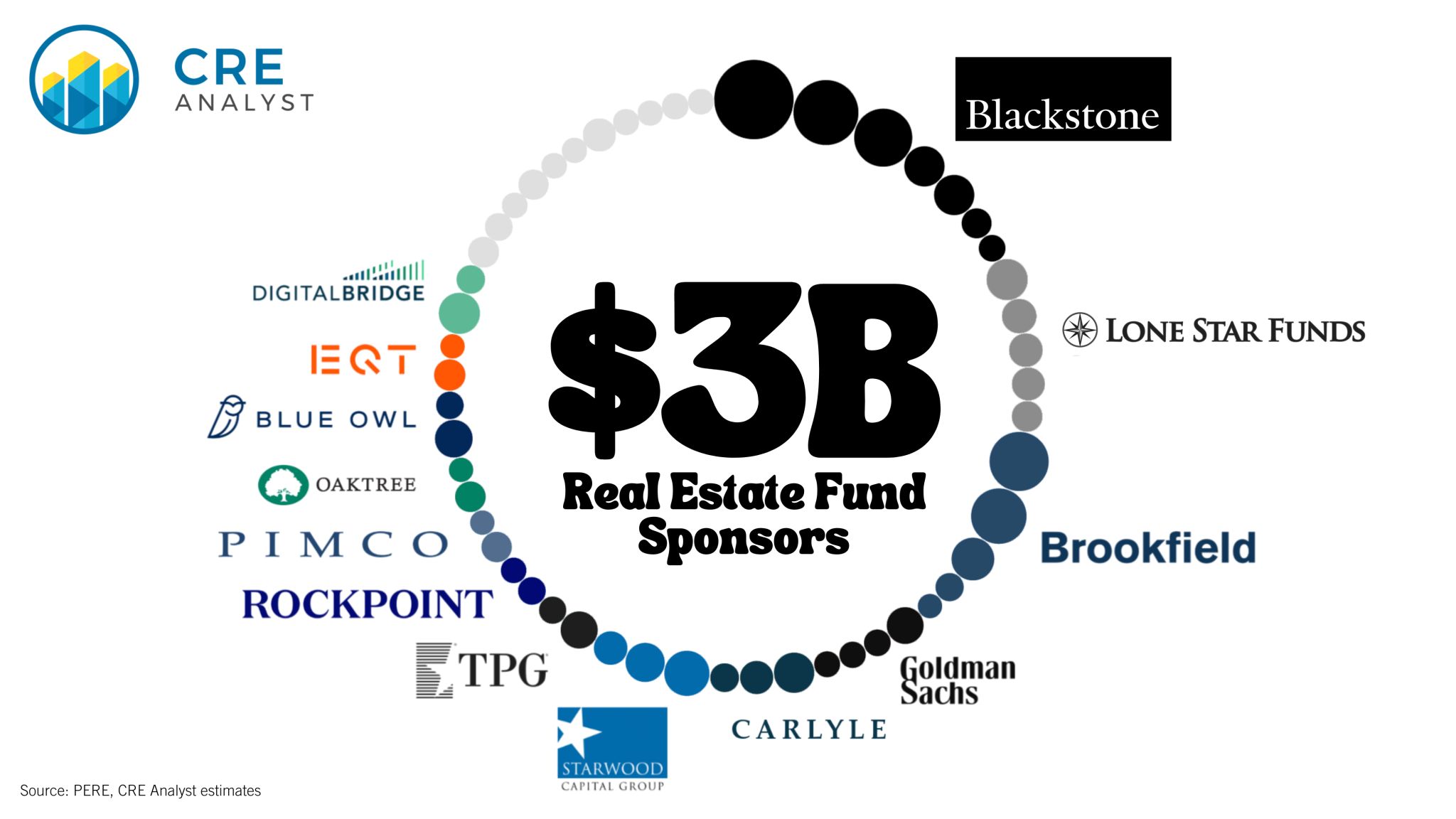

Real estate funds raised over the last few cycles:

About 4,000

Number of $3B+ funds:

66

Platforms with multiple $3B+ funds:

13

Blackstone, Brookfield, and a few other giants aren't just playing the game. They are rewriting the rules.

Why does this matter?

1. Scale Wins:

Big funds have more firepower. They can buy better assets, weather downturns, and move faster than the rest. In a storm, the biggest ships stay afloat.

2. Institutional Muscle:

These firms bring in strict management, deep controls, and sharp operations. They're bigger than a few individuals and set the standard for how real estate is run. The sector is no longer a playground for small players.

3. Global reach:

The top sponsors are everywhere. They hunt for deals in New York, London, Singapore, and beyond. This global push means more diversification and more ways to win.

4. Innovation engine:

With size comes resources. These giants are driving new tech and new sourcing pipelines, and they're not always price takers. They have the money and the mandate to push the industry forward.

5. Transparency and trust:

Big funds answer to big investors. That means more reporting, more oversight, and better alignment. The days of “trust me” are over. Now, it’s “show me.”

What does this mean for everyone else?

The middle is getting squeezed. And although many small operators have found a niche, they too are finding fundraising more difficult.

Our bet: the big are getting bigger, and they’re just getting started.

Interested in leveling up in a more competitive environment? DM us to explore our upcoming FastTrack cohort. The last cohort hit 90 NPS.

COMMENTS