Case study: How to lose a billion dollars

(Even big names can light money on fire.)

---- Worldwide Plaza: A quick history ----

2 msf office building in midtown Manhattan...

1. Built for $650M in 1988 by Zeckendorf.

2. Blackstone bought it after the early 90s recession for $375M.

3. BX flipped it from Zell/EOP to Macklowe days before the GFC for $1.73B.

4. Macklowe lost it two years later for $600M.

5. American Realty Capital bought it at $1.25B in 2013.

6. SLG/RXR recapped it in 2017 at $1.73B.

7. The property was appraised last week at $343M.

---- Big value decline ----

Having lost 80% of its value since its CMBS debt was issued in 2017, the property is worth less than when it was built nearly 40 years ago.

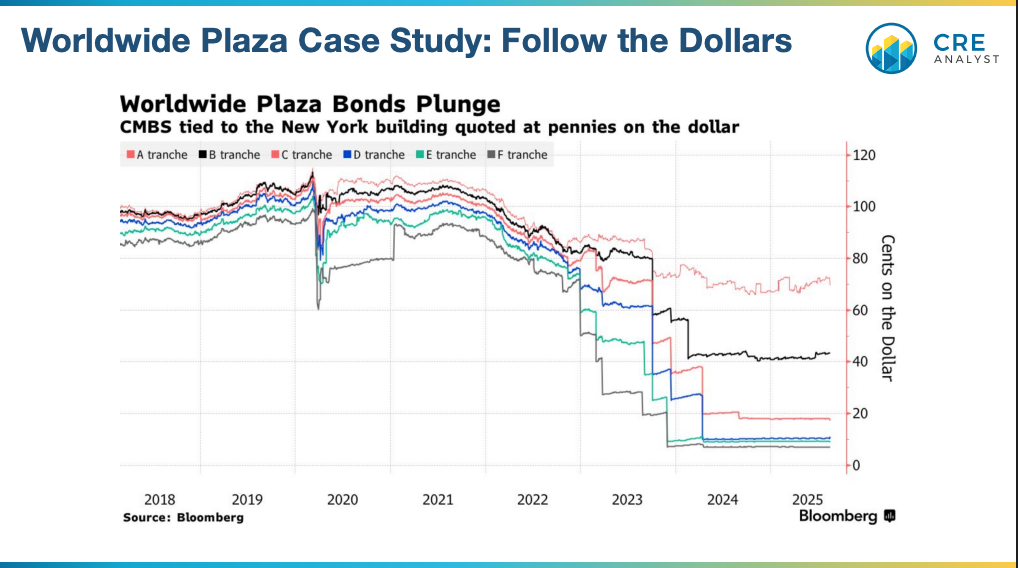

---- Underwater AAA bonds ----

Some previously-rated AAA bonds are hanging on to investment grade ratings but trade at 30% discounts.

---- Plenty of losses to go around ----

$435M of junior bonds likely wiped.

Class B trades at ~43 cents.

Class D at ~11 cents.

Pimco and Northwestern Mutual have been among the largest bondholders.

---- Emerging themes ----

While other office buildings are selling at 6% cap rates, buildings like this continue to struggle. What do they have in common?

1. Tenants want nicer space

WW Plaza recently lost a big law firm that left a 30% hole and another big bank has downsized and threatens to leave another 34% vacant. The building is currently only 65% occupied and can't cover debt service.

2. Huge capex costs

Re-tenanting the property would require about $400M of capital expenditures in order to re-stabilize NOI.

3. Maturity vs. term defaults

This loan doesn't mature until 2027, but since it can't cover debt service, every month the current owners have to feed it to survive. Are they throwing good money after bad?

---- Fundamentals in practice ----

This case study perfectly highlights two fundamentals we cover in our FastTrack class...

1. Every property has a lifecycle.

We refer to it as the lifecycle clock. Once you pass "core" (midnight), it takes a lot of capital to keep buildings in shape. Failing to appreciate that buildings aren't lines on spreadsheets is a perilous error.

2. Capital isn't ubiquitous.

We think in terms of 'first dollars' vs. 'last dollars'.

Debt vs. equity, mezz/pref vs. first lien, etc.

Securitization allows investors to slice capital stacks into many different pieces which dramatically affects risk profiles.

Being able to assess the risk and return profile of every slice relative to underlying collateral is like a cheat code for investors.

Interested in diving into these and the other fundamentals that define our business?

DM us to explore our upcoming FastTrack cohort.

Starts in two weeks.

Only a few spots remaining.

COMMENTS