Trigger warning: Cap rates are bullsh*t

A few weeks ago, Blackstone announced its planned acquisition of a $10 billion apartment REIT (AIRC).

The market's reactions generally fell into two camps:

Camp 1: 6% cap! 50% lower values vs. a few years ago.

Camp 2: 5% cap! 25% lower values vs. a few years ago.

Note: We've always been in Camp 2 because we think AIRC's approach to measuring NOI differs greatly from how buyers measure NOI. But set this debate aside for now.

KEY TAKEAWAY 1:

Valuing a property by "capping" NOI and then making decisions based on that value will often lead to misinterpretation and/or bad investment decisions.

Here's an example...

A leading REIT analyst published this when the BX/AIRC deal was announced:

"...we calculate that the transaction is approximately a 6% cap rate..."

No harm, no foul if the analysis ends here, but it never ends here.

"If we put in some deal costs of about 2% or so of the total price, the implied cap rate looks to be something around 5.8%. Our NAV estimate was about $42/share utilizing a 5.65% cap rate on the stabilized portfolio, so this is a bit inside of our estimate but arguably not too far off on the equity value."

This analyst is basically saying: "Blackstone is affirming our estimates of private asset values." ...estimates which are based purely on cap rates and form the bedrock of the analyst's buy/hold/sell recommendations. But we think Blackstone paid a higher price relative to income, which is important.

KEY TAKEAWAY 2:

No one buys properties (outside of NNN leased retail) on a cap rate basis.

Blackstone example...

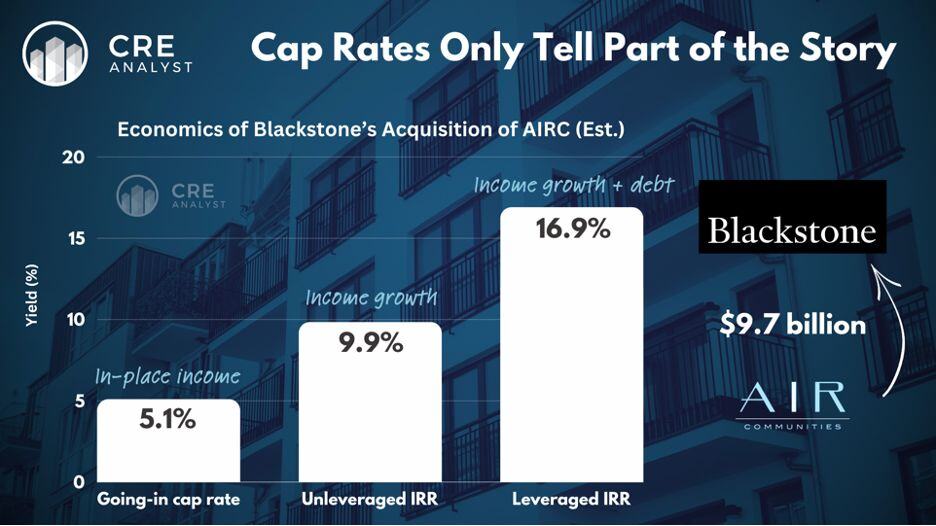

Let's go back to Blackstone's acquisition of AIRC.

Did Blackstone agree to buy the REIT because it was a 5% or a 6% cap? No. Blackstone is buying AIRC because it thinks the purchase will generate 15%+ returns for BREP X investors.

Here's our assessment of Blackstone's logic:

Going-in cap: 5%

CF growth: +5%

Favorable debt: +7%

Leveraged IRR: = 17%

Blackstone's promote: (2%)

BREP X investor returns: 15%

CONCLUSIONS

You can agree or disagree with our estimates, but what's more important, especially for early career professionals and/or anyone who hasn't lived through a cycle, is this:

1. Valuation is the most important skill in real estate.

2. Investors don't buy properties based on cap rates.

3. Properties are priced based on discount rates/UIRRs.

4. Investors use debt to juice returns to satisfy investors.

We cover all of this in detail in our FastTrack and Argus certification classes. If you don't get these skills from us, get them somewhere if you want to invest in real estate.

COMMENTS