7 messages from Blackstone’s announced acquisition of AIRC for the rest of the market…

1. You're asleep at the wheel

Thanks for staying on the sidelines and plowing into credit. I know you think debt offers equity-like returns, but there's not much upside in that underwriting, and debt platforms aren't always silver bullets. Either way, thanks for creating space for BREP to get opportunistic returns on core-like investments.

2. Distress is overrated

You think this is like the S&L crisis? Good call. Please keep waiting for the government to take over all the banks after they fail from the foreclosures that aren't happening, then sell you collateral at 50 cents on the dollar.

3. Cap rate expansion is over

Nothing was trading 6-12 months ago, which left many people eyeing worst-case scenarios (including us). But the market has shifted a lot in the last six months. 4-5% Treasurys are workable, especially with SASB spreads coming in. We can generate mid-teens returns by buying in the 5s and generating a few hundred basis points of cash flow growth. Any further interest rate and/or cap rate declines are gravy.

4. In-place debt helps

Assumable mortgages make the math outlined above even better. AIRC's average in-place debt is at about 4.3%.

5. Income growth matters

While you were obsessing about syndicators and higher taxes/insurance, rent growth has found footing in many markets. Most renters don't have anywhere to go, and the supply pipeline is shutting off. 2024 may be slow, but we like the way the next few years are shaping up.

6. No NYC, no problem

The NYC apartment situation is a mess with increasing threats of widespread rent regulation (good cause eviction?!). The low discount rates we used to afford NYC apartments due to supply barriers and abundant capital seem gone for good. Minimal exposure in AIRC's portfolio.

7. California Love

Lots of talk about everyone moving out of California, but if ever there were a place in short supply of decent housing options. More than 1/3 of AIRC's portfolio is in California, and that's good with us.

---- Background / Perspective ----

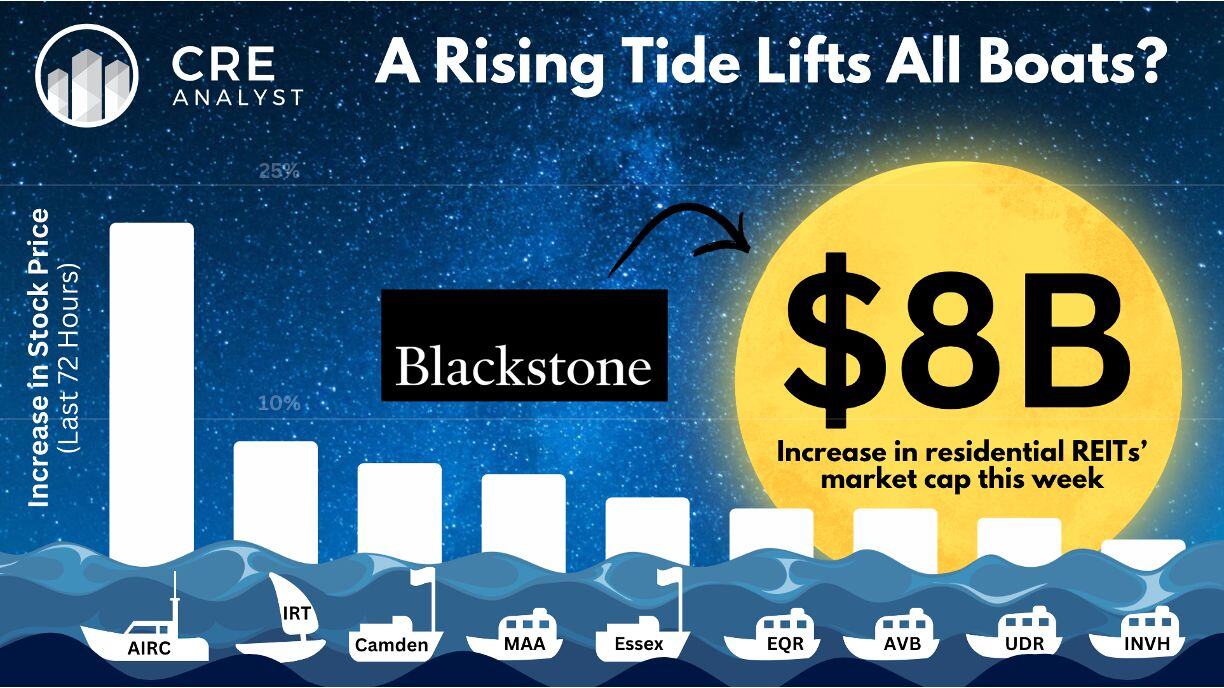

15 publicly traded residential REITs had a combined market cap of $156.6 billion last Friday.

Those same REITs were worth $164.4 billion within 48 hours of BX's announced acquisition.

...a $7.8 billion pickup in 48 hours.

---- Obvious takeaway ----

Some of the euphoria around these REITs may fade, but it's clear that the market is reading more into this proposed transaction than what can be priced into AIRC's value.

One side is going to be wrong (i.e., prevailing market sentiment or Blackstone). Which side are you on?

COMMENTS