"It's not you, it's me."

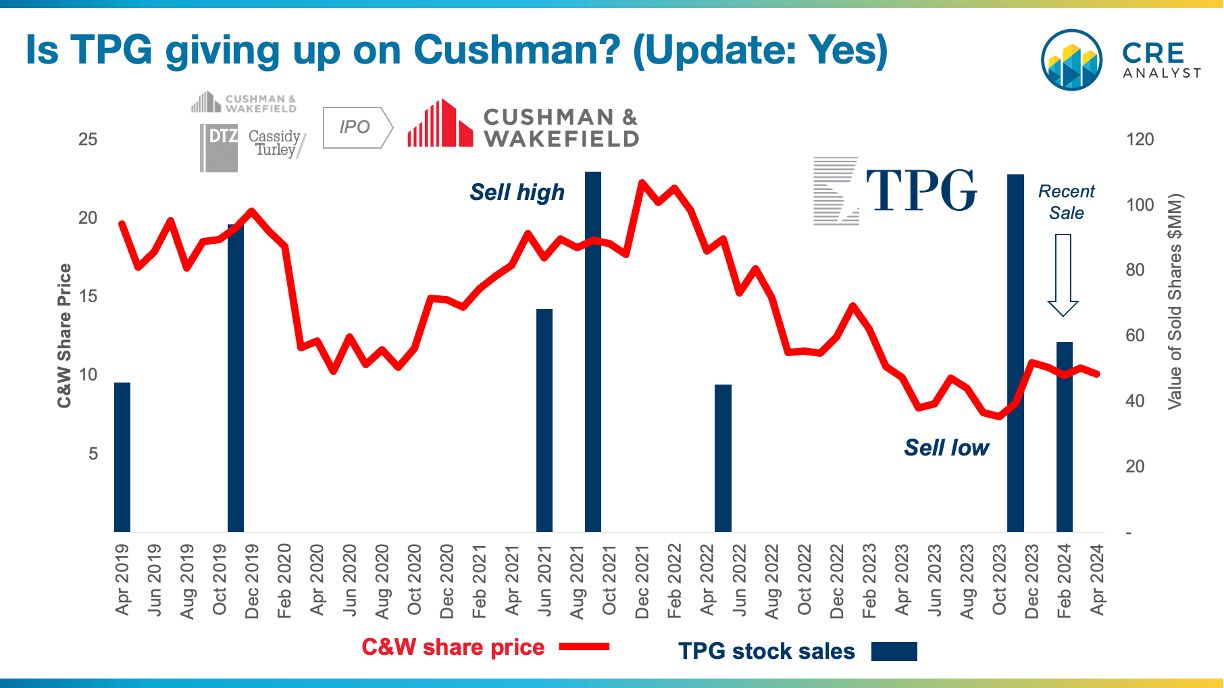

In late 2023 we noticed that TPG sold a large block of C&W stock near all-time low pricing.

[TPG: The private equity giant and architect of C&W's consolidation/IPO.]

...so we asked if TPG (then C&W's largest shareholder) was throwing in the towel on Cushman.

Fast forward three months: TPG just sold another big block of stock 54% below the post-COVID peak valuation.

---- Background ----

Back in 2018, media reports suggested that 'TPG played Cushman deal perfectly and made a huge profit.'

Maybe so, on paper.

...but TPG straddled C&W with a lot of debt, which needed continued profit growth and a stable valuation for TPG to cash in on those paper profits.

Lots of debt, high rates, and sluggish brokerage activity changed TPG’s calculus.

---- Dumping stock ----

When we originally shined a light on TPG's $110MM stock sale in late 2023 we said: "We'll get an updated read when C&W reports earnings in early Feb, but it looks like TPG is on the way out."

Well, we got an updated read about a month ago when TPG sold another $60MM of its shares, bringing its ownership to about 7.5% of the company.

Two big stock sales after 50%+ declines don't inspire a lot of confidence about future company valuations.

And, for comparison, the market has improved since October lows, but C&W has been outshined by other brokers. E.g., Newmark's bounce has been about 2x C&W's.

---- Takeaways ----

1. Signs of stabilization from last earnings call

C&W's Dec 2023 YoY revenue was down compared to 2022, but the pace of decline moderated (-3.5%), which boosted operating income due to C&W's recent cost-cutting. Income was still down by about 50% from the recent peak, but signs of stabilization are positive, and C&W suggested that it's done cutting costs for now.

2. Execs vs. brokers

C&W's balance sheet issues are upstream from C&W's operations. C&W has some of the strongest and most successful brokers in the business, but it will be interesting to see if enterprise/capital challenges eventually affect operations. In some ways, these challenges could be good for brokers, since C&W will likely seek to avoid any perception of flight.

3. What to watch

Many signs point to at least a moderate rebound in transaction activity, which should help C&W to further stabilize operations. A pick-up in office activity would likely send a favorable jolt through the C&W system.

Also, C&W doesn't have the overhang of maturing bonds like it did last year, which gives the firm a few years to convince the market it has a path to progress.

---- Open door ----

If you work at C&W, let us know what you think about our observations. Many people send us DM tips/feedback, and we always keep them strictly confidential.

Similar invitation for C&W executives. If you're on the leadership team and want the market to better understand your rebound plans, we would welcome an opportunity for a candid Q&A.

COMMENTS