"The things you own end up owning you."

---- Go big or go home: They went big ----

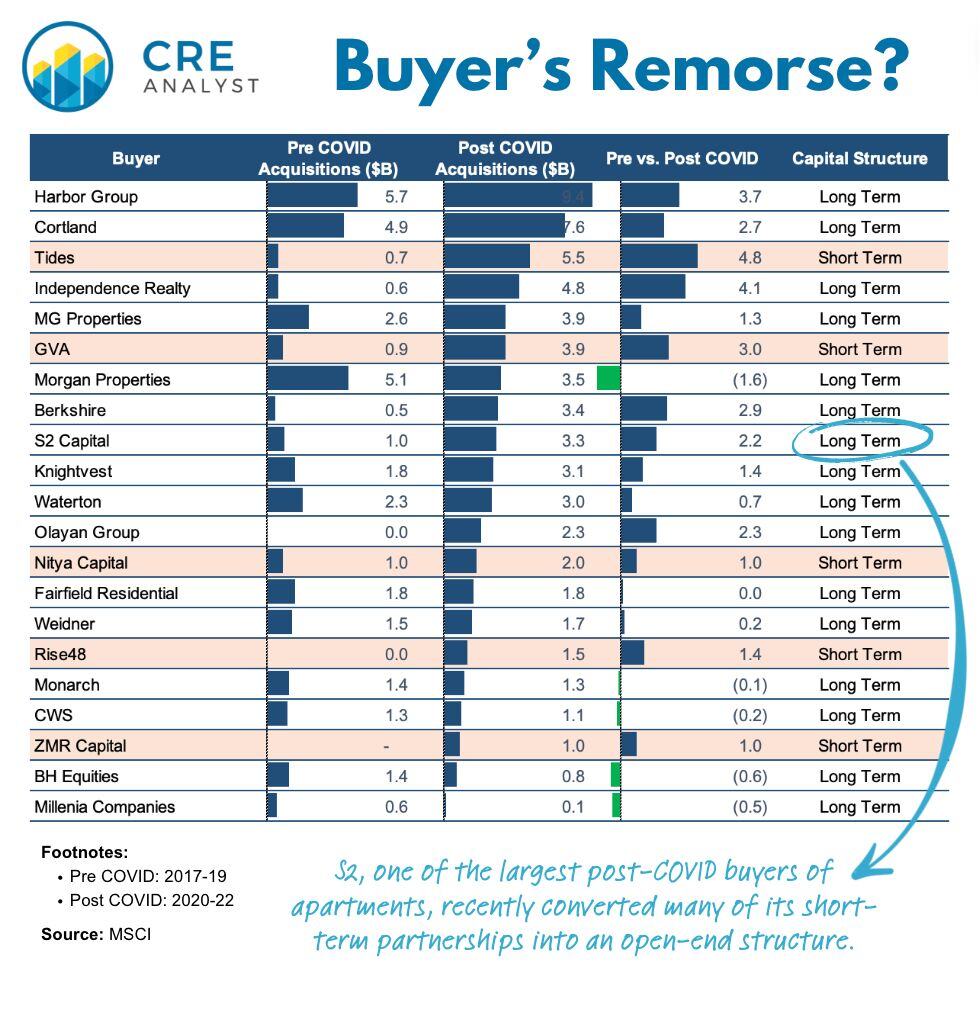

These 21 multifamily sponsors were big buyers during the COVID rebound.

They collectively bought $65 billion of apartments near peak pricing.

---- Winners vs. losers ---

We think those property values are likely down by about $20 billion, but losses won't hit investors evenly.

What will differentiate performance?

---- Background 1: Fortune favors survival ----

We posted an analysis yesterday that suggests 99% of multifamily markets go up in value over 10+ year hold periods.

Implication: How do you make money investing in apartments? Survive.

---- Background 2: Changing structures ----

One of the names on this list would have been highlighted in red a few weeks ago, but S2 Capital recently converted much of its equity into a perpetual, open-end vehicle.

Hard to overstate how meaningful this transition could be for the firm, which was a notable floating-rate borrower when rates were around 2%.

We recently posted an analysis of this transition.

[See links to both of these posts in comments.]

---- Key differentiator ----

So what will differentiate winners from losers?

Long-term capital.

...if you have it, you'll be good. Those paper losses will turn into paper gains as NOI growth pulls you out of the jam.

...if you don't have long-term capital, survival may be questionable.

We believe the highlighted firms have disproportionate exposure to short-term debt and equity. They were also relatively aggressive borrowers (i.e., high LTV loans with low cap rates).

The other firms have longer-dated debt and/or equity and/or didn't go "all in" at the peak.

---- Two existential problems ----

Market indexes would imply that the five highlighted firms have lost about $4 billion of paper value from the peak.

Existential problem 1: We estimate they invested less than $5 billion, which would imply 80% equity losses.

Existential problem 2: 80% loss rates would only jeopardize survival if they were forced to recognize losses. ...say due to loan maturities. Well, many of these sponsors have pending maturities.

---- Takeaways ----

This situation isn't new. Investors who finance long-term investments with short-term capital hit rough waters every decade or so.

The jury is out on these five sponsors. They aren't necessarily doomed. History suggests that candid discussions and overcorrection inspire confidence and give sponsors the best chance of recovery.

Our goal is to shine a light on these situations through the lens of our class frameworks, which hopefully promotes insight instead of sensationalized generalizations.

PS - The CEO of Nitya Capital recently agreed to a Q&A interview with CRE Analyst. If he follows through, we will post his responses to our candid questions in the coming days.

Stay tuned...

COMMENTS