Good news is boring but this seems like a big deal...

---- CRE Media 101 ----

What sells? Sex, fights, conflict, bad guys.

What doesn't? Nuance, slow progress, resolution.

---- Syndicator challenges ----

The apartment syndicator narrative is well-known...

A handful of apartment buyers led a historic surge in floating-rate financed purchases at all-time-high prices during the COVID rebound.

Now they're struggling.

S2 was in the mix, buying $3B+ coming out of the pandemic, mostly with floating-rate debt.

...but S2 hasn't attracted the spotlight focused on Tides, GVA, Rise48, Nitya, etc. (for good reason).

However, S2 has certainly been grappling with similar challenges:

-- Loan maturities

-- Higher interest rates

-- Lower values

-- Forced paydowns

-- Expensive rate caps

The keys to solving these challenges are clear:

-- Key 1: Perpetual equity

-- Key 2: Long-dated debt

-- Key 3: It's easy to get Key 2 when you have Key 1.

However, implementing these solutions is difficult. Ask Tides. They're reportedly trying to raise preferred equity. Good luck with that.

We're skeptical that 2021 solutions can solve 2024's problems.

S2, on the other hand, might be leading the pack in terms of finding 2024 solutions...

---- CRE manna: Perpetual equity ----

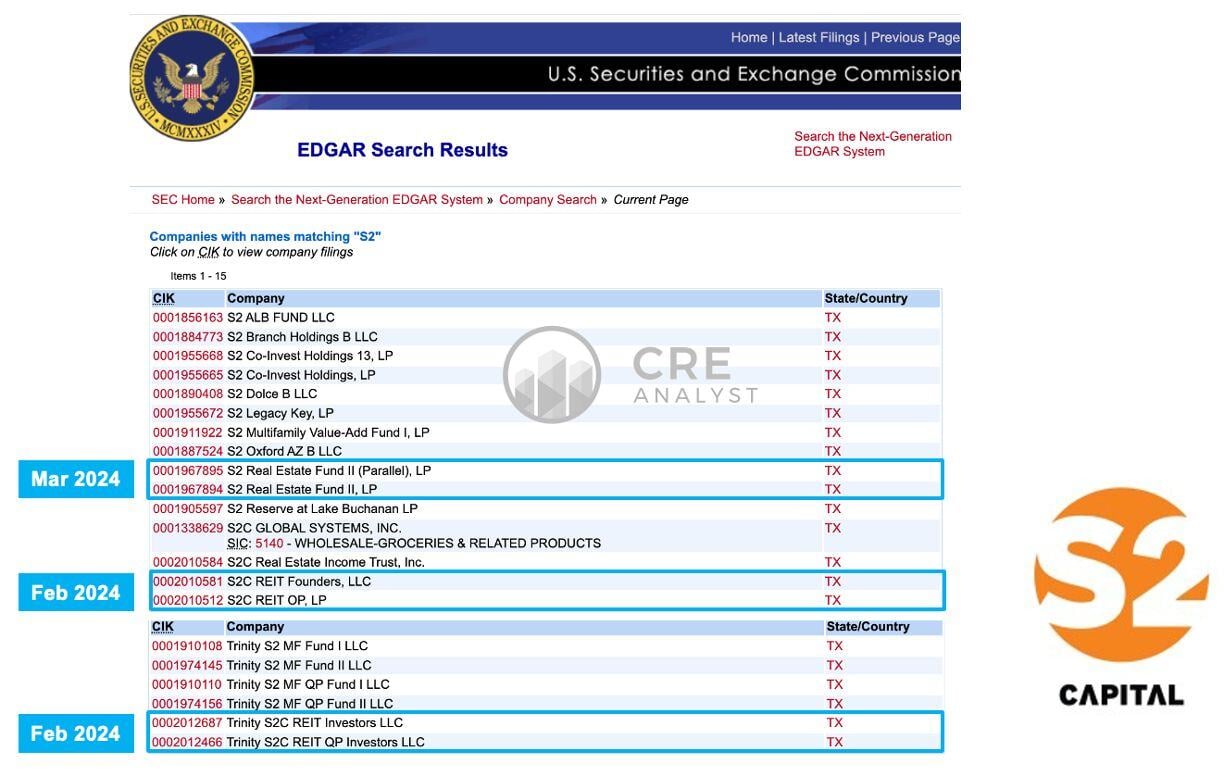

We just stumbled on some interesting SEC filings, all from the last 60 days:

-- S2C REIT Founders

-- S2C REIT OP

-- Trinity S2C REIT Investors

-- Trinity S2C REIT OP Investors

-- S2 Real Estate Fund I

-- S2 Real Estate Fund II

Uninformed guesses about what this could mean:

-- S2C: S2 Capital

-- REIT: a tax entity structured for long-term ownership

-- Trinity: $2B+ allocator

-- Funds: Pooled vehicles

Overall, we think it's possible that S2 just created a perpetual vehicle for its existing investments. Converting investors to an open-ended vehicle would provide S2 with a runway to secure relatively favorable financing.

If this is what happened, S2 just showed other syndicators how to survive until '25.

COMMENTS