We recently talked with Ryan Severino, CFA, the Chief Economist at BGO (a leading CRE investment manager), about the commercial real estate sector's trends and troubles.

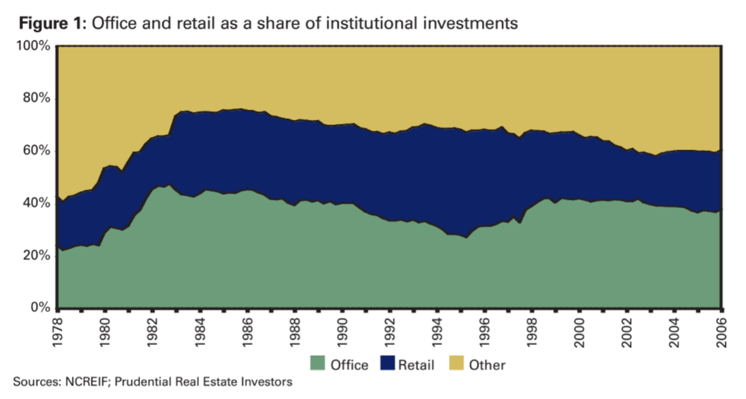

Retail and Office Allocations

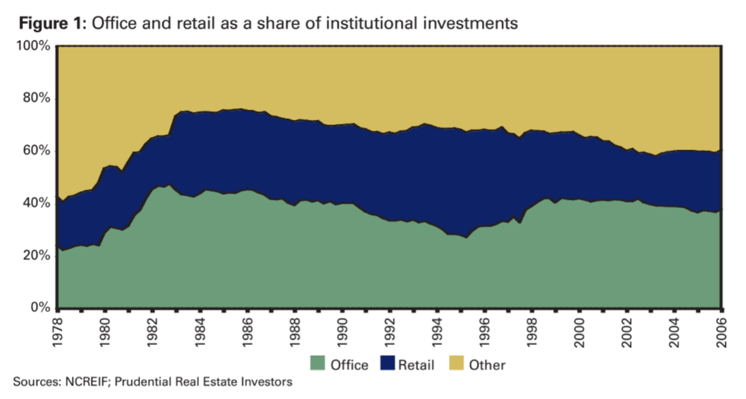

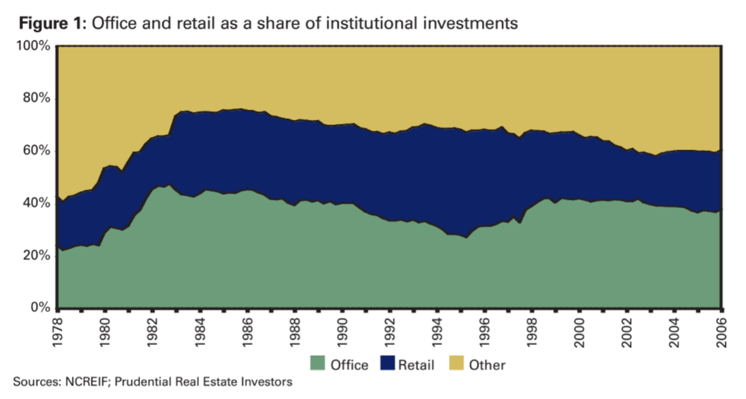

You wrote a widely cited paper a long time ago about how it can be advantageous for investors to rotate between asset classes. It seems like the current rotation out of office and retail—the sectors you highlighted in that paper—are more structural in nature, away from both sectors.

If institutions are currently 30%+ allocated to office and retail (especially malls), what will their office/retail allocation be in ten years? What sectors will fill the void?

Thanks for the shout-out! Very appreciated.

What’s interesting to me is that relative to when I wrote that paper (and a couple of decades leading up to then), desired property-type allocations for the four major food groups have been turned on their heads.

Once upon a time, office and retail were more dominant. Apartments got included in institutional portfolios later than other asset classes and industrial was long thought of as sleepy and consequently was perceived as not producing very attractive returns.

Now, the CRE world is enamored with industrial and apartments while office and retail are out of favor. That will likely persist because of the structural changes you mentioned. I’m not saying I fully agree, but I understand it.

Therefore, relative to the era during which I wrote that paper I’d expected higher allocations to industrial, apartments, and sectors such as self-storage, data centers, and single-family rental (SFR).

Distressed Properties

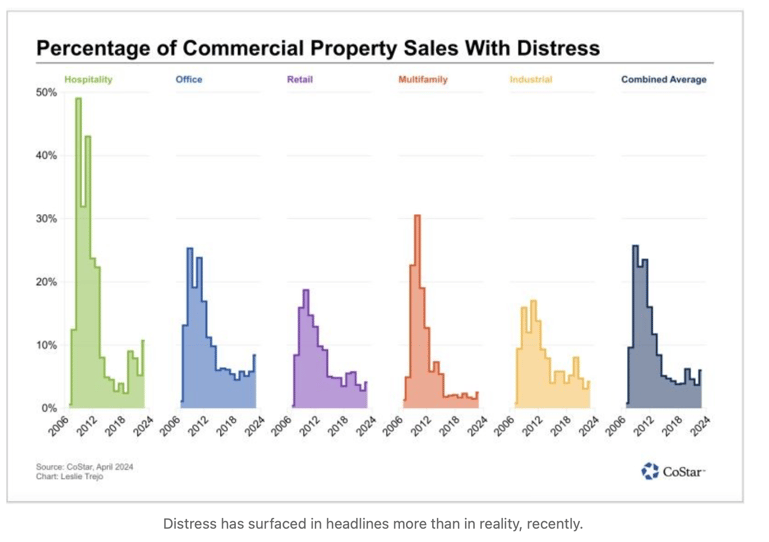

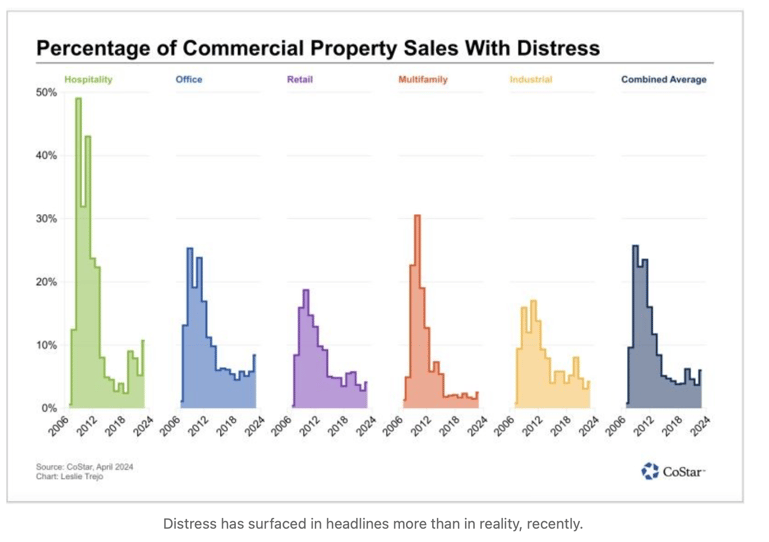

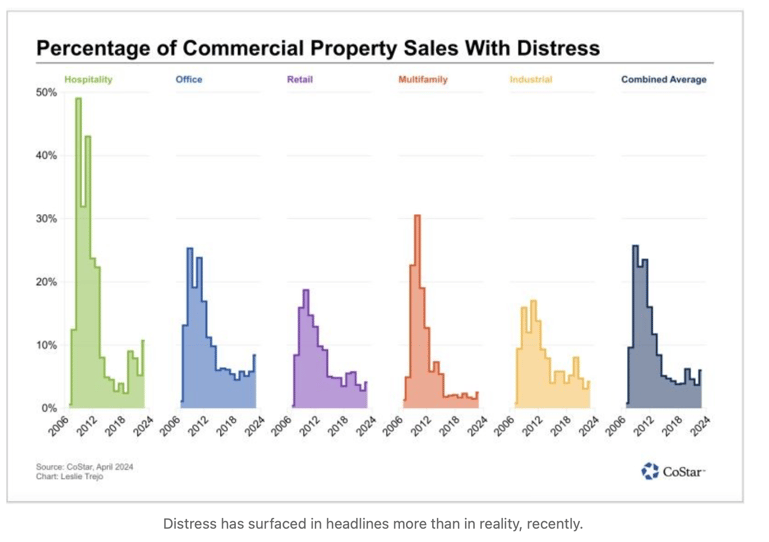

There’s been a lot more talk than action on the distress front. “Extend and pretend” is a popular buzz phrase, but no one seems to be pretending. Delinquencies, although up from the recent trough, are well below prior downturns, and most borrowers are putting in fresh capital to preserve their investments.

Are we headed to a tsunami of maturities that will change the game or is "slow and choppy" the name of the game going forward?

I feel like during every down cycle people get really excited about distress, but what actually happens almost always falls short of grand proclamations. It happened after the GFC. It even happened last year.

That’s not to say that there won’t be more distress, including delinquencies and defaults. That doesn’t occur instantaneously. It always takes a bit of time. There are certainly shoes still to drop, especially for low-quality office.

However, these grand proclamations about blood in the streets seldom if ever occur. There will be opportunities for investors, especially those willing to step in to fill holes in capital stacks, but timing and perspective matter.

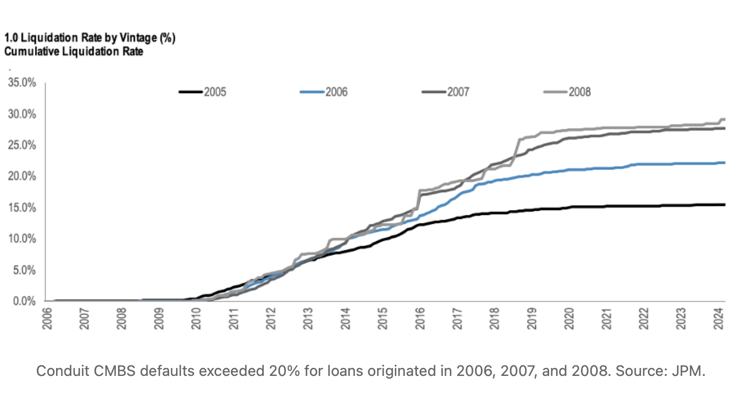

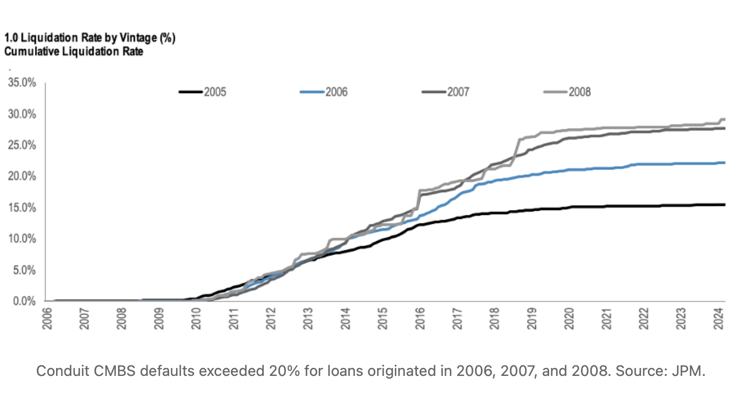

Commercial Mortgage Defaults

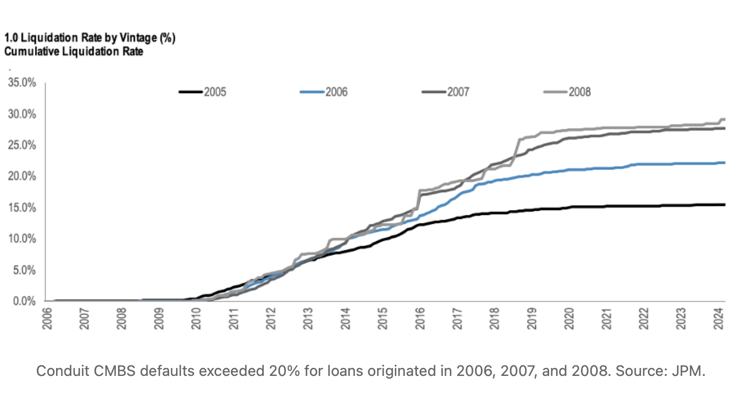

Default rates for loans originated right before big historical real estate crashes were extremely high. i.e., 30%+ on multiple occasions. What’s the likelihood of loans originated during the COVID recovery hitting those ominous benchmarks?

You might see higher default rates in certain pockets, but nobody is walking away from good collateral just because the financing situation gets a bit bumpy. The abundance and diversity of capital sources will see that off. However, there may be instances of lower-quality collateral in office or apartments that still benefitted from very cheap capital, and of course, that’s a different story.

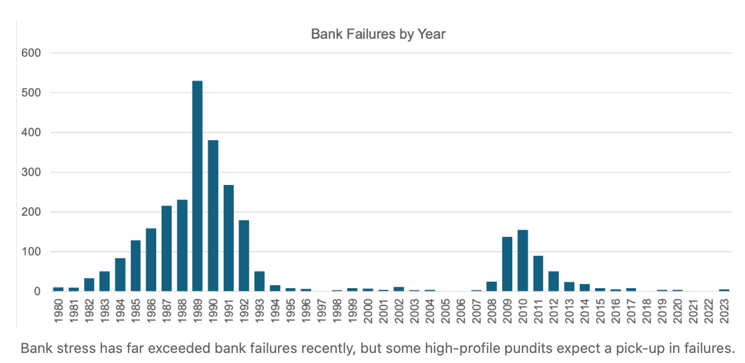

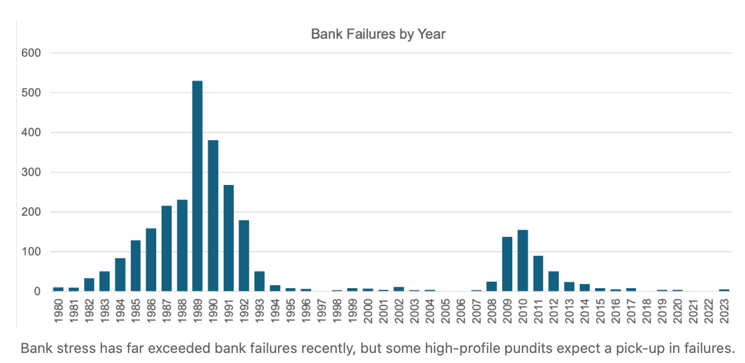

Bank Failures

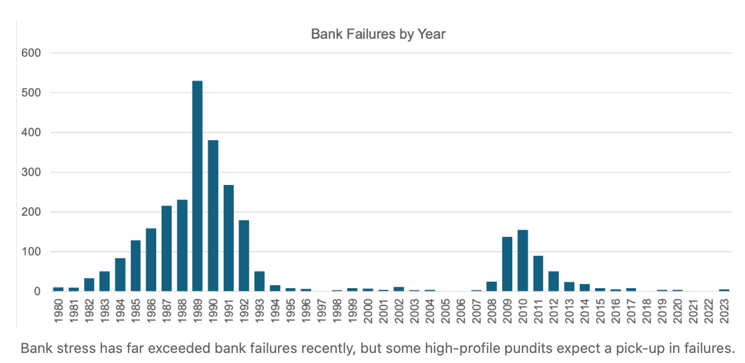

Despite pervasive commentary about bank stress from real estate exposure, bank failures are running at about 10% of the GFC pace and only 4-5% of the 1980s and 1990s experience.

CBRE called for more bank failures in 2024, and Jerome Powell recently said that “more will be bank failures.” Do you see a meaningful pick up in bank stress from real estate loans?

I don’t know if I would characterize it as a meaningful pickup in bank stress per se, but some could likely occur. Like what I said before, people tend to speak in hyperbolic terms about things like distress and bank failures, but the reality seldom matches up to such proclamations. Yet, there are a few important qualifiers here.

First, CRE is not housing. Housing is fundamental to the economy and roughly two-thirds of households. It poses a huge systematic risk when it goes awry. But CRE? It is relatively more discretionary than housing, so its impact is less pervasive and acute. This means its impact on the macroeconomy, lenders, etc. tends to be lower. The S&L/RTC Crisis was about as bad as it could get for CRE loans (and it was really ugly), but the fallout was a lot less than during the GFC.

Second, most CRE is performing well in terms of space market fundamentals. That limits distress.

Third, relatedly, there exists a selection-bias phenomenon for some CRE lenders - the collateral they lend on is not that good-quality collateral. They tend to be smaller, more regional lenders that don’t get the pick of the litter for collateral quality or market selection.

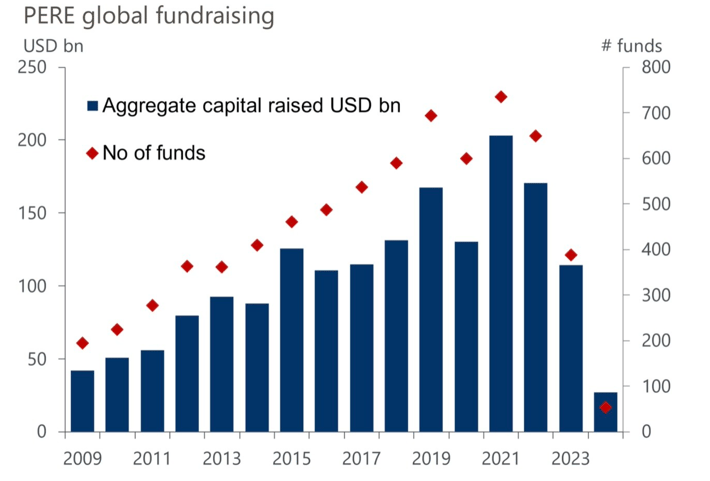

Investor Appetite for Equity

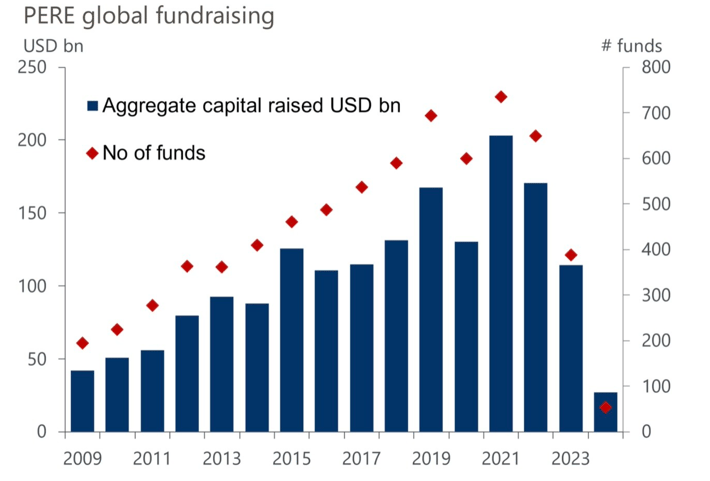

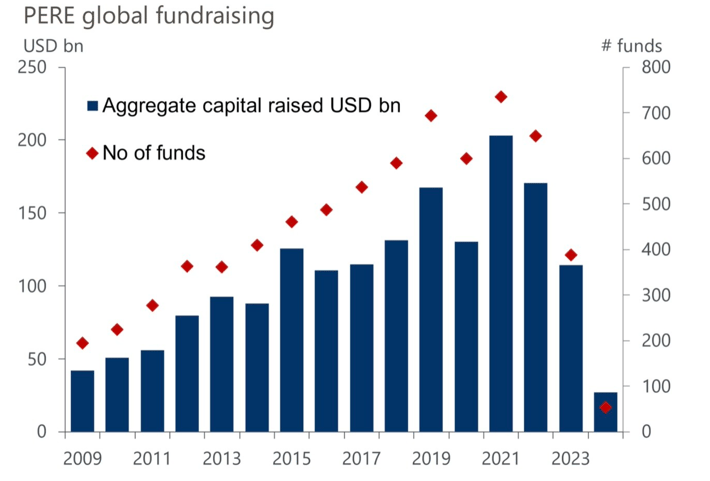

For the last two years, a dominant mantra from investors has been: “Why would I invest in equity if I can get equity returns in debt?” Accordingly, there’s been a big drop in equity fundraising. When does the tide come back toward equity?

The big issue is monetary policy. Research shows that when the Fed stops raising rates, returns revert into positive territory quickly. That is getting delayed this cycle because we had such an abrupt regime change for monetary policy in such a short period of time so in some respects the CRE market is still catching up.

This really is a matter of when not if. Once the market adjusts its expectations, especially once the Fed starts cutting, that will cause returns to accelerate, attracting investor capital while simultaneously lowering the yield that can be had on debt instruments.

This is a cyclical phenomenon, and it will play out again this cycle.

Artificial Intelligence in CRE

Will AI meaningfully affect the real estate investment management business?

Absolutely! Do not underestimate the impact of data science (artificial intelligence, machine learning, etc.).

We are already aggressively using it to help us forecast, rank, and target markets - more than other firms we work with. We have a deadly serious effort, we’ve been working on this for five years, and we keep pushing the envelope. We will increasingly use this to help us target markets for investment, manage individual assets on our balance sheets, and manage our portfolios.

The problem is that this is like dotcom 2.0 – there will be some firms that use this technology amazingly and transform how our industry works, but there will also be many that are nonsense, who aren’t implementing serious techniques and will fail sooner than later.

This technology is even more esoteric and complex than the internet, making it very difficult for the average industry participant to distinguish between the two types of firms.

But make no mistake about it - data science is a train that is leaving the station. If you aren’t on this train you are going to find yourself underneath it.

Topics

We recently talked with Ryan Severino, CFA, the Chief Economist at BGO (a leading CRE investment manager), about the commercial real estate sector's trends and troubles.

Retail and Office Allocations

You wrote a widely cited paper a long time ago about how it can be advantageous for investors to rotate between asset classes. It seems like the current rotation out of office and retail—the sectors you highlighted in that paper—are more structural in nature, away from both sectors.

If institutions are currently 30%+ allocated to office and retail (especially malls), what will their office/retail allocation be in ten years? What sectors will fill the void?

Thanks for the shout-out! Very appreciated.

What’s interesting to me is that relative to when I wrote that paper (and a couple of decades leading up to then), desired property-type allocations for the four major food groups have been turned on their heads.

Once upon a time, office and retail were more dominant. Apartments got included in institutional portfolios later than other asset classes and industrial was long thought of as sleepy and consequently was perceived as not producing very attractive returns.

Now, the CRE world is enamored with industrial and apartments while office and retail are out of favor. That will likely persist because of the structural changes you mentioned. I’m not saying I fully agree, but I understand it.

Therefore, relative to the era during which I wrote that paper I’d expected higher allocations to industrial, apartments, and sectors such as self-storage, data centers, and single-family rental (SFR).

Distressed Properties

There’s been a lot more talk than action on the distress front. “Extend and pretend” is a popular buzz phrase, but no one seems to be pretending. Delinquencies, although up from the recent trough, are well below prior downturns, and most borrowers are putting in fresh capital to preserve their investments.

Are we headed to a tsunami of maturities that will change the game or is "slow and choppy" the name of the game going forward?

I feel like during every down cycle people get really excited about distress, but what actually happens almost always falls short of grand proclamations. It happened after the GFC. It even happened last year.

That’s not to say that there won’t be more distress, including delinquencies and defaults. That doesn’t occur instantaneously. It always takes a bit of time. There are certainly shoes still to drop, especially for low-quality office.

However, these grand proclamations about blood in the streets seldom if ever occur. There will be opportunities for investors, especially those willing to step in to fill holes in capital stacks, but timing and perspective matter.

Commercial Mortgage Defaults

Default rates for loans originated right before big historical real estate crashes were extremely high. i.e., 30%+ on multiple occasions. What’s the likelihood of loans originated during the COVID recovery hitting those ominous benchmarks?

You might see higher default rates in certain pockets, but nobody is walking away from good collateral just because the financing situation gets a bit bumpy. The abundance and diversity of capital sources will see that off. However, there may be instances of lower-quality collateral in office or apartments that still benefitted from very cheap capital, and of course, that’s a different story.

Bank Failures

Despite pervasive commentary about bank stress from real estate exposure, bank failures are running at about 10% of the GFC pace and only 4-5% of the 1980s and 1990s experience.

CBRE called for more bank failures in 2024, and Jerome Powell recently said that “more will be bank failures.” Do you see a meaningful pick up in bank stress from real estate loans?

I don’t know if I would characterize it as a meaningful pickup in bank stress per se, but some could likely occur. Like what I said before, people tend to speak in hyperbolic terms about things like distress and bank failures, but the reality seldom matches up to such proclamations. Yet, there are a few important qualifiers here.

First, CRE is not housing. Housing is fundamental to the economy and roughly two-thirds of households. It poses a huge systematic risk when it goes awry. But CRE? It is relatively more discretionary than housing, so its impact is less pervasive and acute. This means its impact on the macroeconomy, lenders, etc. tends to be lower. The S&L/RTC Crisis was about as bad as it could get for CRE loans (and it was really ugly), but the fallout was a lot less than during the GFC.Second, most CRE is performing well in terms of space market fundamentals. That limits distress.Third, relatedly, there exists a selection-bias phenomenon for some CRE lenders - the collateral they lend on is not that good-quality collateral. They tend to be smaller, more regional lenders that don’t get the pick of the litter for collateral quality or market selection.

Investor Appetite for Equity

For the last two years, a dominant mantra from investors has been: “Why would I invest in equity if I can get equity returns in debt?” Accordingly, there’s been a big drop in equity fundraising. When does the tide come back toward equity?

The big issue is monetary policy. Research shows that when the Fed stops raising rates, returns revert into positive territory quickly. That is getting delayed this cycle because we had such an abrupt regime change for monetary policy in such a short period of time so in some respects the CRE market is still catching up.

This really is a matter of when not if. Once the market adjusts its expectations, especially once the Fed starts cutting, that will cause returns to accelerate, attracting investor capital while simultaneously lowering the yield that can be had on debt instruments.

This is a cyclical phenomenon, and it will play out again this cycle.

Artificial Intelligence in CRE

Will AI meaningfully affect the real estate investment management business?

Absolutely! Do not underestimate the impact of data science (artificial intelligence, machine learning, etc.).

We are already aggressively using it to help us forecast, rank, and target markets - more than other firms we work with. We have a deadly serious effort, we’ve been working on this for five years, and we keep pushing the envelope. We will increasingly use this to help us target markets for investment, manage individual assets on our balance sheets, and manage our portfolios.

The problem is that this is like dotcom 2.0 – there will be some firms that use this technology amazingly and transform how our industry works, but there will also be many that are nonsense, who aren’t implementing serious techniques and will fail sooner than later.

This technology is even more esoteric and complex than the internet, making it very difficult for the average industry participant to distinguish between the two types of firms.

But make no mistake about it - data science is a train that is leaving the station. If you aren’t on this train you are going to find yourself underneath it.

COMMENTS