Jay Parsons has emerged as a top voice by regularly sharing his housing market insights. We recently talked with Jay about 10 trends defining the U.S. housing market.

Multifamily syndicators...

Nearly $70 billion of multifamily properties traded around the recent peak. A large share of those recent acquisitions was purchased by a handful of syndicators. With values down 30%+, are they all toast or do you think some winners will emerge?

“Winners” is probably too strong of a word but most will be okay. As you’ve pointed out, there’s more stress than distress in multifamily. But there will of course be some real distress, too, and we’ve already seen that. I continue to think distress will be concentrated among syndicators who paid peak prices for older assets needing heavy value-add work and using short-term, floating-rate debt.

"distress will be concentrated"

Value add multifamily...

Here are a few slides from a respected multifamily sponsor with 10+ years of experience. They focus on buying and improving A- assets. No class B, nothing older than 2000. Pretty impressive track record. If you were a passive investor with a day job and some money to invest, might you invest in a play like this? What big questions would you need to be answered before investing?

It’s a strong track record for sure so I’d consider it. I’m a markets nerd, so I’d want to better understand their strategy for selecting markets and submarkets. I do think the multifamily investment climate has changed quite a bit since COVID, and historically low-risk, solid-return markets may not be so going forward. I’d also want to better understand their value-add strategy. While it may look insignificant on paper, there’s a big difference between a 15-year-old A- asset and a brand new A+ asset. I’d be leery about value-adding up so much that you’re competing with the massive wave of newer supply. There’s no magic number, but I think there’s a sweet spot of around 16% discount relative to A+ assets – which is the equivalent of a two-month concession.

"I'd be leery of value-adding up so much that you're competing with a the massive wave of newer supply."

Affordability crisis...

Would you rather buy a starter house now or in 1980s when mortgage rates peaked above 18%? If you were a 28-year-old young professional, would you be a renter or a buyer right now?

I know people will argue that the 1980s were better because starter home prices were significantly cheaper, but even still, that 18% mortgage rate looks a bit daunting, haha. The 28-year-old me wouldn’t look at rent-versus-buy calculators. I believe a house is first and foremost a lifestyle and life-stage decision. And if I were reasonably confident I’d be in that house for 5+ years, I’d buy the house. But most 28-year-olds will prefer more lifestyle flexibility at that age, and renting makes more sense logistically and financially. As an aside, there was a research study last year that showed a slight majority of Gen Z’ers see more “financial freedom” in renting versus owning. I suspect many will change their minds as they age, but that reflects the life stage they’re in today.

Promoting more affordability...

Despite recent moderation and decline in rents, there’s still a meaningful gap between home prices and incomes relative to historic levels. There seems to be a consensus that this gap will likely narrow over time, but there’s no consensus around potential solutions. Many people thought home price declines would be the answer, but those calls have been wrong. Now there seems to be a chorus around zoning and density, which also seems broadly tenuous. It still costs $250K to $350K to build an entry-level home. What do you think could close the gap between incomes and home values?

I suspect the for-sale housing storylines will shift from affordability to accessibility. By that, I mean that I doubt homes actually get meaningfully more affordable. But because political will is so bent toward supporting the “American Dream” of homeownership, I’d bet we find ways to make buying a home more accessible to those who can’t afford to buy with a traditional down payment and 30-year mortgage. President Biden spoke about this in his 2024 State of the Union, and announced new tax credits to help homebuyers save for a down payment. And I think we’ll start seeing other initiatives like more zero-dollar down payment programs, longer-term mortgages, and maybe even portable mortgages – where you can transfer your mortgage to a new house.

Housing supply...

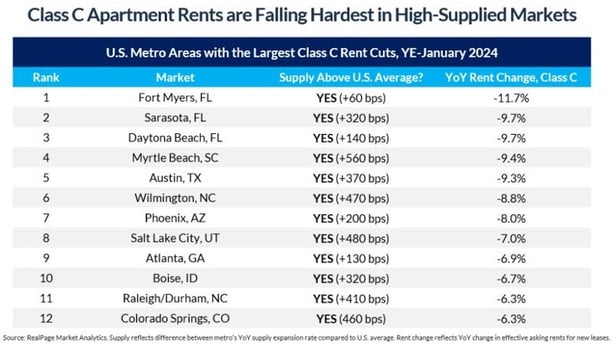

You recently posted about how the correlation between excess luxury construction and Class C apartment rent declines. Weren’t many people investing in Class C properties on the assumption that lower-rent occupants have nowhere else to go? Rent declines seem to fly in the face of that thesis. Also, is there really some sort of butterfly effect within the U.S. housing market where luxury apartments in Miami somehow affect rents and occupancy for Class C apartments in Phoenix?

I need a longer word count for this one. I think it’s the biggest surprise of the 2023-24 apartment market cycle. I’ve been telling people that my biggest “miss” in the 2023-24 outlook is the accelerated speed of the phenomenon that academics call “filtering.”

With apartment construction at 50-year highs, I initially expected Class B and Class C to be somewhat more isolated. My reasoning was that the rent gap between new lease-ups and Class B/C was just too large in most markets – given the sharp rise in construction costs dictating higher rents. But I was wrong for a couple reasons. First, I underestimated the depth of qualified, upper-income demand for newer, pricier apartments. We’re seeing higher-income Class B renters eagerly moving up – even if they’re paying more – and then, in turn, some Class C renters are moving up into Class B. Second, I underestimated developers’ urgent zealousness to put “heads on beds” and therefore slash base rents (in addition to offering traditional lease-up concessions) in order to achieve stabilized occupancy so they can then refinance from that pricey construction loan into a not-quite-as-pricey permanent loan.

I don’t think there’s much evidence that luxury apartments in Miami have a dramatic impact on Class C apartments in Phoenix; but there’s ample evidence that the wave of luxury apartments in Phoenix is impacting Class C apartments in Phoenix. The phenomenon is specific to high-supplied markets. We don’t see Class C rent cuts in low-supplied Midwest markets, for instance.

All of this does put pressure on Class C investors in high-supplied markets. It’s true that Class C tends to be higher occupied – and it still is across most markets. But they’re cutting rents to stay that way. Class C is the one segment where we can see affordability barriers and higher rent-to-income ratios, so when they cut rents, they’re expanding the demand pool. Contrary to headlines and some misleading research, very few operators will lease to renters spending >30% of income on rent. So you gotta cut rent to capture more leases.

Anyway, this is why we could see some distress concentrated in Class C. If you bought an older, Class C property at 2021-22 peak pricing AND you banked on a big value-add program AND you used short-term, floating rate debt, it’s going to be a tough road. I suspect we’ll see normalizing cap rate spreads between A to C; and on top of that, you aren’t likely to achieve those pro forma rents.

Single-family rentals...

Single-family rentals have gotten a lot of attention over the last few years. What share of the housing stock do those firms own? Their returns skyrocketed as rents and home prices climbed and interest rates fell, but these trends have all reversed over the last two years. Have we reached peak SFR for the aggregators? What about build-to-rent? Is this sector here to stay?

Single-family rentals have gotten a lot of attention over the last few years. What share of the housing stock do those firms own? Their returns skyrocketed as rents and home prices climbed and interest rates fell, but these trends have all reversed over the last two years. Have we reached peak SFR for the aggregators? What about build-to-rent? Is this sector here to stay?

Isn’t it fascinating that, contrary to narrative, SFR boomed when individual homebuyers were buying homes – and weakened when homebuyers went to the sidelines? I told you I was wrong about the Class C story in multifamily, but I’ll take credit for calling this one in SFR. Rental housing investors should ALWAYS root for a strong for-sale housing market. Why? Because historically, when the for-sale housing market is strong, the for-rent housing market is strong. A rising tide boosts all ships. The Wall Street world talks about move-outs to home purchase as a frightful headwind, but they are 100% wrong. When people are moving out to buy houses in big numbers, you’re likely backfilling those units quickly and at higher rents.

Okay, back on topic. Various estimates show institutional investors own anywhere from 1-3% of single-family rental homes. Headlines usually focus on investor purchases as a share of sales, but they totally ignore investor dispositions. Census data shows investors (as a whole) have sold more homes than they’ve bought over the last eight years, so the homeownership rate has actually trended up.

Have we reached peak SFR? I suspect that, like multifamily, we won’t see anything like 2021-22 in terms of rent growth any time again in our careers. I suspect that’s a once-in-a-generation event akin to what happened in the 1970s with peak inflation back then. But everything is cyclical. The market will eventually rebound. Institutions still like SFR long term, and especially build-to-rent. BTR is still in the early innings. It’s a new asset class, and it allows investors to target the same demographics as SFR but with added benefits – lesser policy risk, faster to scale, easier to manage.

Office-to-multifamily conversions...

Office-to-multifamily conversion gets a lot of media attention as a potential solution to the lack of affordable housing and as a potential solution to the stock of obsolete office buildings. But we estimate that only about 5% of the office stock could be converted, regardless how far the price of office falls, which makes it hard to think that conversions can move the needle. On the other hand, many conversions are surprising to the upside with respect to timing, rents and lease-up. What needs to happen for conversions to play a bigger role?

Remember a decade ago when everyone was buzzing about micro units as the next thing? It was always more buzz than reality. Office-to-residential conversions are the new micro units. We can all understand why the idea is so popular, but to your point, people overestimate how many office buildings are suitable for conversion given larger floor plates and other structural issues. Second, people underestimate the cost of these projects. They’re tremendously complicated and expensive. That’s why most office conversions historically tend to be Class A+ projects with high rents. It’s often cheaper just to demolish and rebuild. Like with micro units, some folks have misguided expectations that office conversions will help solve the shortage of affordable housing. That’s just not going to happen.

"Office-to-residential conversions are the new micro units."

Here's a cold splash of water: In October, the White House launched a $35 billionprogram to finance office-to-residential conversions. As of the end of February, exactly $0 had been spent, according to a recent Bloomberg article.

To be fair, some projects do work – and they tend to be very cool, unique projects when they do. I suspect we’ll see more, too. But not enough to really move the needle on housing supply.

Multifamily distress...

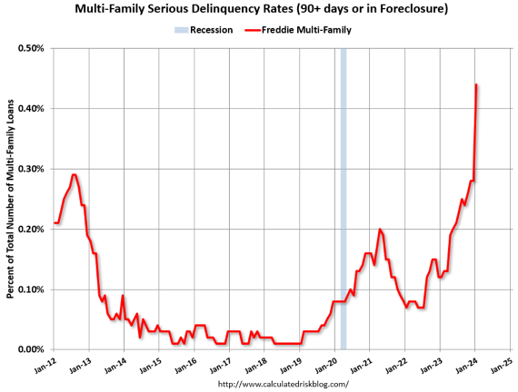

Bill McBride recently highlighted a big spike in multifamily serious delinquencies, which got the industry talking. It’s hard to not be alarmed by the chart, but JP Morgan’s CMBS/RMBS analysts have since reported that the spike was largely caused by a big exposure to an idiosyncratic senior housing portfolio and loans secured by NYC rent-regulated multifamily. “Adjusting for those two situations, the serious delinquency rate drops from 0.41% to 0.27%, a 5 bp increase month-over-month.” Is this spike an anomaly or a sign of things to come?

I’m a Bill McBride fanboy, so I’ve got nothing but admiration for him. The social media doomsday crowd obviously didn’t squint and look at the scale of this chart. Even with the spike, these are very low numbers relative to other sectors. And to your point, there were clear outlier loans driving that little bump. Of course, delinquency will increase. I don’t think anyone is debating that. But barring some massive shock, this chart isn’t pointing to a doomsday scenario.

The NYC housing mess...

Regulated housing has been a consistent driver of headline stress over the last year. E.g., Signature Bank, New York Community Bank, the recent Fannie delinquency spike, etc. Why is rent-regulated housing suddenly a big problem for real estate investors? For folks who lived through the GFC, this rhymes a bit with Peter Cooper / Stuyvesant Town, which some consider to be a good example of pre-GFC excess.

Most folks would tell you this all started in 2019 with a (short-sighted) change in New York state law that further tightened rent rules on rent-stabilized apartments. The change amounted to vacancy control, and it triggered the law of unintended consequences. Vacancy controls meant building owners could no longer raise the rent closer to market once tenants moved out. In turn, that made it near impossible to fund typical unit upgrades and maintenance upon turn – which is especially challenging given that many of these properties were built for Gen Z’s great-great grandparents and have significant deferred maintenance needs. That, in turn, reduced property values. Lower rents = less value; but also, who wants to buy a property where you risk getting labeled (perhaps rightly!) a slumlord who can’t afford to maintain their building? Reduced liquidity = reduced property values, too. And now some properties are worth less than their loan value.

"This problem started long before 2019"

But I’d argue this problem started long before 2019. Some banks and institutions grossly underestimated policy risk in coastal markets they perceived to be “core, low risk” like New York. This a market where the playing rules have long been moving targets. New York has tightened its rules on rent control and/or rent stabilization multiple times over the decades. The 2019 tightening could hardly be considered surprising – even if it ends up taking down a >$100b bank (NYCB). The Peter Cooper / Stuyvesant Town is another case where rules were changed after the game had already started.

CRE 101 teaches us that a “core” market is one that offers low risk and steady, predictable returns. Specific to multifamily or SFR, at least, who could anyone argue New York or Los Angeles is a “core” market anymore? I suspect investors may have finally learned the lesson and, whether they formally label it as such or not, are reclassifying some coastal cities as high-risk opportunistic markets.

Dualling perspectives on housing...

You’ve emerged as a voice of reason on housing policy and affordability by, for example, pointing out that most renters say that renting allows them to live in an area they otherwise couldn’t afford. You’ve also shined a light on research perspectives that suggest institutional ownership of rental housing doesn’t push up prices or hurt homeownership. There are very loud voices on the other side of this argument, though. Can you summarize their primary arguments, your responses, and where you think the debate may be headed?

You’ve emerged as a voice of reason on housing policy and affordability by, for example, pointing out that most renters say that renting allows them to live in an area they otherwise couldn’t afford. You’ve also shined a light on research perspectives that suggest institutional ownership of rental housing doesn’t push up prices or hurt homeownership. There are very loud voices on the other side of this argument, though. Can you summarize their primary arguments, your responses, and where you think the debate may be headed?

I was talking with a friend about the misleading popular narratives around rental housing, and she told me: “The facts don’t matter.” It was jarring to hear that, but she was right. The “institutional landlords are crushing the American Dream” narrative is a great example of this. I read a paper by a government researcher on the topic of DECLINING homeownership. Not once did the author point out that homeownership was actually INCREASING, not declining, and had been consistently for seven years at the time the paper was published. I guess that would have killed the paper. The government’s own data (U.S. Census) shows us that homeownership is up nearly 300 bps since bottoming in 2016 – and even climbed upward in 2021-22 when institutions were supposedly outmuscling individual homebuyers. Government data shows us that investors have actually lost market share in the single-family home market over the last eight years. Investors are selling more than they’re buying.

I’m convinced there are two issues at play here driving these myths.

First: A lot of anti-“landlord” sentiment is rooted in anti-renter bias. As the Center for Generational Kinetics’ study shows, renters feel like homeowners treat them as second-class citizens. Homeowners are often guilty of seeing renters through a tinted lens, where an incredibly diverse group of renters are reduced into two groups: jilted-but-wanna-be homebuyers OR noisy, messy troublemakers underserving of living in single-family neighborhoods.

Second: The for-sale housing market has been so tight for so long that there’s a natural desire to blame SOMEBODY. And “private equity” or “hedge funds” are easy, faceless targets – even if inaccurate ones. No one wants to blame individual homebuyers who are bidding up house prices or blame a simple shortage of supply.

"rental housing unquestionably opens up neighborhoods to people who otherwise couldn’t afford to live there"

The truth is that rental housing unquestionably opens up neighborhoods to people who otherwise couldn’t afford to live there. We should be celebrating increased diversification, but instead we’re trying to push out people who can’t afford to the buy the right to live in a nice single-family house. Crazy.

As for where the debate is going? I’m a glass-half-full guy by nature, but it’s increasingly difficult to feel optimistic on this topic given that populist narratives are taking deep root. Even the conservative governor of Texas, Greg Abbott, recently piled onto the false narratives by tweeting out a desire to explore blocking investors from buying single-family homes.

Growing anti-landlord rhetoric...

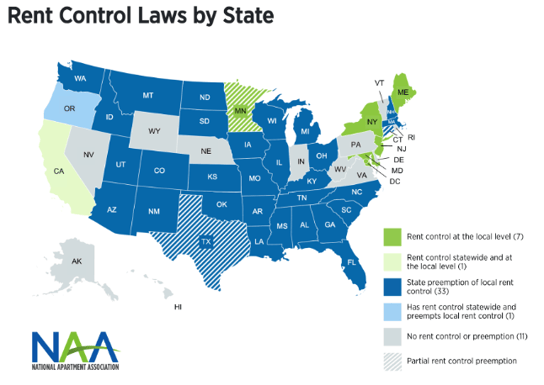

Housing in NYC is incredibly unaffordable, and the anti-landlord rhetoric is as high as it’s been in a generation. Do you think there’s a path for regulation to mitigate runaway housing costs without replicating NYC’s mess? Could you see rent regulations spreading outside of Northeast and West Coast markets? What advice would you give to lawmakers who want to serve up a win for their constituents?

The pragmatist in me would hope that policymakers would take the time to learn from history, from numerous academic studies, and from the expertise of countless unaffiliated economists with no skin in this game. After all, even after a century of rent controls (with various flavors) in New York City, it’s still the most expensive rental market in the country. But I’m reminded of my friend’s quote I shared earlier: The facts don’t matter.

"rent control gives policymakers some false sense of political achievement"

In the rush to do SOMETHING, rent control gives policymakers some false sense of political achievement in the era of instant gratification. It’s already happened in St. Paul, Minnesota, which approved what is perhaps the nation’s most draconian version of rent control, and has since tried to backtrack a bit after seeing the consequences. And we’re even seeing this spread even to places like Orlando, Florida. The city council there commissioned a third-party study on whether the city should pursue rent controls. The researchers commissioned to do the study came back and said (and I paraphrase), “We did the research, and it’s clear rent control is a bad idea that will backfire on the very people we’re trying to protect.” So what did the city do? It went ahead and voted in favor of rent control. You just can’t make this stuff up. But thankfully it ended up going nowhere due to state rules pre-empting the city.

Rent control advocates have carved a big niche as the anti-science, anti-vaxxers of housing. I realize that is harsh, but when people of influence are openly advocating for something proven to be harmful to society, I do think it’s important to call them out. They’ll argue “well this is rent stabilization or ‘good cause eviction,’ not classical rent control, and this particular flavor hasn’t been studied enough.” But it’s so silly. It’s like arguing we don’t know that the measles vaccine is truly effective because we haven’t isolated studied to blonde-haired females with O+ blood types who took a vaccine shot in the left forearm.

"this is not a red state versus blue state thing"

And I want to be very clear that this is not a red state versus blue state thing. A number of “blue” states continue to block rent control because they trust the science. Surveys of economists show opposition to rent control across the political spectrum. And when the “blue” city of Minneapolis considered rent control, a progressive city council member named LaTrisha Vetaw concluded that rent control would “likely make the affordable housing problem worse in the long run.”

So thanks to people like Councilmember Letaw, we do have hope that the facts can win out in some cities and states. I’ve written about this quite a bit, but the right answer is a rather obvious and boring one: It’s all about supply. Rents are falling where supply is going in big numbers right now, and rents are rising where supply is limited. That is an indisputable fact. Let’s learn from it. Cities serious about solving housing affordability and accessibility challenges are removing artificial barriers like zoning constraints and costly building aesthetics codes and lengthy approval processes. They’re also pushing tax abatement programs to incentivize low- and moderate-income housing. We can also ensure rental assistance and eviction diversion protections go to those who need it most.

It’s easy to tell someone else to do something. But we show our priorities by how we spend our own time and money, or in this case, how elected officials spend public resources. Florida led by example when it passed the Live Local Act. Let’s follow that example. That one state committed more net new resources to affordable and workforce housing last year than did the U.S. federal government, as Congress continues to sit on President Biden’s affordable housing proposal.

Career progress...

Let’s talk about the next step in your career. You had to be somewhat of a celebrity at RealPage. Seems like it would have taken something extraordinarily interesting to make you leave that perch. What’s your new role? Can we expect to continue getting your takes on the housing market?

Thank you for the kind words. I spent 15 amazing years at RealPage and I wouldn’t trade that for anything. That job gave me the opportunity to learn from investors, operators, managers, developers, lenders, brokers, policymakers and even renters – all customers of RealPage who I interacted with in my role. I can’t think of a better environment for a young researcher to learn all facets of the industry.

I was given an opportunity to join as a partner in a multifamily investment group, and I couldn’t pass that up. I’ll be working alongside a great team at Madera Residential, helping them expand across the Sun Belt and build out an attainable housing platform.

And yes, I’ll continue to post takes (for better or worse!) on both multifamily and SFR nationally. My new partners have given me a lot of freedom to write and speak and advise on rental housing topics across the country. That was very important to me because it’s something I not only enjoy, but it sharpens me too – interacting with different stakeholders with different strategies. I didn’t want to give that up, and I’m thankful I won’t have to.

Jay, thank you for the candid discussion! You have a gift for thoughtfully engaging various people around these issues, and we appreciate you sharing your time and thoughts on these important topics.

Additional resources:

-

Jay's upcoming newsletter. Housing market insights.

-

CRE Analyst newsletter. Real estate and capital markets insights, case studies, and callouts.

-

Upcoming valuation and Argus course. Instruction, certification, case studies (e.g., value the Empire State Building).

-

Upcoming FastTrack course. High impact and a fraction of the time and cost of grad school. Excellent networking.

Feedback, questions, comments, requests, partnership ideas? Email us at admin@creanalyst.com.

COMMENTS