ODB and open-end fund managers:

Baby, I got your money

Don't you worry, I said hey

Baby, I got your money

...but maybe the tide is shifting.

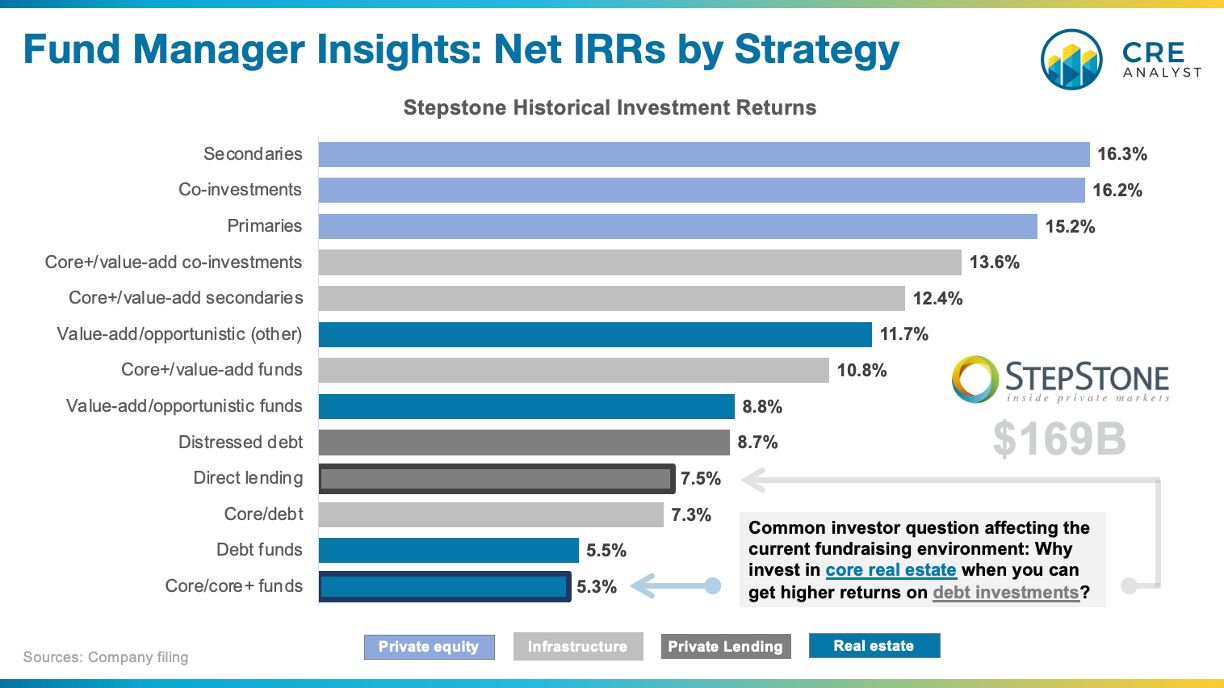

---- Returns by strategy ----

-- Private equity: 15%+ IRRs

-- Infrastructure: 10%+ IRRs

-- Debt: 7%+ IRRs

-- Core/Core+ real estate: 5% IRRs

Source: StepStone Group's track record overseeing $170B for institutional investors (per last week's earnings presentation.)

---- Backdrop: Tough time for CRE fundraising ----

PERE, May 2024: "...the first quarter of 2024 recorded the lowest Q1 fundraising amount since 2011."

PERE, July 2024: "...rolling first closes are becoming a make-or-break factor for managers during a difficult capital-raising environment."

CoStar Group, August 2024: "Raising capital for any type of real estate investment has been depressed since the Federal Reserve started increasing interest rates in 2022."

---- Pulling it together ----

Takeaway 1: Real estate returns have underperformed recently. This is especially true for income-oriented properties (core/core+) due to disproportionate cap rate exposure.

Takeaway 2: It's been difficult to raise money for real estate strategies, which suggests (i) investors think there's more pain to come, (ii) yesterday's pain hasn't been fully incorporated into today's values, and/or (iii) there are just better opportunities in other sectors.

---- A potential pivot ----

One commonality emerged from this recent earnings cycle.

REITs, commercial brokerages, investment managers, and lenders provided several reasons to think green shoots are emerging.

Sales volumes have troughed. Deal pipelines are growing. Rates and spreads are down. Cap rates aren't as bad as many feared. Lender caution is waning.

We're not saying everyone is out of the woods...

Apartment syndicators, the companies that financed them, and most office players still have much pain to work through. We wouldn't be surprised to see some high-profile dominos fall over the next 6 months.

But the green shoots seem to be forming more of a trendline and less of an anecdotal narrative.

COMMENTS