This week's megadeal started ten years ago...

Two days ago, Blackstone and Equity Residential announced another big apartment sale: "Equity Residential to Acquire $1 Billion Apartment Portfolio from Blackstone Real Estate"

---- Quick highlights ----

-- $964 million for 3,572 units, 11 properties in Atlanta, Denver, and DFW.

-- EQR wants to grow its sunbelt footprint.

-- Buying below replacement cost was a key driver.

-- The properties were sold from three different Blackstone vehicles: (i) BREIT, the non-listed REIT for retail investors with redemption queues, (ii) BPP, the core+ vehicle for institutional investors with redemption queues, and (iii) BREP, one of Blackstone's flagship closed-end opportunistic funds.

-- Blackstone is selling but still likes apartments, stressing that this was a win for everyone involved.

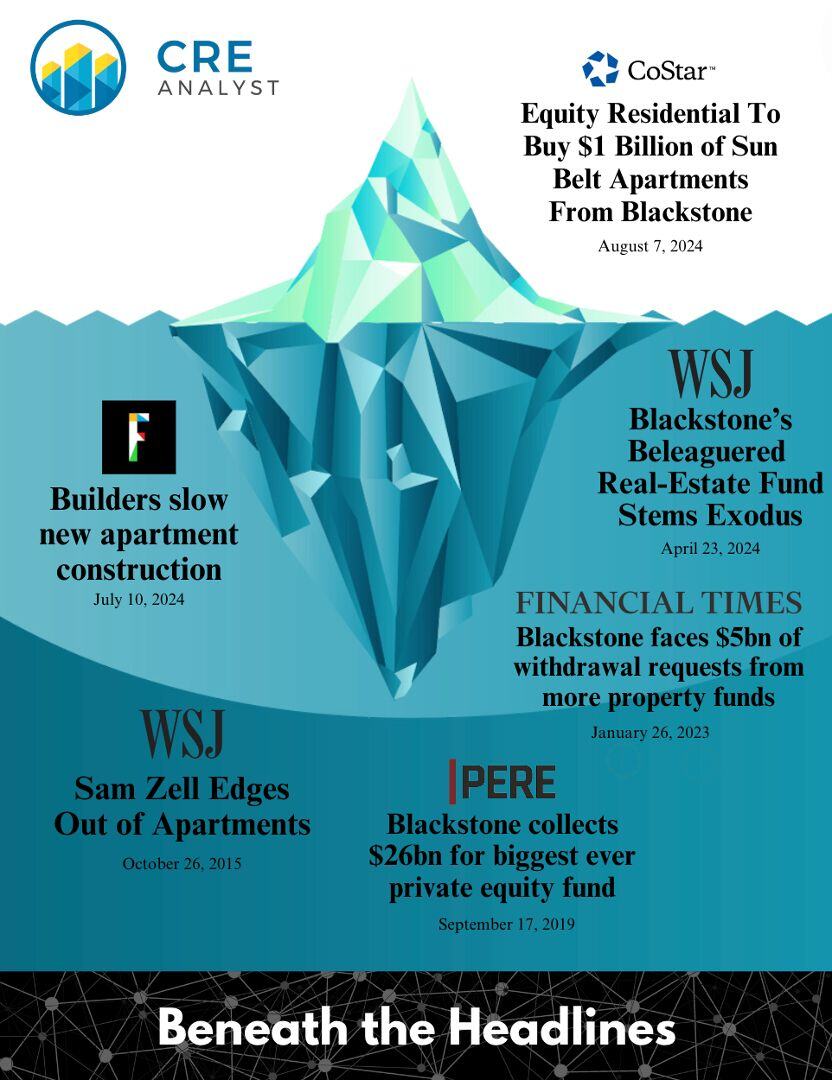

---- Beneath the headlines ----

This week's deal deservedly got a lot of attention.

Perhaps because, despite many pundits calling for 6% cap rates and doom loops, it's the third $1B+ apartment deal to be announced over the last four months.

However, we think the most interesting story behind this deal started nearly ten years ago when EQR sold $6 billion of apartments to focus on "gateway" markets.

The biggest move was announced in October 2015 when EQR sold a $5+ billion portfolio to Starwood.

EQR's then-CEO said it was an extremely opportune time for the REIT to monetize investments in this portfolio:

"Not only have we demonstrated the enormous value created for our shareholders through the realization of an unlevered internal rate of return of 11.1%, but we have also narrowed our focus, which will now be entirely directed towards our core, high-density urban markets that will fulfill our strategic vision and drive EQR performance for many years to come."

CoStar reported that EQR's selloff wouldn't slow as it intended to sell another 5K units at a weighted average cap rate of 6% to 6.25%, as EQR excited South Flordia, Denver, and New England.

---- Postmortem Questions ----

Was EQR's exit from these markets ten years ago a mistake?

"Yes, it was a mistake."

EQR missed out on meaningful income and appreciation over the last ten years and doubled down on the markets that were hit the hardest during Covid.

"No, it was a good deal for EQR."

EQR executed its business plan, achieved double-digit unleveraged returns, and returned substantial capital to shareholders.

Our take...

As in most things related to CRE, both deals (this week's $1B sale from Blackstone's vehicles to EQR and EQR's $6B of sales to similar funds 10 years ago) follow the capital.

We'll dive into our rationale for these transactions over the next week.

Kudos to Eastdil Secured, RBC Capital Markets, Santander, and Sumitomo Mitsui Banking Corporation – SMBC Group for pulling the deal together in a challenging environment.

COMMENTS