Are sandbagged appraisals exacerbating illiquidity?

Our post on optimistic appraisals last week received a lot of attention. Here's a realistic bottom-up example that explains how current appraisals could be muting transaction activity...

----- Quick background -----

What's wrong with potentially inflated appraisals?

1. They could slow investors from buying into funds.

2. They could accelerate investors wanting to exit funds.

3. They sideline funds from buying properties, even at attractive values.

----- Property example -----

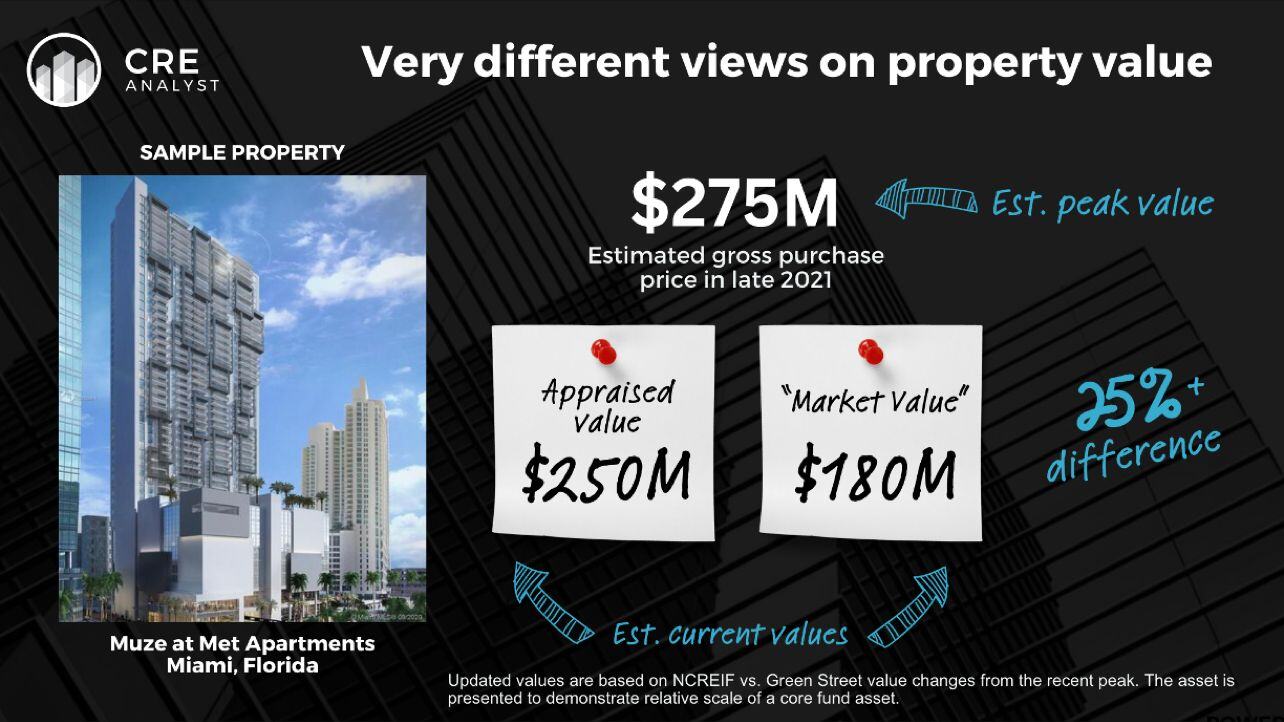

A large core fund bought this property near the peak in late 2021. We estimate the gross asset value at the time was about $275M.

Note: The only reason we are aware of the trade is because the acquisition showed up in a presentation to a pension fund, which was later made public.

----- Competing perspectives -----

Perspective 1: Appraisals

Based on how much NCREIF values have fallen since the recent peak, per publicly available reports, the implied carrying value for the sample property would be $250M.

Perspective 2: Index based

Based on Green Street's publicly available CPPI data, multifamily devaluation from the peak would put the asset's value at about $180M.

——- Takeaways ——-

Thus sample property was worth $275M but is now worth either $250M or $180M.

If you were a fund investor, would you buy into the fund if this property (and others like it) were being carried at $250M? Would you sell your interest if you were an existing fund investor?

The obvious challenge in an environment defined by price discovery and a lack of trade relates to uncertainty around value.

We highlight this issue because NCREIF data, or at least the information that is publicly available, suggests that fund values are materially higher than other industry value estimates, which could be contributing to the most flexible and capable buyers (institutional funds) not being able to buy.

COMMENTS