You cannot navigate the real estate industry until you disaggregate it.

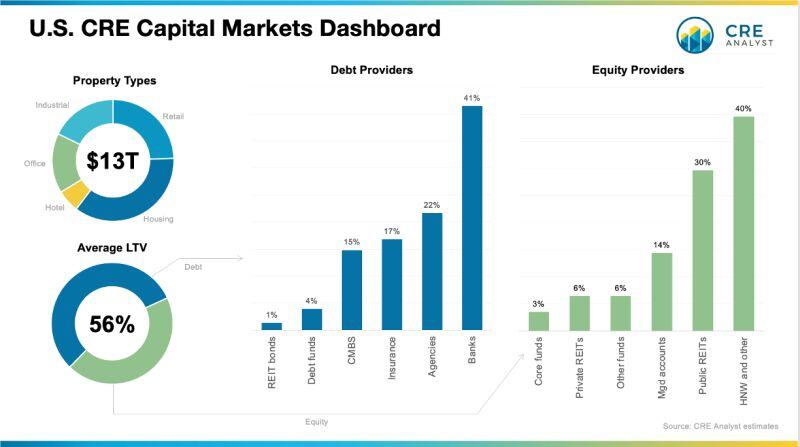

TOTAL VALUE: We think U.S. income-producing properties are worth about $13 trillion.

DEBT VS. EQUITY: We estimate that about 56% of existing capital is debt and 44% is equity, which means a 15% across-the-board value decline (what many players are calling for) would imply 34% equity erosion.

SIGNIFICANT DISPERSION: Unlike prior cycles, which were largely defined by cap rate compression, we believe we will see very significant performance dispersion in the coming months and years. There will be a meaningful difference between winners and losers.

SIZE VS IMPACT: On the debt side, banks are by far the biggest category, but this is primarily because 1) banks dominate construction lending and 2) tens of thousands of relatively small/mid-America properties are financed by local banks with local equity, and those dollars add up.

However, we believe some of the smaller players (from a market share perspective) could send shockwaves through the real estate industry in the near term:

CORE FUNDS only account for 3% of the equity, but they are critically important because they seek the most bond-like real estate, and when they find it, they pay the highest prices because they have the lowest cost of capital. The exit queues are growing quickly across the 20 or so funds in the NCREIF ODCE index, which will generally put these funds on the sidelines and leave everyone else guessing about "best pricing" for a while.

PRIVATE REITS only account for about 6% of the equity markets, but they're critically important too, because, like core funds, they're open ended and have relatively cheap capital, but they have been more open to alternative types, locations, and risk profiles. They have come on strong the last five years but have backed up quickly over the last six months, most notably with Blackstone (the biggest player) announcing yesterday that it would gate investor redemptions.

OTHER FUNDS are more value-oriented, closed-end vehicles. They target 15%+ leveraged returns, which were easy to achieve with cheap financing but are much more difficult now. Good news: This capital likely puts a floor on how far the market can fall. Bad news: They probably won't step into the market in until values fall to around that floor.

CMBS has never gotten close to its production levels of 2005-07, but it has generated a consistent $100 bn or so of debt every year that has significantly affected real estate values, and--unfortunately--CMBS is almost totally on the sidelines for now.

Note 1: These estimates and takes are best guesses, but we don't pretend to be perfect and welcome feedback, questions, comments, etc.

Note 2: If you aren't familiar with the debt and equity players as outlined below, we are accepting applications for our next class, which kicks off in Jan. We always start with a deep dive into the capital markets.

COMMENTS