"Fear is the mind-killer."

A fundamental lack of confidence and clarity around the office market has pushed its participants deeper into darkness.

How much has the average office building fallen in value from the peak? What does "average" even mean within the office market? What is a Class A or a Class B building? Should those profiles be considered in the same discussion?

Every market participant has been seeking answers for the last 3+ years. It's too early to have answers, but here are a few observations, thoughts, and takeaways from our recent analysis of 1,000 REIT office buildings...

-- Office property values are reportedly down by about 50%.

-- Vacancy has spiked from around 12% (pre-COVID) to 18% and could hit 20% in the next few quarters, as tenants continue to downsize and slow decisions.

-- Contrary to headlines, most tenants aren't looking to give back all of their space. A recent CBRE survey suggests the average tenant wants to downside by 10-20%.

Our takes...

-- The gap between winners and losers will likely expand significantly. If the delta between A and B assets was historically $30/SF in rent and 300 to 400 bps in cap rate, it could be 2x that in the future. Lower-quality buildings could easily be worth a little more than land value.

-- The share of "loser" buildings is probably much lower than headlines (e.g., "doom loop") imply. Rough guess: 10-35% of what was previously considered B+ or better is in trouble.

-- Lender confidence will likely be an initial catalyst for an office recovery. Value-oriented capital needs 18%+ returns, which is an impossible hurdle without debt, and there's virtually no debt for office right now. Bad buildings, like B and C malls, will find it very difficult to attract capital, but higher-quality properties will get attention. Income is the only pathway out of the industry's current hole, and office offers one of the only paths to immediate income. Yes, many tenants will downsize and CapEx will surprise to the downside, but higher-quality buildings will remain competitive and 10%+ in-place (and durable) income hides a lot of warts. We could rediscover this as soon as lending begins to thaw, which seems to be happening.

Another pre-requisite to a recovery? Incremental certainty on property quality. The need for gradations could come into view as transactions pick up. To this end, we took a first shot by reviewing 1,000 properties owned by the big office REITs...

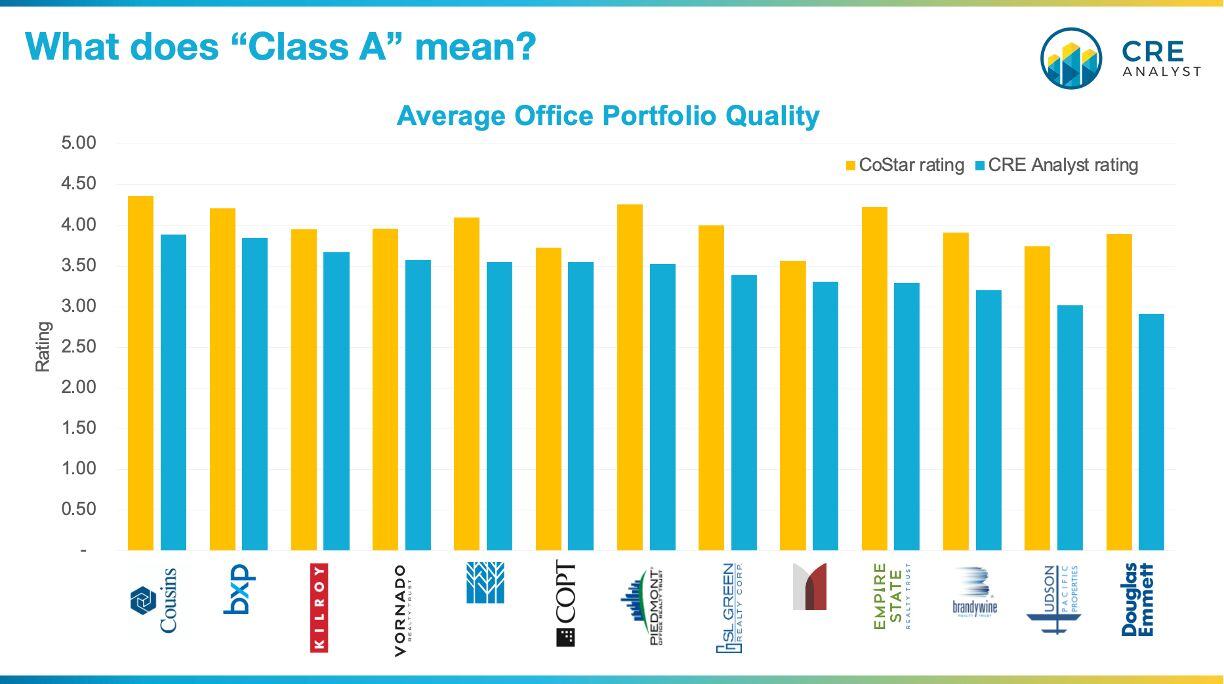

Our approach resulted in scores that are 10-15% more conservative than CoStar ratings and the big brokerages' grades. But even with our moderately more conservative take, 63% of REIT office buildings are at least A- in quality which corresponds to 90%+ leased, good locations, marketable floor plates, etc.

This chart shows how our average scores compare to CoStar's rating by owner...

COMMENTS