Another green shoot: translating good news from Greek to English for everyday real estate players...

---- What is NFI-ODCE? ----

The NCREIF Fund Index (open end diversified core equity) is an index of 20+ institutional perpetual funds ("core funds") that pensions and endowments have invested in to get durable, income-oriented real estate exposure for the last 40 years.

---- Why do core funds matter? ----

They focus on durable, income-related properties with very low leverage. They have the lowest cost of equity. In theory, they focus on the safest properties. In practice, there's no black/white definition for a "core" property.

Sidenote: Want to make a fortune in real estate? Buy value add properties at 10% discount rates, de-risk them enough to be considered core, sell to core funds at a 7% discount rate. Repeat.

These core funds make up a small share of the overall real estate equity markets, but they matter because they tend to drive pricing.

...and since 2022, they've been almost entirely out of the market because their investors have been running for the exits.

---- Redemption queues ----

A unique feature of open-ended funds: they provide investors with the ability to enter or exit the fund on a periodic basis, allowing for a degree of liquidity in an illiquid asset class.

But askin' ain't gettin'...

When contributions and redemptions are requested, managers may or may not honor them immediately. When requests mount, they enter what is known as a “redemption queue.”

---- Worse than the GFC ----

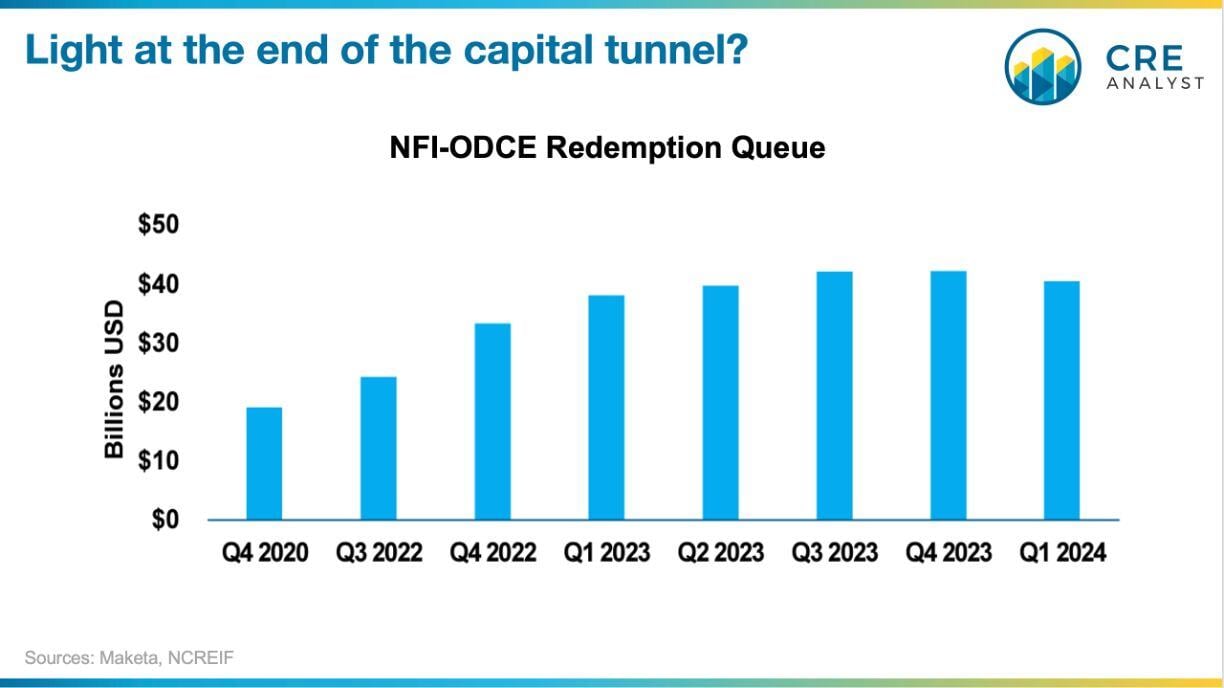

During market downturns, the number of redemption requests tend to accumulate in a queue, causing a backlog of requests. Redemption queues in perspective...

GFC: 15% of NAV

Covid: 9% of NAV

Q1 2024: 19% of NAV

---- No good way to generate liquidity ----

One of the primary reasons for the delay in satisfying redemption requests is low levels of transaction activity in the real estate market. Real estate is inherently illiquid. When redemptions cannot be matched with incoming contributions, managers may be inclined to sell properties as a way to raise the cash.

One reason for the largest redemption queue buildup in 40+ years: managers don't want to sell properties at the low valuations that currently prevail in the real estate market, particularly for office properties. Higher quality properties get better pricing but selling those can result in a resulting portfolio of underperformers.

---- Pricing resets ----

Malls were the first assets to trade at 4% cap rates 20+ years ago, but those same malls now trade in the 6% range. What changed? Core funds don't like malls anymore. Guess what else they don't like: office.

---- Light at the end of the tunnel ----

Redemption queues have peaked, which is a prerequisite for a pricing recovery.

Source: some of the text above was adapted from a recent Meketa Investment Group's insightful and well-researched white paper titled "Current State of Core Real Estate."

COMMENTS