A core odyssey: appraisal lags, redemptions, and capital flows.

1) How do we know what a property is worth?

Transaction value: It sells, which gives us an actual transaction value, or...

Appraisal: An appraiser estimates value based on historical norms, or...

BOV: A market participant (usually a broker) estimates value based on forward-looking assumptions.

2) Why would anyone use appraisals or BOVs?

Because bid-ask gaps halt transaction activity, leaving participants to guess about actual values.

3) Why an appraisal over a BOV?

Because they're certified and rigorous.

4) Why are BOVs sometimes preferred over appraisals?

Because BOVs are intended to be based on current buyers.

5) Why are estimates needed?

Because investors in open-end funds (e.g., core funds) need to know the current value of their holdings.

6) What happens to various value approaches through the cycle?

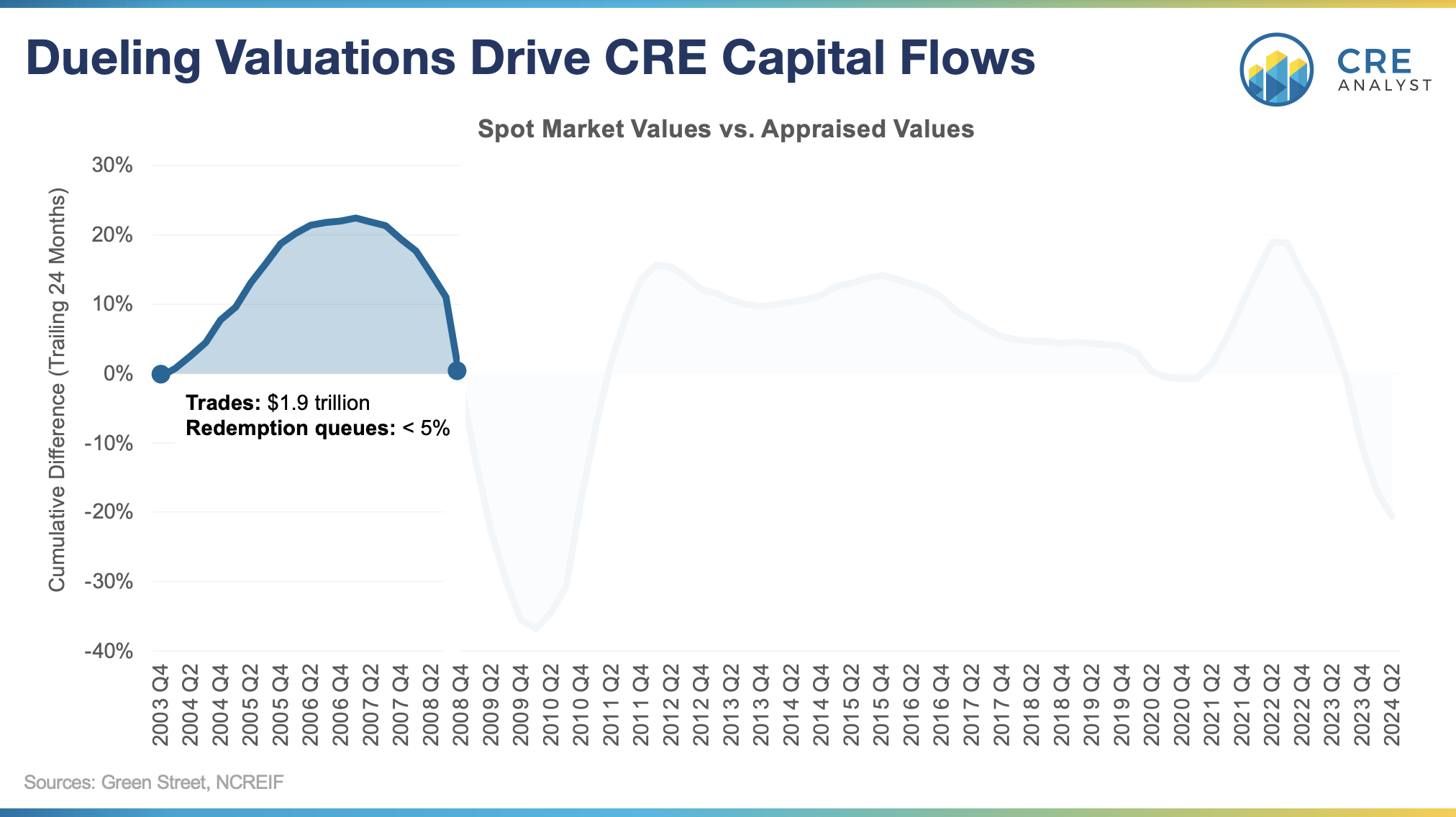

Appraisals lag spot market values, failing to incorporate market peaks and troughs. This chart shows that spot market estimates are significantly more volatile vs. appraised values. Green Street's CPPI is down 23% vs. NCREIF's 18% peak-to-now decline.

7) What causes redemption queues?

Open-end fund investors think actual values are lower than holding/appraised values, so they try to redeem at relatively low holding values. Fund managers get backlogged with requests, creating redemption queues.

8) Why does this matter?

Despite textbook commentary, core capital isn't efficient. It's often forced to sell when it's a good time to buy and buy when it's a good time to sell. And asset pricing typically declines when income-oriented buyers are sidelined.

9) What are redemption queues today?

Nearly 20% of NCREIF ODCE core funds' NAV is locked in redemption queues, and many core plus funds reportedly have 5-10% redemption queues.

10) What's the turning point?

When investors believe that carrying/appraised values are accurate and incorporate reasonable future CFs, they'll slow their push to sell out of their positions, relieving pressure on fund managers to sell/redeem and allowing them to get back into acquisition mode.

More to come... Read our full analysis here.

COMMENTS