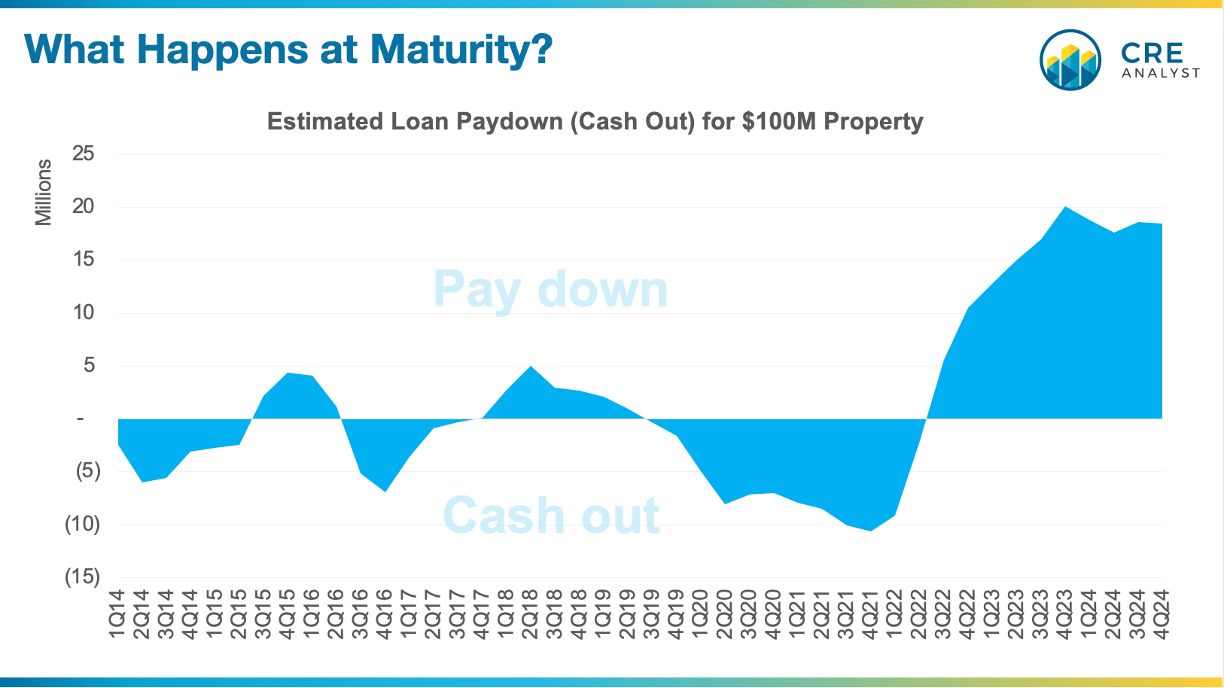

You own a property with $5M of NOI.

Lenders are willing to provide financing up to 1.25x DSCR at a market interest rate with 30 year amortization.

You maximize proceeds every three years when your loan matures.

Assuming no NOI growth, your property would have been worth about $100M over the last 15 years, on average.

It ballooned up to $130M during the Covid rebound, fell to $86M during the steep rate hikes, and has since recovered to about $96M.

Since you refi'd every three years, you got a big payday during the Covid rebound. You could have pulled $5-10M out of the property.

The problem?

Today's interest rates are pulling down debt availability under then 1.25x DSCR constraint.

At the next maturity, you'll need to pay down the loan by $10-15M.

Welcome to the new normal.

Lenders are willing to provide financing up to 1.25x DSCR at a market interest rate with 30 year amortization.

You maximize proceeds every three years when your loan matures.

Assuming no NOI growth, your property would have been worth about $100M over the last 15 years, on average.

It ballooned up to $130M during the Covid rebound, fell to $86M during the steep rate hikes, and has since recovered to about $96M.

Since you refi'd every three years, you got a big payday during the Covid rebound. You could have pulled $5-10M out of the property.

The problem?

Today's interest rates are pulling down debt availability under then 1.25x DSCR constraint.

At the next maturity, you'll need to pay down the loan by $10-15M.

Welcome to the new normal.

COMMENTS