Signs of distress or efficient capital allocation?

---- Recent media reports ----

The Real Deal: "Another major signal of the lackluster multifamily market: One of the biggest homebuilders in the U.S. is selling thousands of luxury apartments in a move that will likely generate billions of dollars."

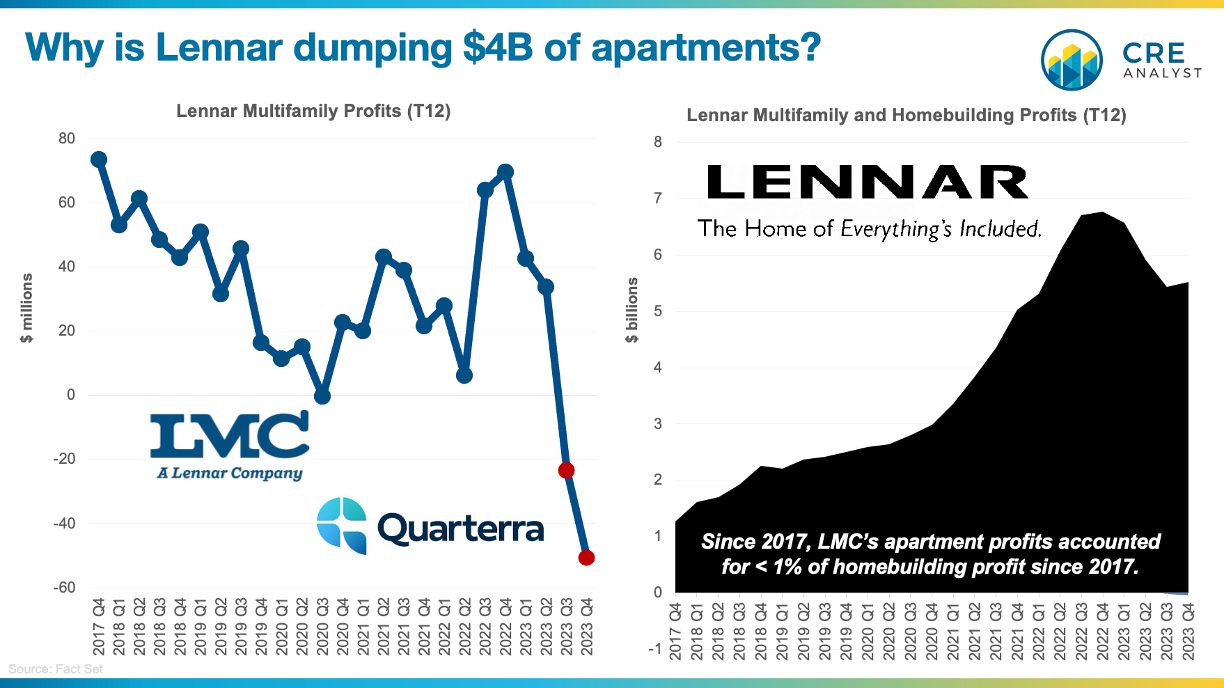

CoStar: "Lennar’s multifamily segment posted a loss in the fourth quarter and the unit is projected to weaken further at a time when a media report says the national homebuilder has hired JLL to sell a portfolio of 11,000 luxury apartments in its Quarterra arm for an estimated price of $4.5 billion."

---- Background ----

Lennar first mentioned its multifamily development platform back in 2012:

"As demand for new sale housing continues to increase from historically low levels, rental demand has continued to grow, fueled by expanding household formations, credit and down-payment challenged homebuyers, and a steadily improving employment picture. As a result, we believe that our core homebuilding business and our new rental segment are very complementary and that both should flourish in this recovering market."

When it launched a multifamily development platform, Lennar outlined its box as follows...

-- Up to 70% LTC financing

-- Lennar to invest up to 25% of required equity

-- Remaining equity to come from institutional LPs (Pru, Carlyle, etc.)

-- Non-recourse bank construction financing

-- Targeting 125-150 bps over current cap rates w/no trending

-- Targeting 25%+ IRRs and 2x+ multiples

The ultimate goal was always to build and spin a big portfolio...

"While we anticipate merchant building and selling some of these apartment developments once they are stabilized, our long-term goal is to build a portfolio of high-quality Class A income-producing properties across the country."

---- "Quarterra Multifamily" ----

Ten years later, in July 2022, Lennar rebranded its multifamily operations as Quarterra in anticipation of spinning off the company by year-end. But Lennar closed out 2022 by saying, “the current market conditions are simply not favorable to our commercial asset manager spin on the year-end timeline,” and refused to update its timeline.

---- Takeaways ----

Many media reports suggest that Lennar is motivated to sell its Quarterra assets due to recent operating losses. ...almost implying that this is a distressed sale.

We think there's a more likely explanation for Lennar's decision...

-- Lennar's stock increased 65% in 2023.

-- Demand remains strong for Lennar's core product.

-- Lennar continues to generate 25% ish margins building that product.

-- Quarterra accounted for <1% of Lennar's profit over the last 5+ years.

Why deal with the headache when you don't see a return to 25%+ IRRs, 2x multiples, and/or a more favorable IPO/takeout for the platform?

COMMENTS