Is Wall Street coming for core funds?

A few dozen core funds have dominated income-oriented capital for decades. Their business model in a nutshell...

-- Focus on allocations over property-specific execution

-- Generate 6-9% returns, primarily through stable income

-- Avoid leverage and volatility

-- Don't blow up

-- Low margin fees on a large base of sticky capital

-- Print money after $10B in AUM since most costs are fixed

---- A bug or a feature? ----

Liquidation value is the biggest challenge with these funds, as with any perpetual fund of private assets.

Since you can't sell an entire portfolio to determine market pricing, what do you pay an investor who wants out?

Next best alternative to third-party sale values:

Appraised values.

Problem with appraised values:

They lag.

Problem with appraised values in a falling market:

Fund investors are incentivized to redeem before values catch up to reality.

Problem for fund managers in a falling market:

Redemptions mount, requiring sales or borrowings, which aren't in the best interest of remaining investors.

Redemption queues aren't new, but there may be an existential threat hiding beneath the surface for core funds.

---- A new model? ----

The average ODCE fund is about 30 years old. Funds have come in gone over the last 30 years, but they all play by NCREIF's rules. Income-oriented, low leverage, etc.

But over the last ten years, an ODCE alternative has emerged as a potential home for income-oriented institutional real estate capital: Private equity-sponsored evergreen funds.

---- A common refrain ----

Blackstone, KKR, Apollo, Carlyle, and Ares have all hosted earnings calls over the last few weeks, and TPG and Brookfield will announce shortly. They represent $4+ trillion in AUM and nearly $900 billion of real estate AUM.

Every earnings call: 'We are building a stockpile of perpetual capital.'

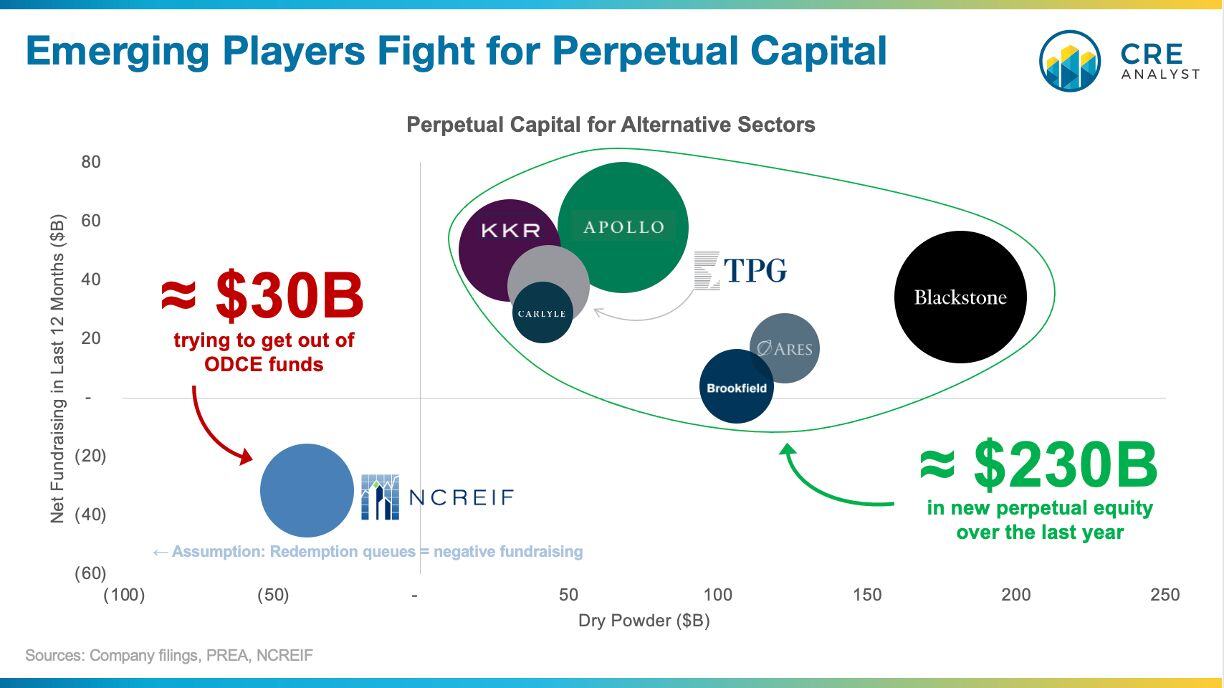

These private equity firms control about $1.6 trillion of perpetual capital, which is up by $230 billion over the last year (13%). In other words, PE funds added 110% of the entire ODCE index to their perpetual capital stockpile over the last 12 months.

They also have about $600B in dry powder compared to ODCE's $30B redemption queue.

Admittedly, this is an apples-to-oranges comparison since the PE firms' perpetual capital covers all alternative asset classes, not just real estate. However, the scale of this comparison could foreshadow meaningful changes for the core real estate space.

---- Key questions ----

1. Are PE-sponsored, income-oriented vehicles competing with core funds for institutional capital?

2. Will these PE firms' open-end vehicles outperform? Blackstone's BPP has about a 6% historical return.

3. Is any capital truly "perpetual" or sticky?

COMMENTS