Sorry, low rates can be bad for real estate...

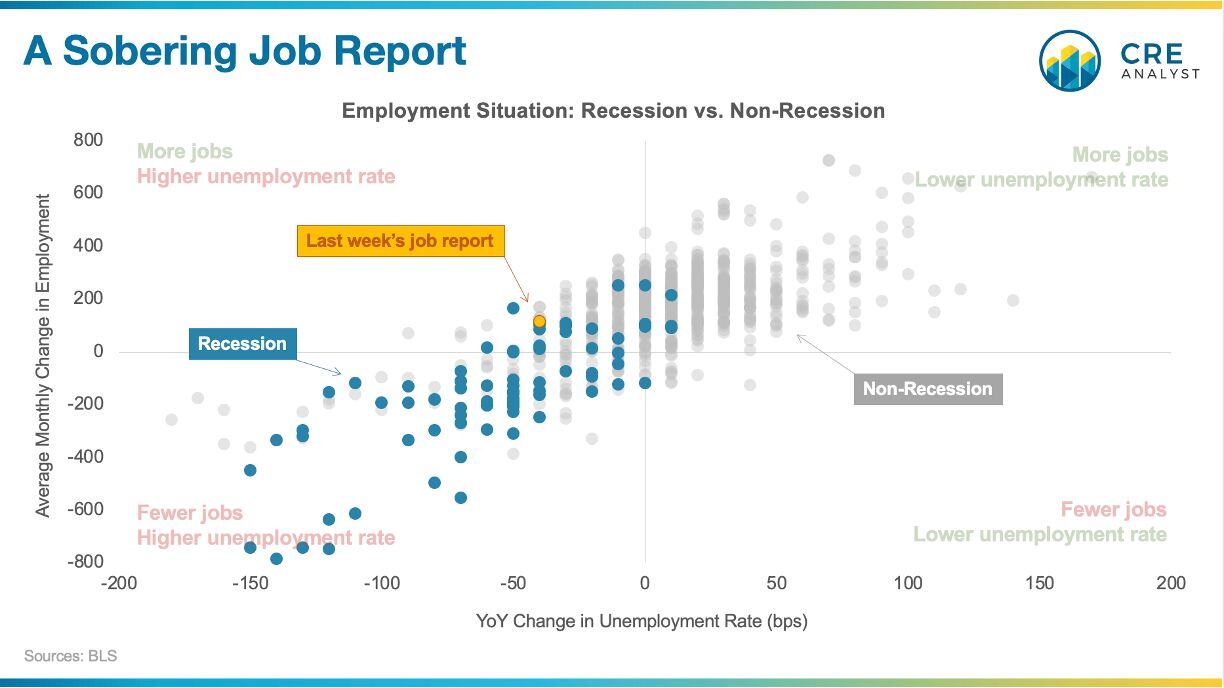

Just about everyone reacted negatively to Friday's job report.

...except for some high-profile real estate pundits, who are very excited about sub-4% interest rates.

On one hand, it's hard to blame them. After staring down a 5% 10-year Treasury less than a year ago, a 3.75% Treasury seems golden.

...because higher rates made loan payments much more expensive.

...because higher rates have crushed real estate values.

...because higher rates have pushed lenders to the sidelines.

But these sub-4 rates may be fool's gold.

Mark Zandi, Chief Economist at Moody's:

"The clear message in today’s soft jobs report is the Federal Reserve needs to cut interest rates. They should have begun cutting rates months ago. Job growth is decidedly throttling back, unemployment is rising quickly, hours worked per week are low and falling, and temporary help jobs continue to evaporate."

Campbell Harvey, founder of the yield curve recession signal:

"My yield curve indicator has been inverted for 20 months. It is 8 of 8 with no false signals since the 1960s. The maximum historic lead time has been 23 months (before the great recession). Ignore it at your own risk."

Claudia Sahm, founder of the Sahm Rule:

"The Sahm rule is currently sending the right cautionary message about the labor market cooling, but the volume is too loud. The swing from labor shortages caused by the pandemic to a burst in immigration is magnifying the increase in the unemployment rate. At the same time, the demand for workers is softening. A recession is not imminent, but the risks of a recession have risen."

Our take...

The job market is slowing, pushing the national economy closer to contraction, and a contraction would be bad for real estate performance.

Recessions lead to less capital, wider spreads, falling NOIs, lower values, and more credit challenges.

We all may be addicted to low rates since the Government spent much of the last 15 years manufacturing rates, which put significant upward pressure on real estate values. Those were the days, but those days are done.

And, unfortunately, there's another driver of falling rates: fear.

...which isn't good for a risky, leveraged asset class like real estate.

COMMENTS