"...we have too many young people in our industry."

---- The OG debt fund ----

When Blackstone launched BREDs coming out of the GFC, it sparked a new era of mega managers in the debt fund space.

$24B later, Blackstone is the largest debt fund manager.

---- Too young!? ----

A leading real estate economist dropped this criticism on a recent podcast:

"I think we have a problem with our industry in that we have too many young people..."

"I go to a lot of events and many folks I talk with, their only experience in the commercial real estate world, you’ve got senior people in our industry in their late thirties, early forties. They've only worked in their professional careers in this low interest rate environment that really kind of came after the global financial crisis."

"There are people out there legitimately thinking that they can refinance at low rates in the future. Mortgage rates will go back down to 4%. They'll pay anything to roll the dice one more time and just refinance at some high rate today for a short term deal, thinking that they can be fine in the future. But I'm not sure how well all of that works out, because I don't know that you get the degree of rate cuts."

"I think the probability of that is probably lower compared to other outcomes in the sense that we're in a totally different environment than we were in the aftermath of the financial crisis."

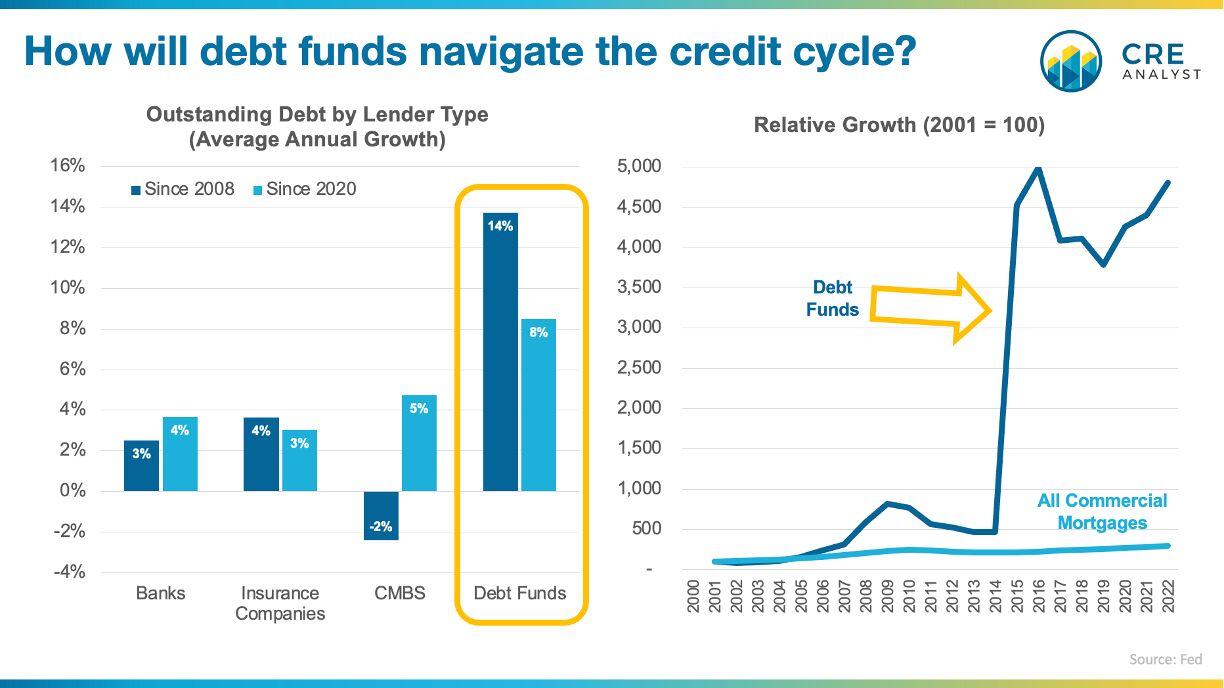

---- Are debt funds CRE's Gen Z? ----

Gen Zers (the post-Millineal generation) were born between 1997 and 2012. Since most debt funds were launched coming out of the GFC, they don't even qualify as Gen Z; they're "Gen Alpha."

So are young Millennials and Gen Zers (who often can't afford to buy a house) "the problem," or might the criticism be more appropriately directed elsewhere?

---- Redirecting ----

Since the GFC, the following debt fund sponsors originated $100B+ in mostly higher leverage, floating rate loans secured by transitional properties.

-- Blackstone

-- Goldman Sachs

-- Lone Star Funds

-- AllianceBernstein

-- Brookfield Asset Management

-- PGIM Real Estate

-- Pacific Coast Capital Partners

-- Oaktree Capital Management

-- LaSalle Investment Management

-- Berkshire Residential Investments

-- Prime Finance

-- Bridge Investment Group

-- BlackRock

-- Kayne Anderson

-- Oaktree Capital

-- Colony Capital

-- KKR

-- Madison Realty Capital

-- Torchlight Investors

-- Silverstein Capital Partners

And these aren't your daddy's bank lenders. They are savvy, yield-focused, and open to foreclosing (ask WS Communities, which just lost half of its properties to debt fund lenders).

This will be the first time we see how these vehicles respond to credit challenges.

...turns out that Millennials and Gen Zers might not be the only problems facing the CRE industry.

COMMENTS