Markets are beautiful when they function:

1. Stable fundamentals allow participants to reasonably forecast outcomes.

2. Buyers have access to prudent but optimistic capital.

3. Sellers readily find buyers at acceptable prices.

4. Yesterday's prices reset values.

5. Repeat starting at 1.

Winners: Those who accurately assess risk and outperform with respect to capital and/or operations.

Losers: Everyone else.

---- Disruptions ----

But every ten years or so, markets fall into temporary states of disorder.

This is especially painful in real estate since properties aren't commodities and don't trade daily. Participants don't get updated reads on values, are left to guess, and get spooked to the sidelines.

We're in one of those disorderly times now.

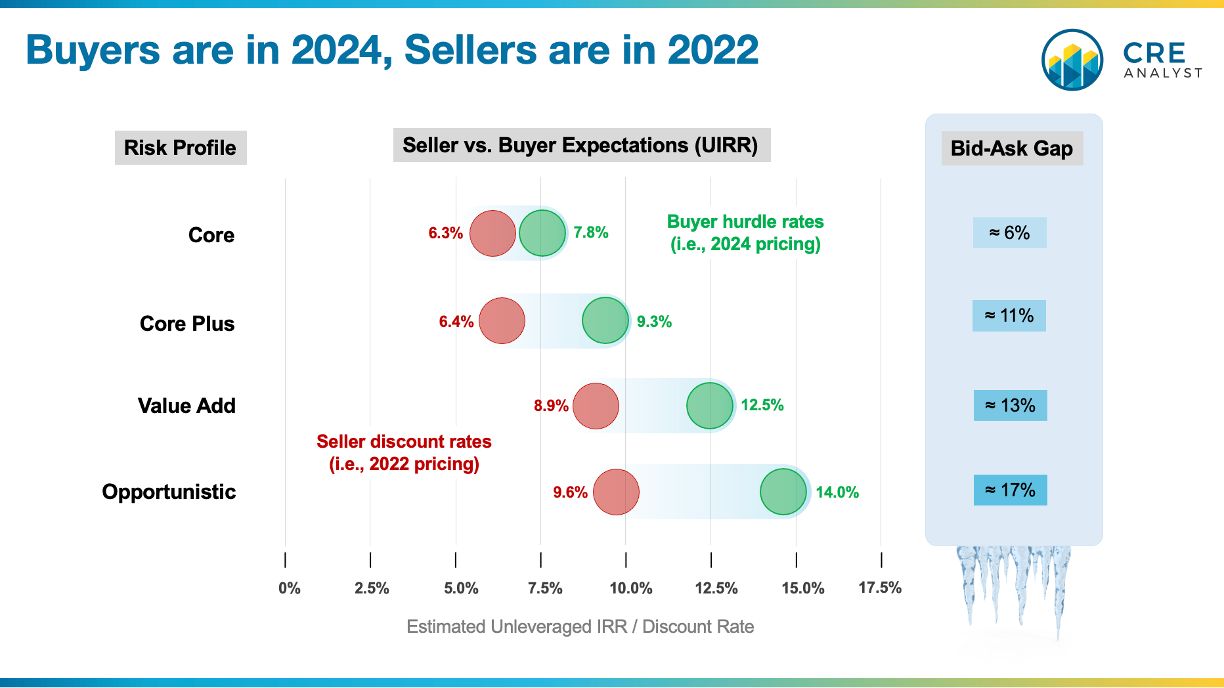

---- Bid-Ask Gaps ----

"Bid-ask gap" is perhaps the most prevalent of buzzwords/phrases that re-emerge when markets deteriorate.

A few other things tend to happen in these times...

1. Transactions are bipolar:

Sellers typically only sell their best properties (easiest to trade) or their worst (throwing in the towel by selling or via foreclosure). These values skew perceptions of typical properties.

2. Hyperbole abounds:

With a lack of trades as evidence, the industry is left to price assets theoretically based on gossip and click-driven media reports (e.g., "doom loops").

3. Estimates of "bids" and "asks" are imperfect:

Researchers often try to quantify the "bid-ask gap" in these times by surveying participants. The problem with this approach is the trust it puts in the hands of each side. i.e., buyers always want to pay less, and sellers always want to get more. Surveying them has a naturally exaggerated bias.

So we put together this simple framework...

-- Seller expectations: We know what sellers want. i.e., yesterday's pricing. Otherwise, they'd be selling properties at market-clearing levels. We polled appraisers to get a sense of hurdle rates in 2021-22 and applied them to generic CF pro formas for each risk profile.

-- Buyers' updated values: We adjusted mortgage rates and proceeds based on feedback from lenders, assumed core and core+ equity need 12-20% higher returns today, and assumed value-add and opportunistic equity returns haven't materially changed (18-20%).

-- Comparison: We applied the new implied discount rates to the same generic CF pro formas for each risk profile to estimate changes in property values.

Is this perfect? No. It's just a thought experiment. However, the approach does reflect (i) where we know properties were trading pre-rate hikes and (ii) where buyers could trade today to hit their return targets.

One big limitation: We didn't change CF forecasts for each profile, so our approach only reflects changes in capital markets conditions.

What do you think about the results? Reasonably accurate? Understated? Overstated?

COMMENTS