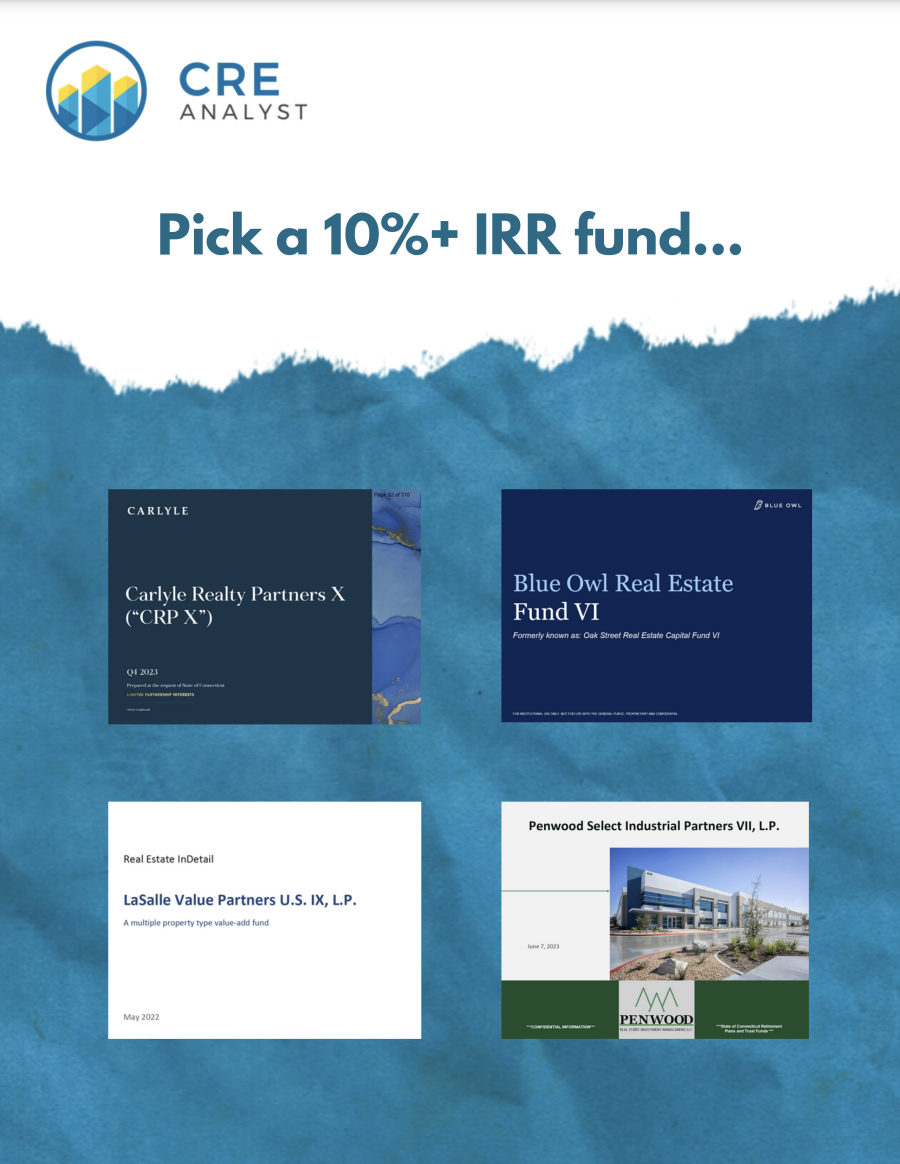

Where would you invest: Blue Owl, Carlyle, LaSalle, or Penwood?

Scenario...

1. You work at a pension fund.

2. The pension is underallocated to value-add real estate.

3. You are considering 4 funds.

4. You get these diligence reports back from your consultants.

Which fund would you recommend?

-- Blue Owl targets 12%+ net IRRs by acquiring and leveraging net leased properties at 7%+.

-- Carlyle targets 14-17% net IRRs by investing in opportunistic plays within "demographic and technology-driven sectors" with meaningful exposure to development.

-- LaSalle targets 12-14% net IRRs by investing in sectors and markets with favorable supply/demand imbalances.

-- Penwood targets 10-12% net IRRs by repositioning and re-leasing industrial properties in SoCal, NJ, Pennsylvania, and Las Vegas.

Read the full report here.

COMMENTS