"Why do you invest in ____ ?"

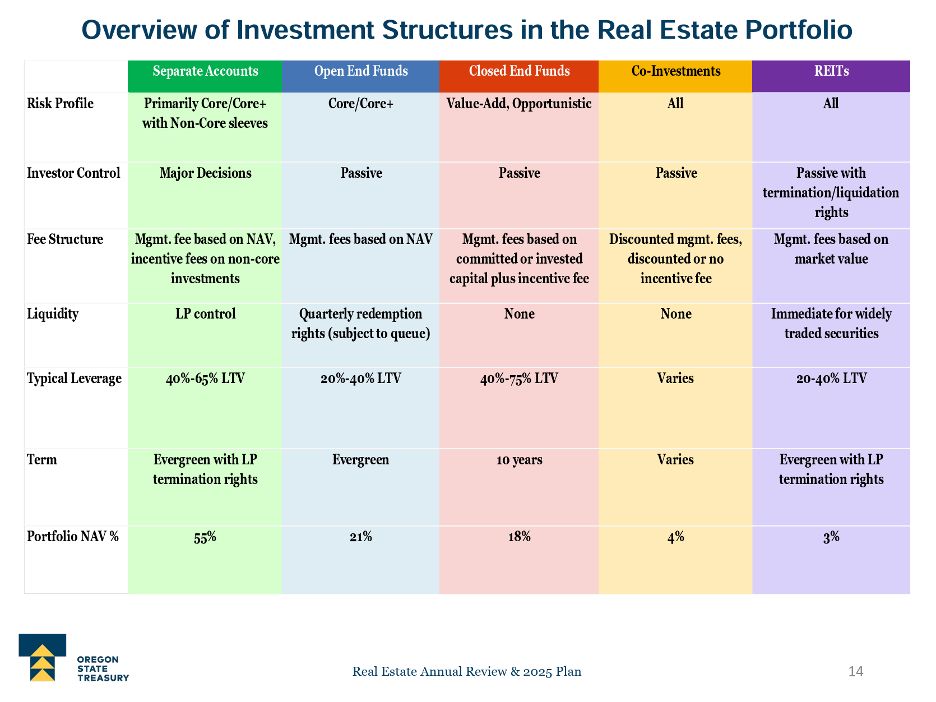

This pension fund expects to make 3-6x $100-150M investments this year and included a great overview of their favorite investment structures.

To get a better sense of the "why" behind each structure, we asked investors to summarize what they like about each in a few words...

---- Separate Accounts ----

Control

Direct say in deals

Custom strategy

Cheap

---- Open-End Funds ----

Coupon clippers

Core exposure

Index plays

Diversified

Set it and forget it

Quarterly liquidity (in theory)

---- Closed-End Funds ----

Targeted

Juice

Higher returns (when it works)

Lock ups

Big fees

Talent

More about the manager than the deals

---- Co-Investments ----

Strategic scraps

No fees or close to it

Only do it with managers we trust

Unpredictable sourcing

---- REITs ----

Liquid

Cheap

Correlated

PS – You can’t raise capital if you don’t understand where it comes from. That’s why we kick off every FastTrack cohort with a deep dive into capital markets, key players, and how real estate capital is structured. Next cohort starts this week. DM us to join.

COMMENTS