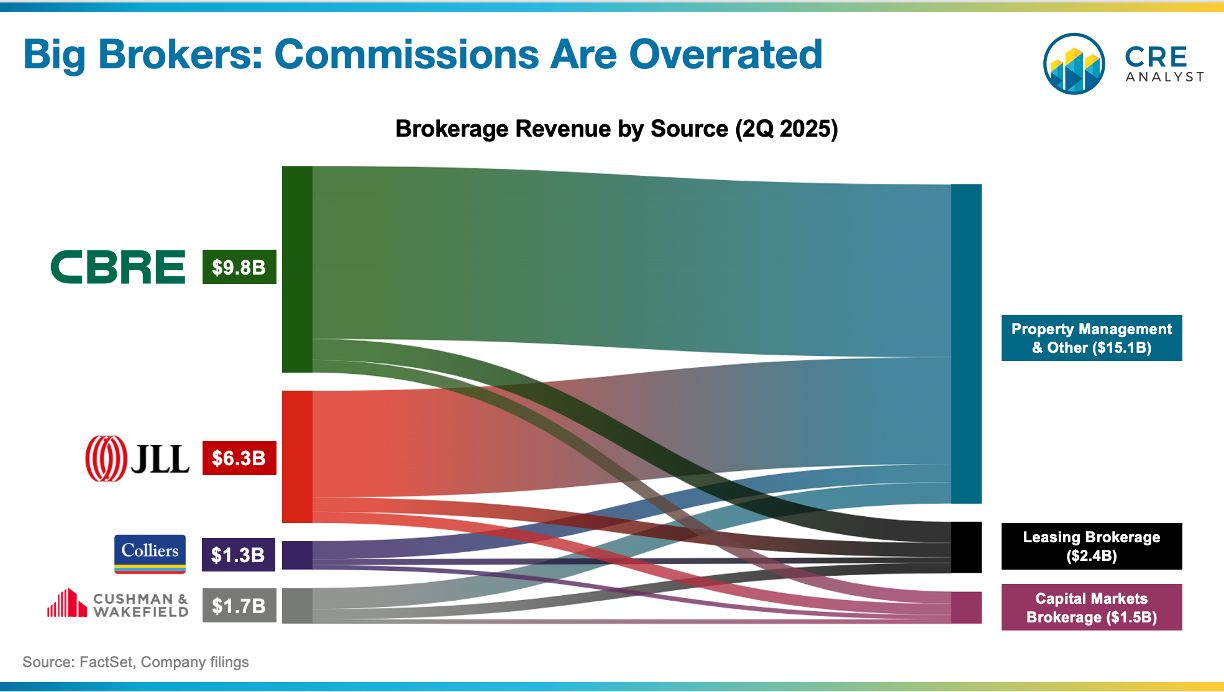

Commissions are now just 20% of big brokers' revenue. The game has changed. Huge implications for all brokers and owners. Navigating new realities...

---- Quick background ----

Ten years ago, big firms lived off transactions.

But deal commissions account for only 21% of revenue now.

The real engine at the largest firms is property/facilities management.

Old model:

-- "Name your fee, we will do anything to win this business"

-- Person to person relationships

-- Bigger often meant better

-- Easy to fire, short tenures

-- Data was an afterthought

New model:

-- “We value you but…”

-- Commoditized service

-- Higher switching costs, longer tenures

-- Data tug of war

-- Room for smaller, hungrier brokerages

---- For owners ----

1. Forget one offs. They want multi year, portfolio wide.

2. Tie compensation to KPIs. Pay for outcomes, not effort.

3. Share verified savings or upside.

4. They will push shared services. Incentivize performance with performance target-triggered ROFOs.

5. Coverage matters. Name the people, not just the logo.

6. Own your data or you will pay for it twice.

7. Create a case study. They invest when they can showcase.

8 Govern like a board with regular reviews and scorecards.

9. Plan the exit. Staff, vendors, and data handoff are what make your “out” real.

10. Don't forget about sharpshooters. Smaller firms often fight hardest for individual deals.

---- For the largest brokerages ----

Kudos for creating cash generation machines and stabilizing the industry in the process. Are you concerned about losing talent?

---- For brokers at other shops ----

The recurring revenue pivot pleases shareholders but dulls hunger, which could be your opening.

---- For owners of other shops ----

Great brokers typically thrive at the tip of the spear and are demotivated by process management. Do you see opportunity to pick up talent?

COMMENTS