The apartment slowdown is here...

We track $100B+ of apartment REITs, all of which recently reported 3Q 2023 earnings.

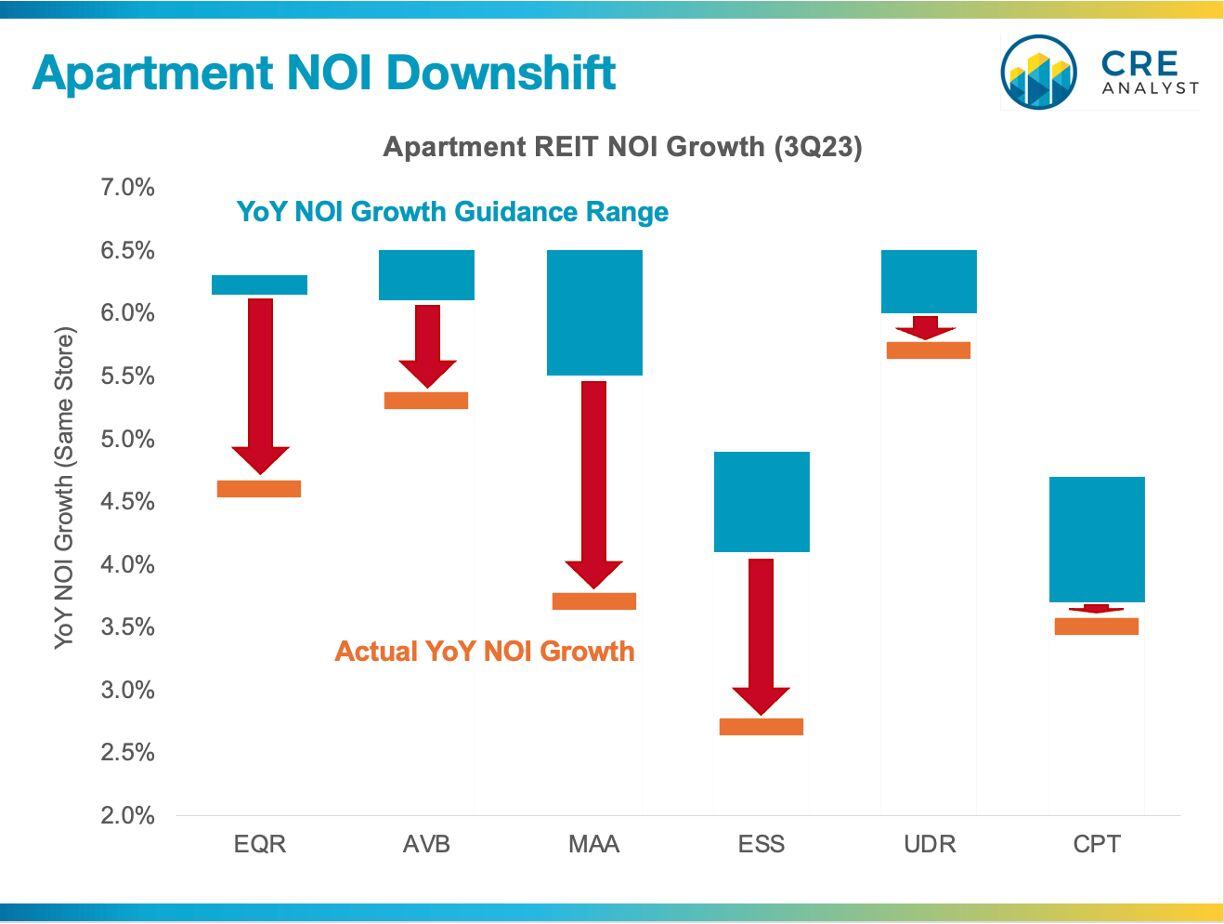

Our biggest takeaway from these recent earnings releases: Apartment NOI growth is slowing meaningfully.

----- Slowing NOI Growth -----

-- Management teams expected NOI growth between 5.6% and 6.2%

-- Actual growth is landing around 4.6% and slowing

-- This represents an average miss of 160 bps or 28%

-- 6 out of the 7 apartment REITs we follow missed

-- Essex and MAA missed the most

-- Exception: AIRC landed at the higher end of its guidance

----- Why is this a surprise? -----

"Disappointment" inherently refers to a benchmark, and the benchmarks being missed aren't from a third party. They reflect guidance that was set by REIT management teams within the last year.

----- What caused the misses? -----

A combination of revenue pressures (falling occupancy, more concessions/credits) and expense pressure (taxes and insurance).

----- What's next? -----

The national apartment market is currently on the leading edge of the largest supply increase in decades.

Since there's no way to avoid this pipeline and since multifamily is one of the few sectors with little expense mitigation (gross leases), we wouldn't be surprised to see continued moderation of NOI growth.

...and if the big, well-capitalized owners are seeing this kind of pressure, what are off-the-radar syndicators experiencing?

COMMENTS