Why predictions?

Drafting thoughtful (-ish) predictions requires reassessment and investing thought into how CRE systems are evolving. Not a bad exercise.

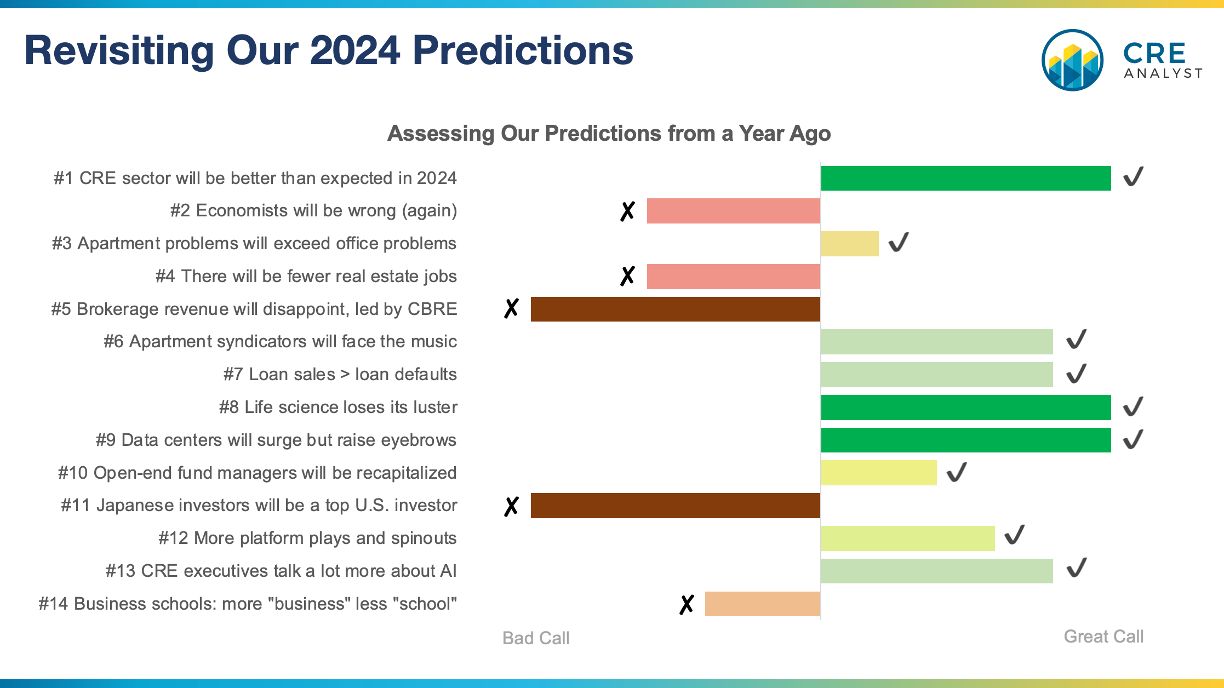

Some thoughts on last year's calls with the benefit of hindsight...

-------------

1. CRE sector will be better than expected in 2024 [✓]

A year ago, calls for a 'real estate apocalypse' dominated headlines. We accurately thought it was uninformed hyperbole.

2. Economists will be wrong again [≈]

Most economists called for a recession in 2023. We guessed they would be wrong again and that job growth would turn negative in 2024. We were 12K jobs away from being right in November when job growth came in at 12K jobs vs. consensus estimates of +100K.

3. Apartment problems exceed office problems [✓]

This one was controversial, but the 2Q24 NCREIF report confirmed more multifamily properties falling short of DSCRs than office properties.

4. Fewer real estate jobs [x]

Thankfully, we were wrong on this one. Hiring slowed to a crawl and there were many layoffs but nothing like prior cycles.

5. Brokerage revenue disappoints, led by CBRE [x]

Brokerage revenue recovered quicker than expected. Glad to miss this one.

6. Apartment syndicators face the music [✓]

Syndicator pain started in 2024. Well over $1B in defaults and restructures. Unfortunately for LPs, still early innings.

7. Loan sales > loan defaults [✓]

Another relatively controversial call. Ended up being accurate, primarily due to very low levels of defaults. But we thought there would be more loan sales.

8. Life science loses its luster [✓]

It's hard to believe that life science was still favored 12-18 months ago. Very tough year for the sector.

9. Data centers will surge but raise eyebrows [✓]

Similarly hard to believe that not many non-data center people were talking about data centers (or their power drains) a year ago. It reached such a fever pitch this year. Big tech companies responded by putting nuclear plans in motion.

10. Open-end fund manager recaps [≈]

There has been significant fund manager recap activity, but we were expecting at least one blockbuster, which never occurred.

11. Japanese investors will be a top U.S. investor [x]

Totally missed this one. Japanese capital ranked 6th this year (so far).

12. More platform plays and spinouts [✓]

Lots of secondary investment activity this year. And many anecdotal examples of mid-career professionals spinning out of established firms. More to come.

13. CRE executives talk a lot more about AI [✓]

We surveyed a dozen REITs and found mentions of "AI" spiked by 50%+ this year.

14. Business schools: more about "business" than "school" [x]

On one hand, we nailed this. Acceptance rates are higher, the traditional B school model is struggling, and their go-to click credential provider filed for bankruptcy this year. But we also predicted that MBA applications would decline this year, which was wrong.

Stay tuned for thoughts on 2025.

COMMENTS