The popular "haves vs. have-nots" narrative misses what's going on under the surface...

Big PE firms have fundamentally divergent strategies:

-- Blackstone: Asset-light partnerships

-- Apollo: Insurance float

-- KKR: International expansion

Insurers, too, choose distinct paths:

-- PGIM/Nuveen: Traditional funds

-- Principal: Sector-specific vehicles

Investment management specialists differ in focus:

-- PIMCO/Ares: Debt

-- Starwood: Distressed assets

-- Invesco: Retail capital growth

Banks are increasingly squeezed by competition in their traditional funds, and true operators (like Greystar) remain rare.

How could you expect anyone to pick up on these narratives?

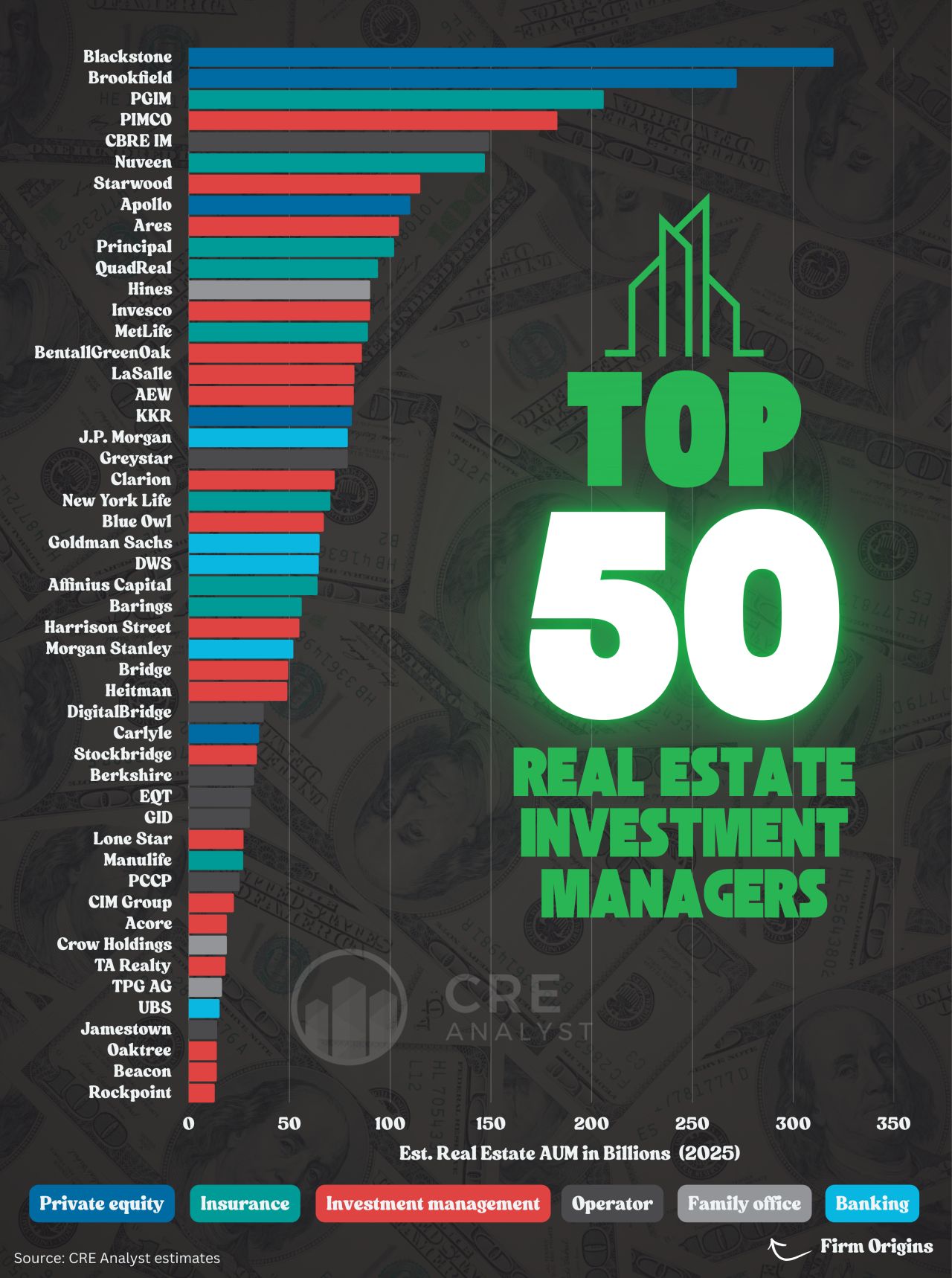

We struggled to find a decent database of the basics when it comes to real estate investment managers (though PERE ranks recent fundraising well).

...so we tasked 15 interns last summer to dig into public filings, which resulted in the 1.0 version of this list.

Our updating of 2.0 provided a surprising anecdote highlighting AI’s leap forward over the last 12 months...

Last summer: 15 interns, 6 weeks to build a decent database.

Last week: ChatGPT updated it (and provided firm-specific insights) in 30 minutes.

15 interns × 6 weeks --> ChatGPT × 30 mins

Processing has never been cheaper.

Thinking has never been more valuable.

Choose your lane wisely.

PS -- If you want to think more and process less, DM us to learn about our Fall FastTrack cohort and upcoming valuation in Argus classes (comes with Argus certification).

COMMENTS