Here's a problem that came up in last week's class. What would you do?

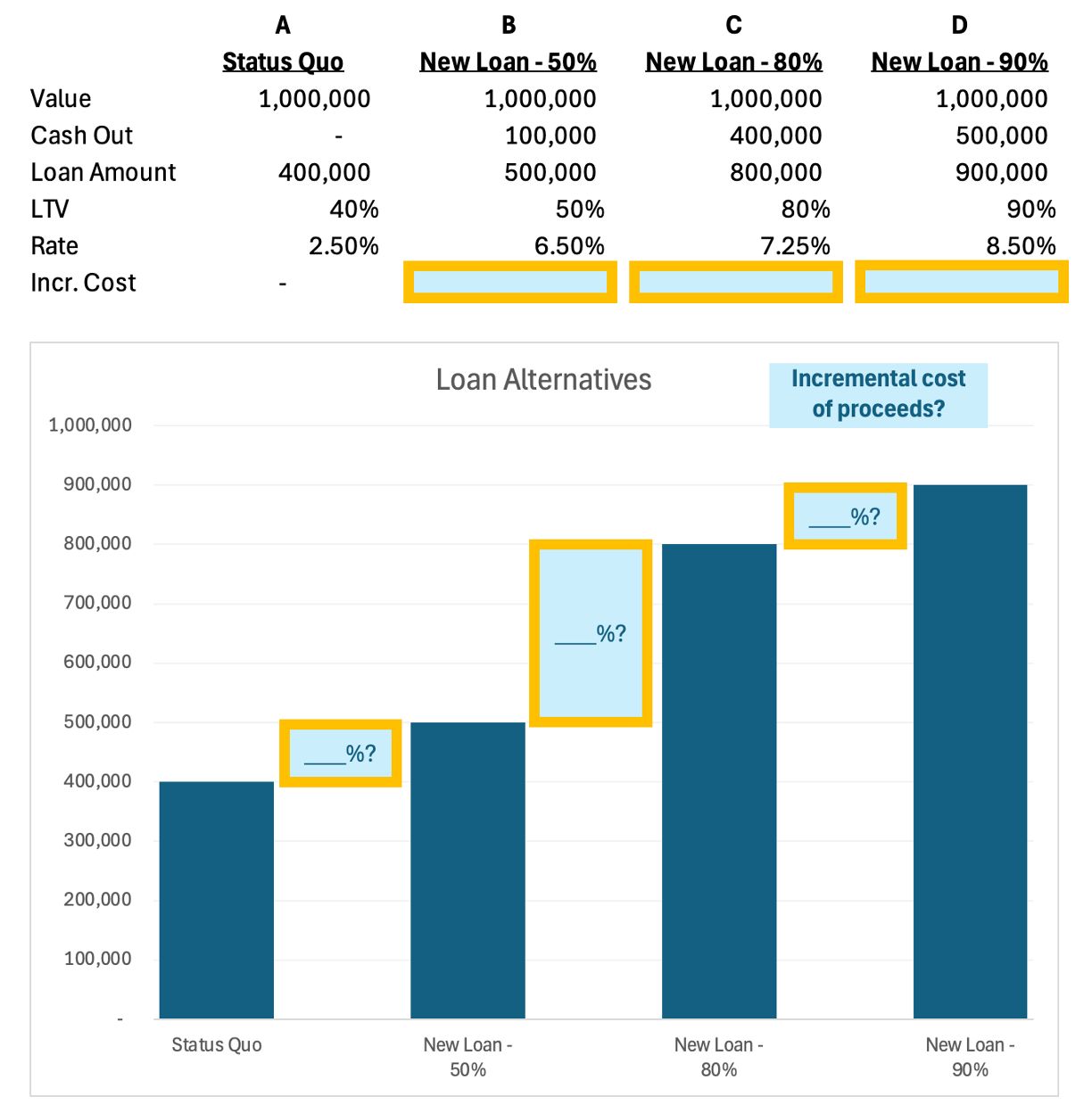

You bought a house in 2019 for $500,000.

The house is now worth $1,000,000.

Your interest rate is extremely low at 2.5%.

[Hello, lock in effect.]

...but you'd like to pull out equity.

Your mortgage broker got three loan quotes:

1. 50% LTV at 6.5%.

2. 80% LTV at 7.25%

3. 90% LTV at 8.5%

What is the incremental cost of each loan?

Are there other factors you should consider?

Which should you do?

A. Nothing. Keep your current loan.

B. Pull out $100K with the 50% LTV loan.

C. Pull out $400K with the 80% LTV loan.

D. Pull out $500K with the 90% LTV loan.

PS -- If navigating real world challenges is something you want more of, DM us to discuss our Fall FastTrack cohort.

PPS -- Special thanks to Brian Abbott for joining class last week and bringing this topic to life by sharing insights into managing a $20B debt fund.

COMMENTS