Please prove this wrong. Seriously.

(...for a friend.)

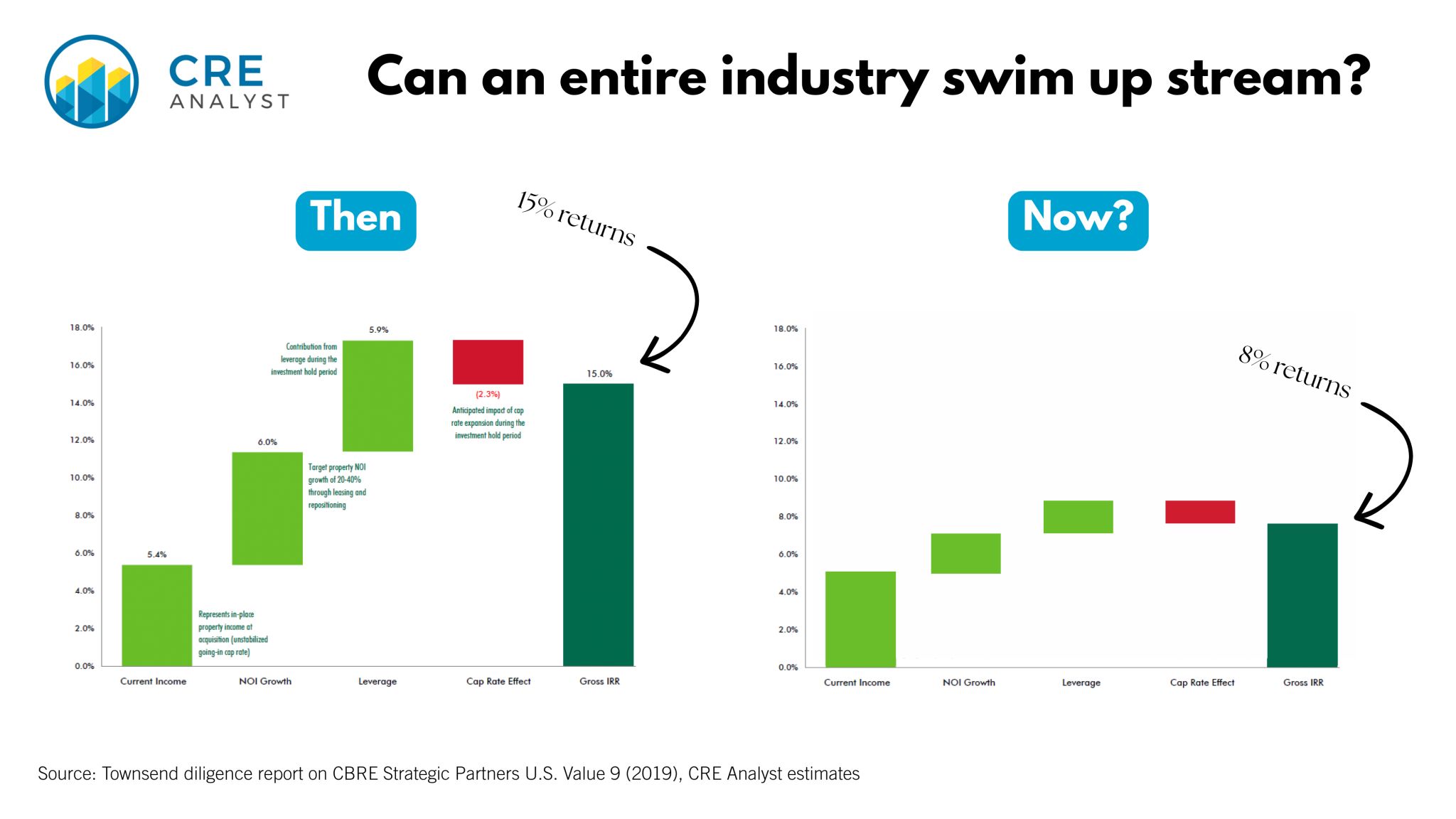

Yesterday we wrote about a CBRE value-add fund that was supposed to outperform because it was lower risk, moderate leverage, had a "cycle-aware" team and an aversion to double promotes.

But buried in the diligence materials was a chart that deserves far more attention.

Who cares if one CBRE fund misses its mid teens target.

This feels systemic.

Could be the most consequential headwind facing real estate today:

Low returns.

Not volatility.

Not drawdowns.

Just suffocatingly low return potential.

...something the industry has not dealt with in a sustained way for decades.

Roll forward a simple but accurate way of thinking about returns and the outlook looks ugly. Returns down roughly half from a period managers already considered tight.

Maybe the first inning was redemption queues.

The second inning was rotation from equity to debt.

What's next?

Some managers will buck the trend, but everyone can't be above average.

Promotes when the industry is producing high single digit outcomes?

Not likely.

Silver lining: we think there could be extraordinary opportunities for 20-and-30 somethings. Old enough to have some skills, young enough to make it through this cycle, and in a position to advance quickly when the crowd of veterans finally hangs it up.

However...

For the last 20+ years you didn't really need to understand the fundamentals of this business to get paid.

That era is over.

Asset managers cannot hide behind a lack of deep operational expertise or failing to know the ins and outs of return measures. Occupancy isn't enough.

Acquisitions teams need to accurately assess and risk profiles with nuance. Way beyond location and building quality.

The only durable path to outperformance is extraordinary income growth.

We are back to reality.

PS -- want to master the frameworks and tools that define our industry? DM us to explore joining the upcoming FastTrack cohort.

Typical class profile: Average age is late 20s making $150-200k, looking to level up. Several accomplished/experienced professionals looking to obtain specific skills. A handful of recent grads trying to break into the industry. ...from all over the country but concentrated in NY, Dallas, Chicago, Atlanta, SoCal, DC. DM for more info.

(...for a friend.)

Yesterday we wrote about a CBRE value-add fund that was supposed to outperform because it was lower risk, moderate leverage, had a "cycle-aware" team and an aversion to double promotes.

But buried in the diligence materials was a chart that deserves far more attention.

Who cares if one CBRE fund misses its mid teens target.

This feels systemic.

Could be the most consequential headwind facing real estate today:

Low returns.

Not volatility.

Not drawdowns.

Just suffocatingly low return potential.

...something the industry has not dealt with in a sustained way for decades.

Roll forward a simple but accurate way of thinking about returns and the outlook looks ugly. Returns down roughly half from a period managers already considered tight.

Maybe the first inning was redemption queues.

The second inning was rotation from equity to debt.

What's next?

Some managers will buck the trend, but everyone can't be above average.

Promotes when the industry is producing high single digit outcomes?

Not likely.

Silver lining: we think there could be extraordinary opportunities for 20-and-30 somethings. Old enough to have some skills, young enough to make it through this cycle, and in a position to advance quickly when the crowd of veterans finally hangs it up.

However...

For the last 20+ years you didn't really need to understand the fundamentals of this business to get paid.

That era is over.

Asset managers cannot hide behind a lack of deep operational expertise or failing to know the ins and outs of return measures. Occupancy isn't enough.

Acquisitions teams need to accurately assess and risk profiles with nuance. Way beyond location and building quality.

The only durable path to outperformance is extraordinary income growth.

We are back to reality.

PS -- want to master the frameworks and tools that define our industry? DM us to explore joining the upcoming FastTrack cohort.

Typical class profile: Average age is late 20s making $150-200k, looking to level up. Several accomplished/experienced professionals looking to obtain specific skills. A handful of recent grads trying to break into the industry. ...from all over the country but concentrated in NY, Dallas, Chicago, Atlanta, SoCal, DC. DM for more info.

COMMENTS