Gravity affects everyone?

Three years ago, Blackstone was on the road pitching its next flagship real estate fund.

Pitch:

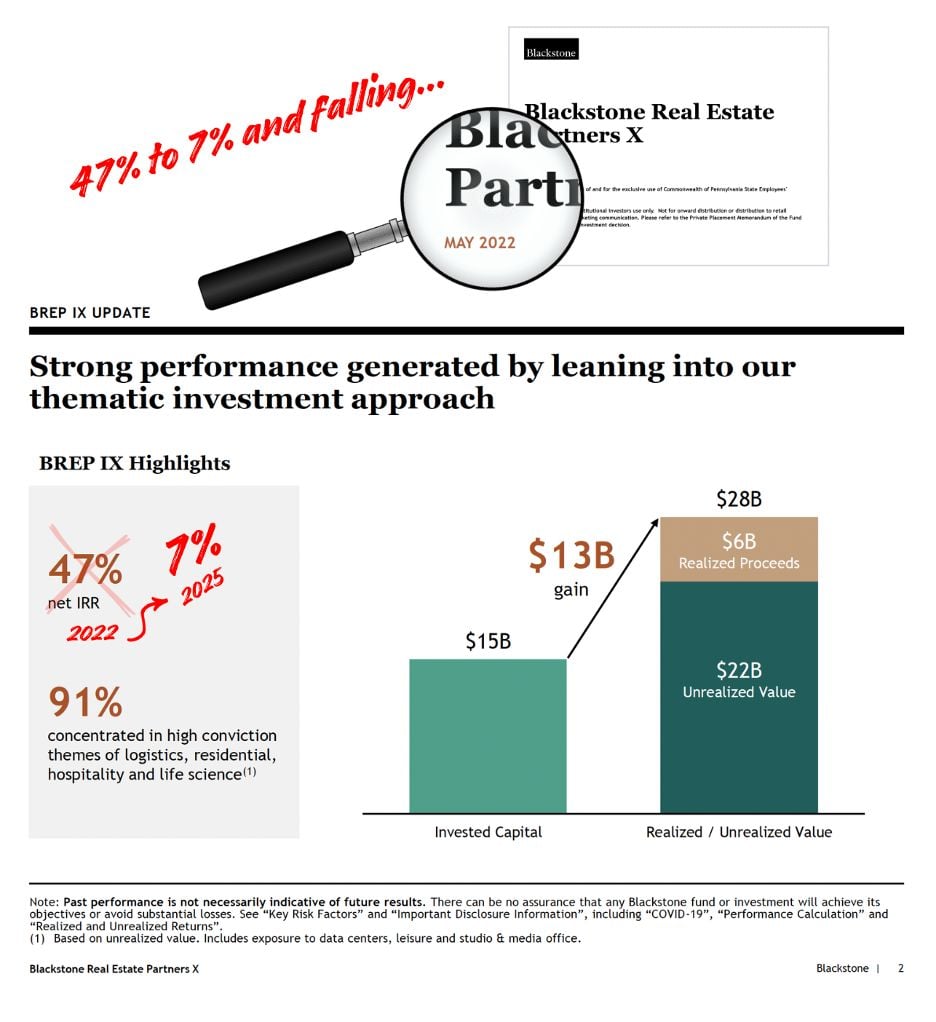

BREP IX was tracking toward 47% net IRRs.

Let's keep rolling.

Outcome:

BREP X raised $30+ billion.

The largest closed-end real estate fund ever.

Fast forward...

Updated results:

-- BREP IX: 7% net IRR, down from 47%

-- BREP X: 10% net IRR

(Note that BX's promote likely doesn't kick in below 9-10%.)

Important math:

~65% of BREP IX and ~50% of BREP X remains unrealized.

Those IRRs are therefore driven largely by appraised values, not exits.

What happens next:

Will assets be monetized?

Rolled into continuation vehicles?

Blackstone will likely be back on the road in 2026 with BREP XI.

Raising $30B in 2022 was extraordinary.

Raising anything close to that without liquidity would be seismic.

Even for Blackstone with its LP base.

If this feels important to you, trust your instinct.

To Blackstone's credit, it doesn't need BREP to thrive.

It's built a unique multifaceted engine.

...but the firm's ability to navigate a challenging environment will be telling for the entire industry.

Three years ago, Blackstone was on the road pitching its next flagship real estate fund.

Pitch:

BREP IX was tracking toward 47% net IRRs.

Let's keep rolling.

Outcome:

BREP X raised $30+ billion.

The largest closed-end real estate fund ever.

Fast forward...

Updated results:

-- BREP IX: 7% net IRR, down from 47%

-- BREP X: 10% net IRR

(Note that BX's promote likely doesn't kick in below 9-10%.)

Important math:

~65% of BREP IX and ~50% of BREP X remains unrealized.

Those IRRs are therefore driven largely by appraised values, not exits.

What happens next:

Will assets be monetized?

Rolled into continuation vehicles?

Blackstone will likely be back on the road in 2026 with BREP XI.

Raising $30B in 2022 was extraordinary.

Raising anything close to that without liquidity would be seismic.

Even for Blackstone with its LP base.

If this feels important to you, trust your instinct.

To Blackstone's credit, it doesn't need BREP to thrive.

It's built a unique multifaceted engine.

...but the firm's ability to navigate a challenging environment will be telling for the entire industry.

COMMENTS