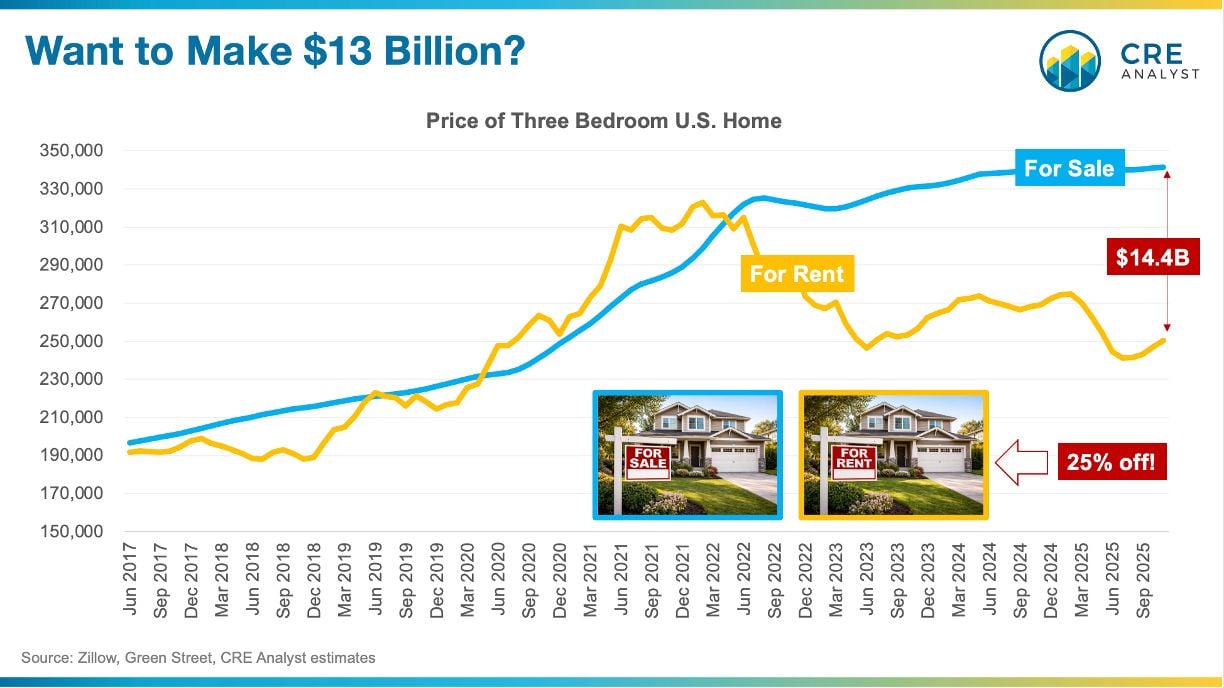

How to make $13B playing the housing market dislocation*

1. Buy the two publicly-traded SFR REITs.

Current total market value of about $45B.

Down 4-5% today thanks to an influential Truth Social user.

Down 25% or so from a few years ago thanks to slower growth and higher interest rates.

2. Sell their 150k homes for $60B (current estimated value) to home buyers.

These are probably the only two large REITs that can literally be broken apart and sold in a matter of only a few months.

Why hasn't anyone done it?

Regulatory pressure and REIT managers that like being REIT managers.

3. Assume 10% costs of sales and purchase premium.

Selling 150K homes wouldn't be frictionless, but they're spread out across 10-15 markets. Buying two tightly managed SFR REITs also wouldn't be frictionless.

Result: $10-13 billion of profits.

Will someone do this? Maybe, maybe not.

But something's gotta give.

We rarely see 25%+ disconnects, particularly in the most commoditized corner of real estate.

[* We don't offer investment advice; just highlighting a big and obvious valuation gap.]

PS -- this is a good example of how competing perspectives on valuation and capital drive real estate markets. Want to know more? Want to sharpen your skills? DM us to explore our FastTrack cohort that kicks off next week.

COMMENTS