Less bid, more ask: Sobering fundraising trends

“Dry powder” gets a lot of attention, but capital’s influence on volume and pricing is nuanced.

Two subsurface realities:

1. Every dollar comes with return expectations. Closed end funds are inherently value-oriented (non core), and open end funds are much more income-oriented (core/core plus.) Higher returns = lower prices.

2. Closed end funds have defined hold periods. Investors want their money back after __ years.

Here’s the sobering part…

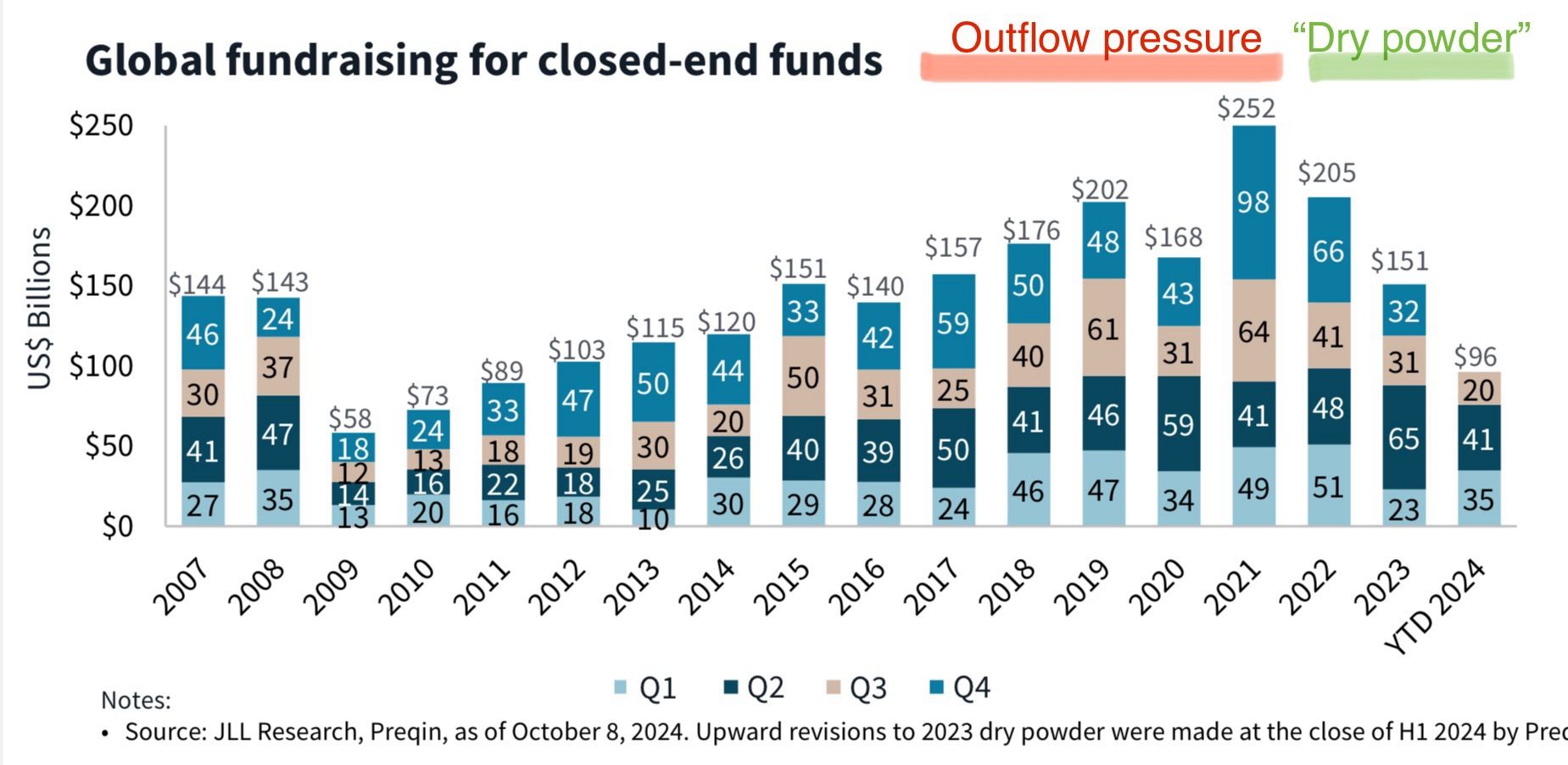

CRE markets experienced an epic fundraising run with non-core capital between 2015 and 2022, and most of those funds had stated lives of 7 years. Those investors want their money back. I.e., there will be sellers.

What about buyers? Closed end fundraising has fallen off a cliff. It’s also been extremely concentrated in the the big mega funds. Less capital on the buy side in the near term.

These dynamics could create stronger pressures on the sell side, putting upward pressure on sales volumes and downward volumes on pricing.

COMMENTS